Select the tab that interest you...

-

Retirement Analysis

-

Social Security

-

Risk Analysis

-

Tax Strategies

-

Estate Planning

<

>

|

When you build a Retirement Plan, you are building a pathway to your dreams! In building an effective retirement plan it is more then looking at optimizing income, protecting assets and measuring expenses.

It takes Taxes into account, applies inflation, measures RISK of return, and utilizes a SAFE money and RISK money approach to overcome market ups and downs. We take time to educate and implement strategies that will have a positive direct affect on your portfolio. Then we measure from year to year and make adjustments as life changes, and market conditions rise and fall. You remain in full control as we offer the guidance you need while you focus on enjoying your retirement. |

|

FREE DOWNLOAD

|

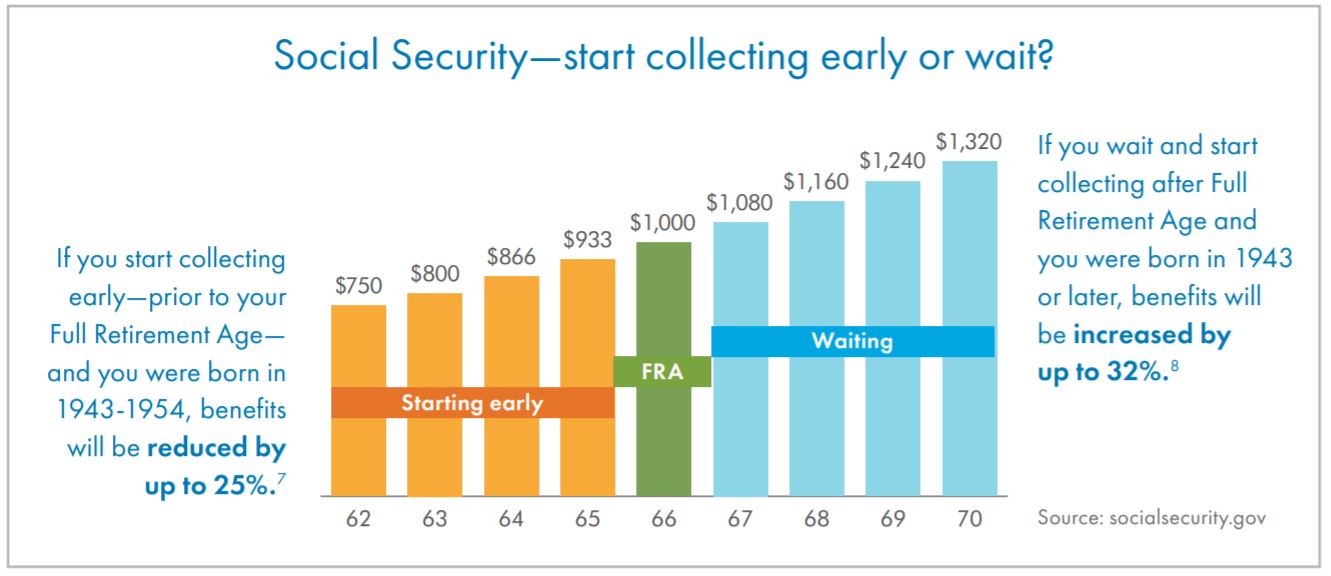

When do you turn on benefits?

The question of when to collect is very difficult. In fact, each year many people forgo spousal benefits or take their benefits either too early or too late. This mistake leaves them missing out on many thousands of dollars.

To help you make the best retirement and/or spousal benefit claiming decisions, we use a custom benefits calculation software to provide you with a report based on your individual circumstances. Request your FREE Social Security Report Today!!! (MORE INFO) |

|

You may upload your documents today. Please be sure to schedule your appointment with us too.

|

MARKET RISK ANALYSIS What makes a good Investment?

First, we begin with your investment statements where we begin to analyze the overall health of the investments and we send you a personal link where we measure your level of comfort with risk of the marketplace. Second, we show what your current portfolio risk, fees and potential growth (risk and reward) results. Often when we first meet with a client, we find the RISK of a clients' portfolio is HIGHER then expected and the client was unaware. Third, we discuss with you strategies of how to reduce fees and potential risk while maintaining the overall rate of return. We believe education of risk and reward, fee structure, and probability of future returns is essential. Request your analysis today... |

|

Free Download

|

Tax Strategies in Retirement

Many aspects of your everyday life begin to change as you prepare for retirement. One of the biggest changes you are faced with involves your finances.

The paycheck you have become accustomed to receiving is no longer coming in. Instead, it is now up to you to decide from which accounts you will take income. Your paycheck may have stopped, but taxes continue. It is important to know and understand the potential tax implications of selecting which assets from which you draw your retirement income. Are you paying more taxes then you need to? Watch an educational TAX WEBINAR We do not provide tax advice. We are offer educational strategies that you may be able to implement with the help of a qualified tax advisor. Please consult a tax advisor prior to using any tax strategy that you receive from us.

|

|

HAVE YOU THOUGHT AHEAD? Estate Planning Strategies

We believe in proper planning for your estate both during your lifetime and after. We have many strategies that may help you accomplish your goals and not lose money to medical cost, lawsuits, probate and estate taxes. Protect what you have worked so hard for. |

Birdseye financial and those working for the company are not licensed Investment Advisors which prohibits us from offering such advice. Any advice you get should be taken as non-investment advice and only educational in nature. However, we often refer our clients over to a licensed investment advisor for any investment advice our clients need. A company we prefer is: Secure Investment Management