|

Social Security

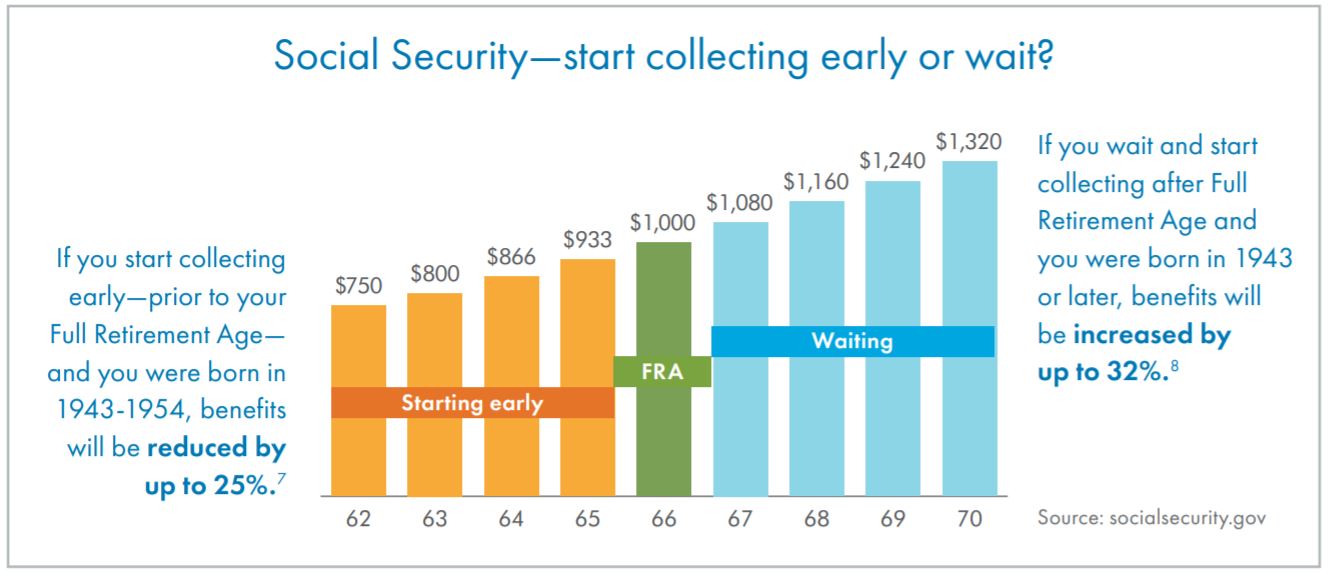

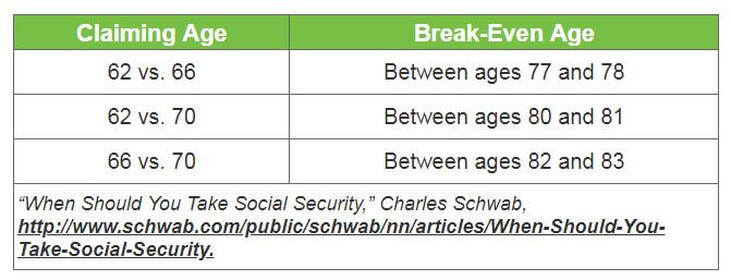

When do you turn on benefits? The question of when to collect is very difficult. In fact, each year many people forgo spousal benefits or take their benefits either too early or too late. This mistake leaves them missing out on many thousands of dollars. To help you make the best retirement and/or spousal benefit claiming decisions, we use a custom benefits calculation software to provide you with a report based on your individual circumstances. |

|

How is Social Security Provisional Income Taxed?

Delayed Social Security Benefits BREAK-EVEN

Delayed Social Security Benefits INCREASE

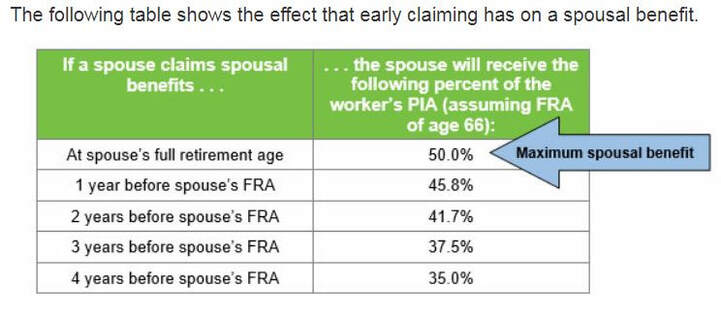

Spouse Benefits taken early

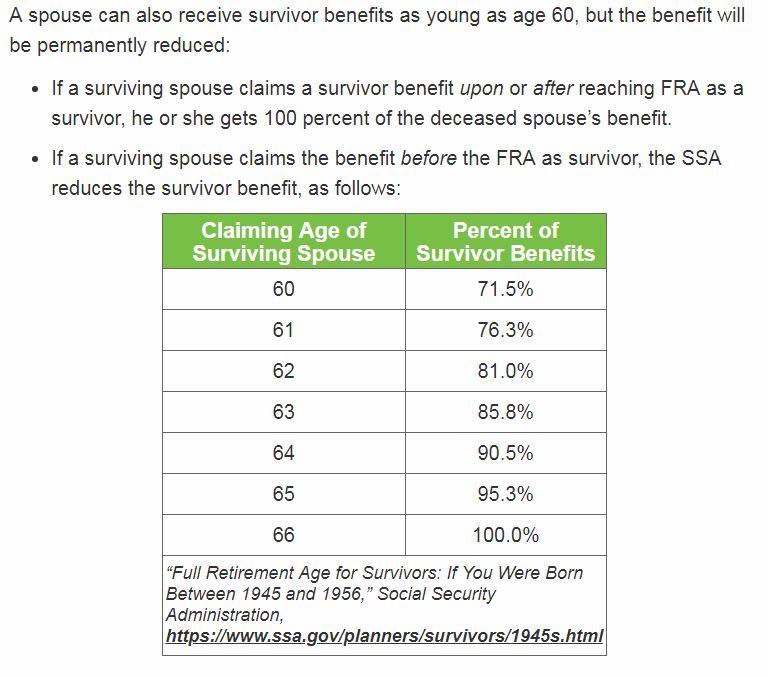

Surviving Spouse Benefits taken early

|

Social Security Resources

QUESTIONS ANSWERED... How Much Can I Earn with Social Security and still get benefits When you begin receiving Social Security retirement benefits, you are considered retired for our purposes. You can get Social Security retirement or survivors benefits and work at the same time. However, there is a limit to how much you can earn and still receive full benefits.

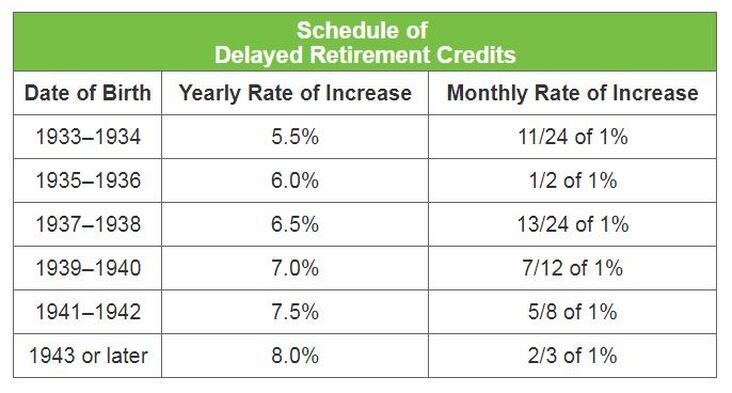

Social Security retirement benefits are increased by a certain percentage for each month you delay starting your benefits beyond full retirement age. The benefit increase stops when you reach age 70. |

7 Things You Must Know About Claiming Social Security

Social Security is a great program, but knowing when and how to claim your benefits can determine how much you collect.Here are seven potential problems you need to consider so you can maximize your Social Security income.

1) Remarrying Before Age 60 - If your spouse dies, you will be entitled, in most situations, to collect survivor Social Security benefits unless you remarry before the age of 60. After that, all social security benefits from your previous marriage will not be paid out. It’s up to you to decide if this financial loss is worth it. Some people forgo legal marriage until after age 60.

2) Claiming Your Benefits Too Early - Claiming spousal benefits before the designated retirement age of 65-67 can reduce the amount of Social Security money you collect – indefinitely. This can vary based on many factors, so it’s important to talk to a financial professional.

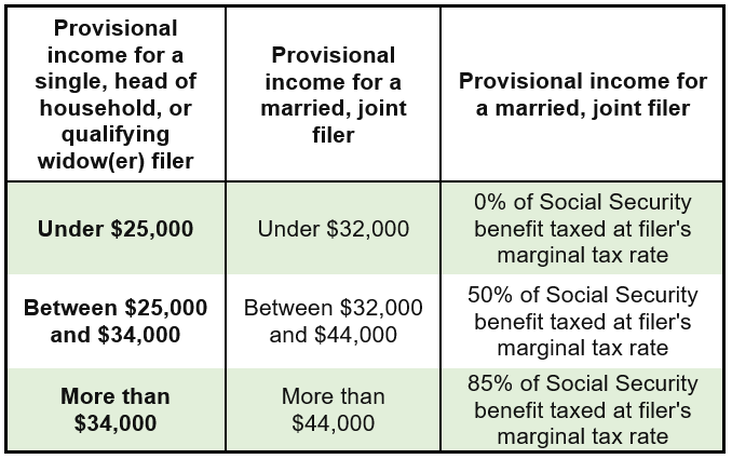

3) Earning Additional Income - If you take another job or start an income-producing business while simultaneously collecting Social Security benefits, you may be taxed on those benefits. It depends on how much you make from extra income. Know the tax consequences before taking on another source of income. You can find out rates and details by contacting the Social Security Administration, IRS, or working with a qualified financial counselor.

4) Applying at the Wrong Time - It would help if you pinpointed when you apply for Social Security and depend on your circumstances. In 2014, the SSA began sending workers statements to help them plan retirement. Read these statements carefully. Go over them with your financial counselor or an advisor at the Social Administration local office. Here is a link to help you find the closest local office near you: https://secure.ssa.gov/ICON/main.jsp A side note: You can get Medicare before selecting Social Security retirement options.

5) Experiencing Government Cuts - Even though President Trump has promised to keep Social Security benefits, that could change. Political directions can change with the multitude of influencers in government and business. Nothing is guaranteed. Keep your eye out for any policy changes.

6) Funding Running Out - NBC claims Social Security could run out by 2034, but this is mostly speculative, and there is much disagreement. Numerous options exist to extend the benefit periods well into the next century, taxes could be raised to fund it further, or benefits could be reduced. However, issues with Social Security should get better with younger, lower-population generations. Baby Boomers entering retirement in record numbers have strained the system.

7) Start Saving - Do not rely on Social Security as your primary retirement vehicle. Instead, save enough to provide for retirement. You can do this through an IRA, 401(k), Bank CDs, bonds, annuities, simple savings account, or a combination.

Social Security is a great program, but knowing when and how to claim your benefits can determine how much you collect.Here are seven potential problems you need to consider so you can maximize your Social Security income.

1) Remarrying Before Age 60 - If your spouse dies, you will be entitled, in most situations, to collect survivor Social Security benefits unless you remarry before the age of 60. After that, all social security benefits from your previous marriage will not be paid out. It’s up to you to decide if this financial loss is worth it. Some people forgo legal marriage until after age 60.

2) Claiming Your Benefits Too Early - Claiming spousal benefits before the designated retirement age of 65-67 can reduce the amount of Social Security money you collect – indefinitely. This can vary based on many factors, so it’s important to talk to a financial professional.

3) Earning Additional Income - If you take another job or start an income-producing business while simultaneously collecting Social Security benefits, you may be taxed on those benefits. It depends on how much you make from extra income. Know the tax consequences before taking on another source of income. You can find out rates and details by contacting the Social Security Administration, IRS, or working with a qualified financial counselor.

4) Applying at the Wrong Time - It would help if you pinpointed when you apply for Social Security and depend on your circumstances. In 2014, the SSA began sending workers statements to help them plan retirement. Read these statements carefully. Go over them with your financial counselor or an advisor at the Social Administration local office. Here is a link to help you find the closest local office near you: https://secure.ssa.gov/ICON/main.jsp A side note: You can get Medicare before selecting Social Security retirement options.

5) Experiencing Government Cuts - Even though President Trump has promised to keep Social Security benefits, that could change. Political directions can change with the multitude of influencers in government and business. Nothing is guaranteed. Keep your eye out for any policy changes.

6) Funding Running Out - NBC claims Social Security could run out by 2034, but this is mostly speculative, and there is much disagreement. Numerous options exist to extend the benefit periods well into the next century, taxes could be raised to fund it further, or benefits could be reduced. However, issues with Social Security should get better with younger, lower-population generations. Baby Boomers entering retirement in record numbers have strained the system.

7) Start Saving - Do not rely on Social Security as your primary retirement vehicle. Instead, save enough to provide for retirement. You can do this through an IRA, 401(k), Bank CDs, bonds, annuities, simple savings account, or a combination.