|

Special Needs Plans

There are many types of plans depending upon your level of qualification. What is a D SNP? Dual Eligible Special Needs Plans - or D SNP's for short - are a special type of Medicare Advantage plan that provides health benefits for people who are “dual eligible,” meaning they qualify for both Medicare and Medicaid. States determine which D SNP's can be offered and the benefits provided. More Info |

|

Generally speaking, D SNP’s may include:

Vertical Divider

|

A DSNP plan will include coverage for hospital services (Medicare Part A), medical health care needs (Medicare Part B), and prescription drugs (Medicare Part D) through a single plan. With a DSNP there may also be social services

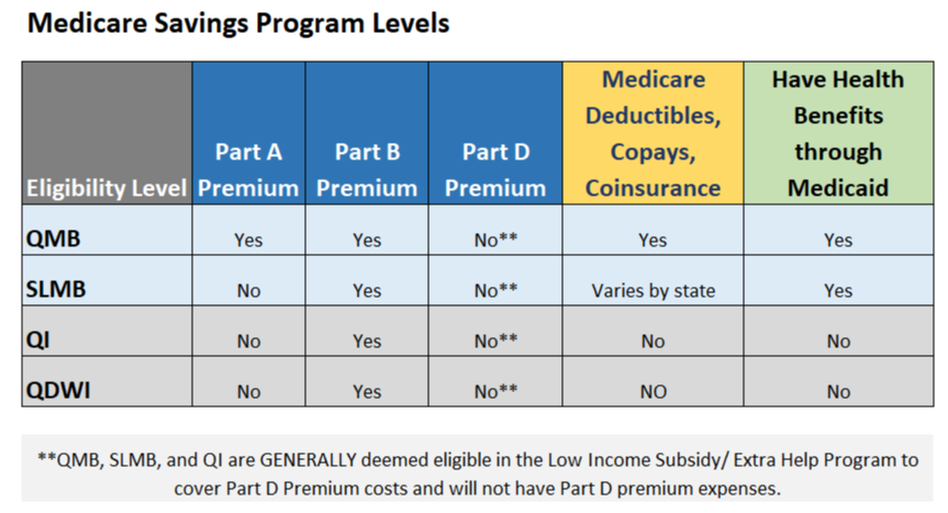

There are five DSNP types with varying degrees of Medicaid coverage:

|

|

Contact DSHS (Dept Social and Health Health Services)

Texas - 800-963-7111 Washington - 800-833-6384 WEBSITE LINK |

Thank You for your information... Next Step, Book Your Appointment...