Strategy Selection

Roth IRA Conversions

What is a Roth conversion?

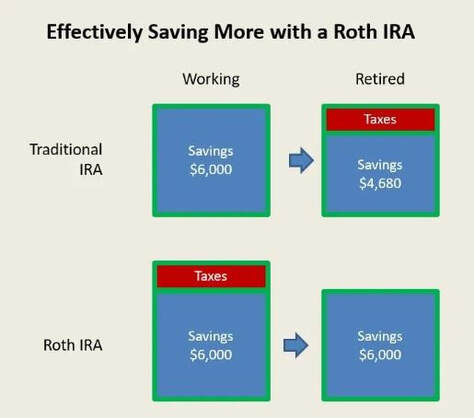

A Roth conversion is the process of repositioning your assets in a Traditional IRA or qualified employer sponsored retirement plan (QRP), such as a 401(k), 403(b), or governmental 457(b) to a Roth IRA. When converting your before-tax savings, you get the benefit of tax-free potential growth in a Roth IRA later.

Generally, a Roth IRA conversion makes sense if you:

A Roth IRA conversion may not be appropriate if you:

Anyone is eligible to convert regardless of their income or tax filing status.

A Roth conversion is the process of repositioning your assets in a Traditional IRA or qualified employer sponsored retirement plan (QRP), such as a 401(k), 403(b), or governmental 457(b) to a Roth IRA. When converting your before-tax savings, you get the benefit of tax-free potential growth in a Roth IRA later.

Generally, a Roth IRA conversion makes sense if you:

- Won’t need the converted Roth funds for at least five years.

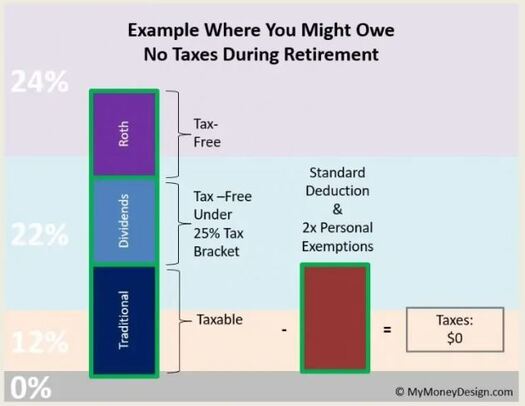

- Expect to be in the same or a higher tax bracket during retirement.

- Can pay the conversion taxes without using the retirement funds themselves.

- May not need the funds for retirement and may want to transfer them to your beneficiaries.

A Roth IRA conversion may not be appropriate if you:

- Are not sure what your tax situation will be like this year because once you convert you cannot recharacterize or "undo" the conversion. More Info

- Have to deplete other assets to pay the taxes due on the conversion.

- Are pushed into a higher tax bracket due to the amount you convert.

- Will be in a lower tax bracket in retirement.

- Will be relocating to a state with no or lower state income tax.

- Are wanting to convert your RMD because RMDs cannot be converted. You must first satisfy your RMD and then complete a Roth conversion.

Anyone is eligible to convert regardless of their income or tax filing status.

CONVERSION OPTIONS

What strategy would you like to use?

Take No Action

Continue to pay taxes at whatever the current tax rate is at that time

Pay the taxes on the pre-taxed funds. Which should lower future RMD's (Required Minimum Distributions) below the tax deductions available every year or use the Bracket Limit conversion and eliminate future taxes on that portion of funds.

Never worry about paying taxes on these funds again.

- Highest Estate Value - Focus on leaving your beneficiaries with the most amount of assets at passing.

- Tax Bracket Limit - Focus on maxing out a tax bracket (Called a Bracket Tracker on our retirement plan)

- Lowest Lifetime Tax Liability - Focuses on reducing the amount you would pay in taxes over your lifetime

- RMD below your Annual Deduction - Focuses on reducing your RMD to be under current Tax Deduction levels to eliminate paying additional taxes.

Take No Action

Continue to pay taxes at whatever the current tax rate is at that time

- Benefit - Defer paying taxes today because you think taxes are too high

- Risk - May pay more in taxes over your lifetime and pass less to beneficiaries

Pay the taxes on the pre-taxed funds. Which should lower future RMD's (Required Minimum Distributions) below the tax deductions available every year or use the Bracket Limit conversion and eliminate future taxes on that portion of funds.

- Benefit - May reduce future RMD’s below the level of annual deductions or reduce a portion of future RMDs in order to lower the amount of taxes paid over your lifetime.

- Risk - Future tax rates and deductions are unknown

Never worry about paying taxes on these funds again.

- Benefit - May eliminate RMDs and future taxes on your qualified funds (Pre-tax) by converting to a ROTH (After Tax) and paying the taxes today rather than on the seed and harvest in the future with a tax rate that is unknown but may increase.

- Risk - Future tax rates and deductions are unknown

How to Maximize a ROTH IRA Conversion

What if you could get a bonus on the ROTH IRA that could help offset the taxes due? Ask us how!!!

BEFORE YOU CONVERT...

HOW DO YOU FIGURE OUT YOUR BEST SOLUTION?

- Always consult with your CPA (who gives tax advice)

- Request a ROTH Conversion analysis and review your numbers before you consult with a tax advisor.

Before converting there are a few things to consider:

- You cannot recharacterize. Understand your tax situation and ability to pay for the conversion because a Roth conversion cannot be recharacterized. More Info

- The availability of funds to pay income taxes. The benefits of a conversion are increased if the income taxes due can be paid out of non-retirement assets.

- To help manage your tax liability, you may choose to convert just a portion of your assets. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years.

- Your time horizon. Generally, if you will need the funds within the next five years, a Roth IRA is not a good choice. This is because a five-year waiting period is required if you are under age 59 1/2 before you can distribute the converted amount without owing the 10% additional tax. The longer the assets in the Roth IRA can be left untouched, the greater the benefit of tax-free earnings potentially accumulating.

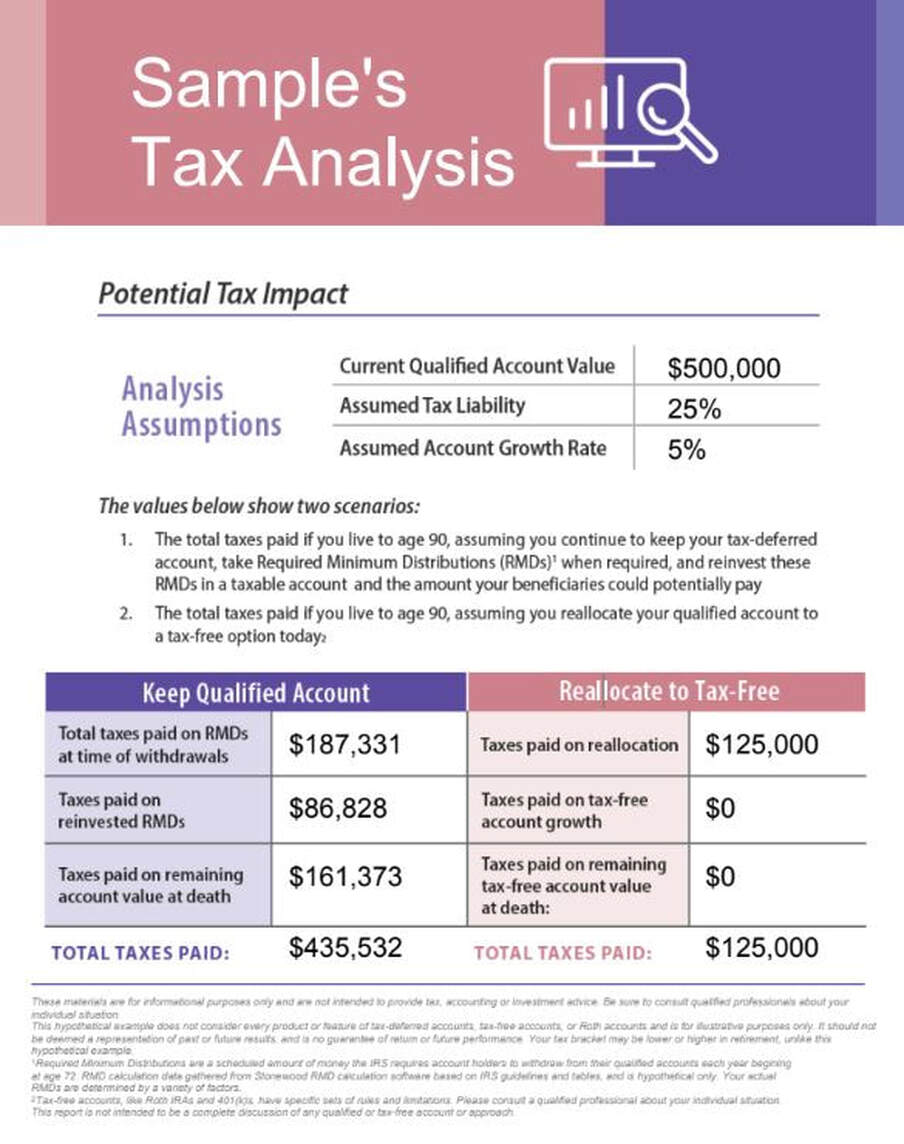

SAMPLE ROTH CONVERSION

Keeping a Traditional IRA may cost you more than you realize. Here is a sample report that compares using a full ROTH Conversion.

DISCLOSURE

These illustrations are for educational purposes only. Please refer to provided illustrations for complete detail. We provide these examples for you to better understand how the concept works. This information is not to be considered tax advice.