MEDICARE OPTIONS can be complicated and confusing to many seniors. However, we take an approach of educating you and servicing you annually so you are able to better understand all the choice that you have. As a licensed agent, we offer most plans in your county and will take the time to help you figure it out.

HOW TO APPLY FOR MEDICARE

|

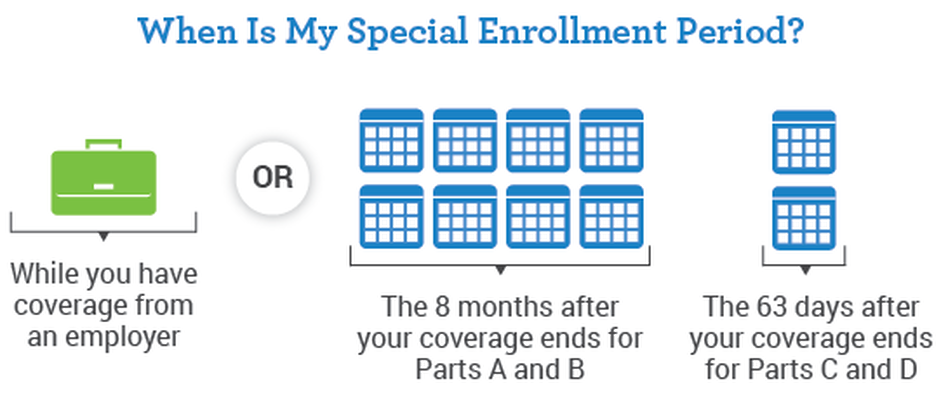

HOW TO APPLY FOR MEDICARE You are provided with a SPECIAL ENROLLMENT window that allows you to apply for Part B when you turn 65 or leave employer coverage. Choose a method below:

HOW TO SUBMIT FORMS YOU PRINTED:

Vertical Divider

|

Additional Resources WHEN IS PART B activated

What if I’m already getting benefits from Social Security or the Railroad Retirement Board (RRB)? If you’re getting these benefits, in most cases, you’ll automatically get Part A and Part B starting the first day of the month you turn 65. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month. You’ll get the “Welcome to Medicare” package that welcomes you to the program. This package is mailed about 3 months before your 65th birthday. What if I’m close to 65, but not getting Social Security or Railroad Retirement Board (RRB) benefits? If you aren’t getting Social Security or RRB benefits (for example, because you’re still working) and you want Part A or Part B, you’ll need to sign up (even if you’re eligible to get free Part A). If you’re not eligible for free Part A, you can buy Part A and Part B. |

|

SCHEUDLE AN APPOINMENT WITH US

We can help you find the right plan for your needs at NO COST. Please complete our Medicare Questionnaire!!! |

Medicare Resources

|

MEDICARE RESOURCES

NEED HELP PAYING FOR...

Are you a Washington State Public Employee?

Vertical Divider

|

MEDICARE RULES AND COMPLIANCE. (MORE INFO)

*** This information is provided as a courtesy. Please verify that the forms and processes have not changed.

|