|

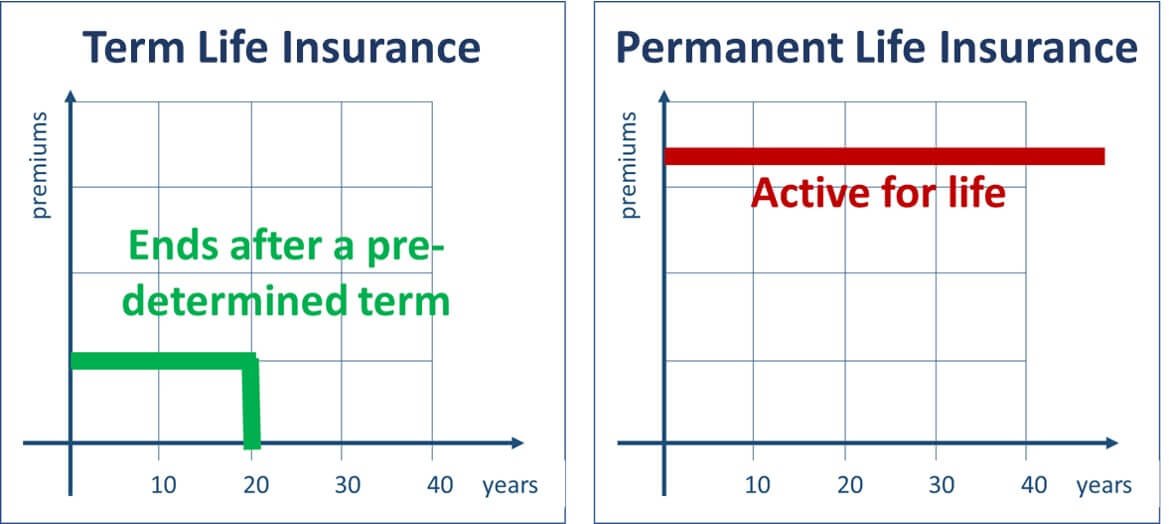

LIFE INSURANCE BASICS Shopping for life insurance can seem overwhelming, but deciding which type of policy you need is actually simple. There are only TWO MAIN TYPES of policies to choose from. It is important that you learn the advantages and disadvantages. WHAT IS THE DIFFERENCE?

|

|

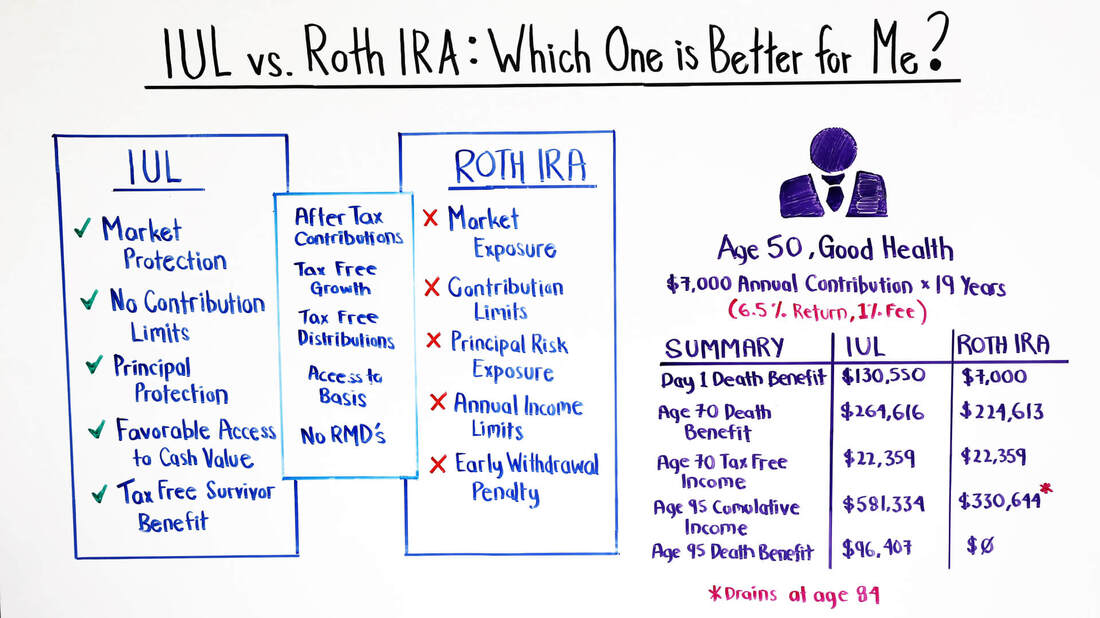

Permanent Life Advantages

|

*** Life contracts are not all the same. Please speak to us and read the product illustrations.

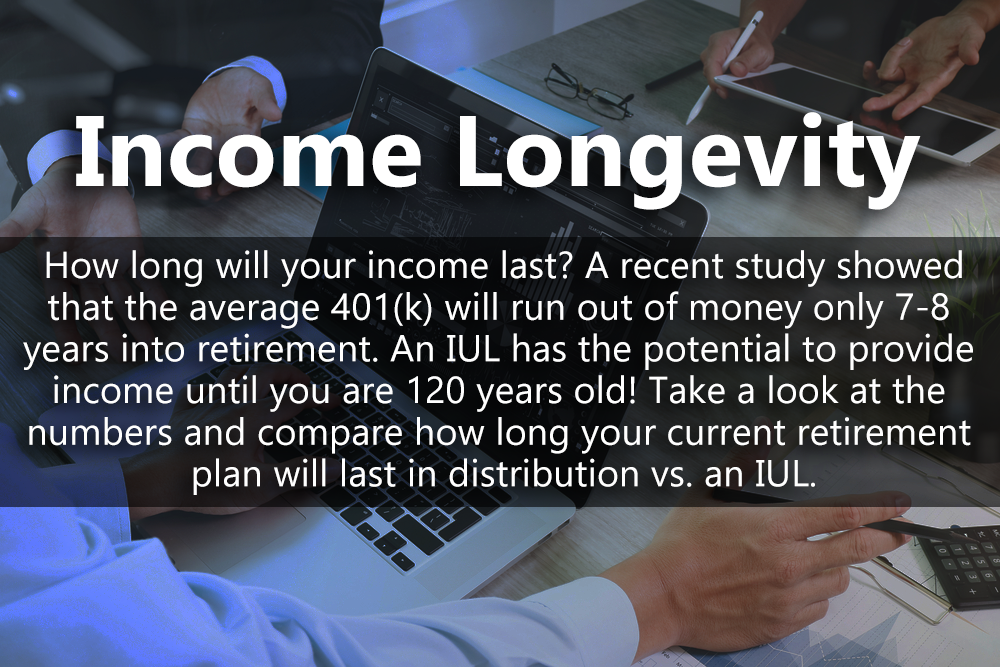

Let's look at some sample Illustrations...

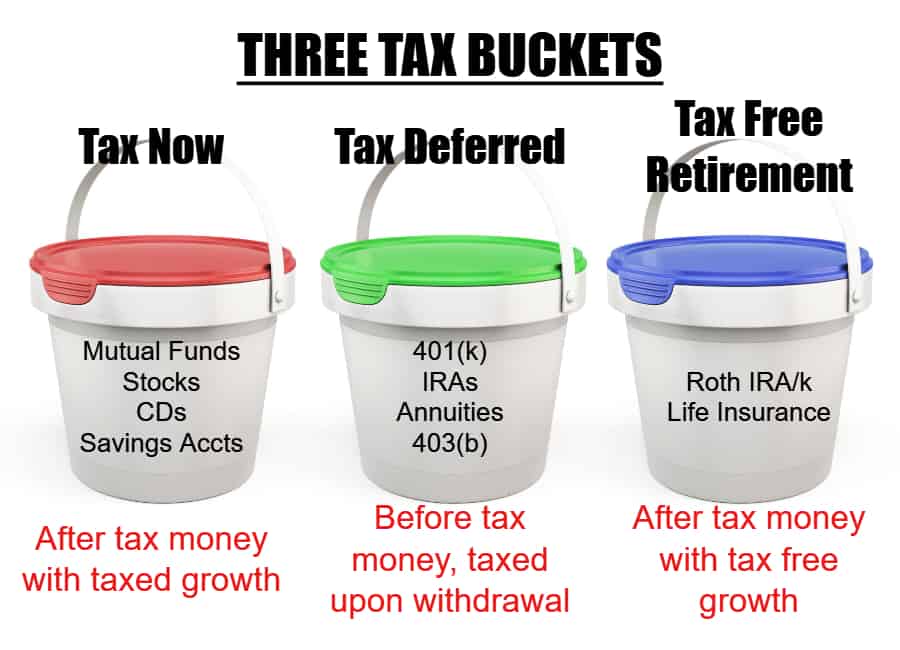

THREE TYPES OF TAXES

HOW IS LIFE INSURANCE TAXED?

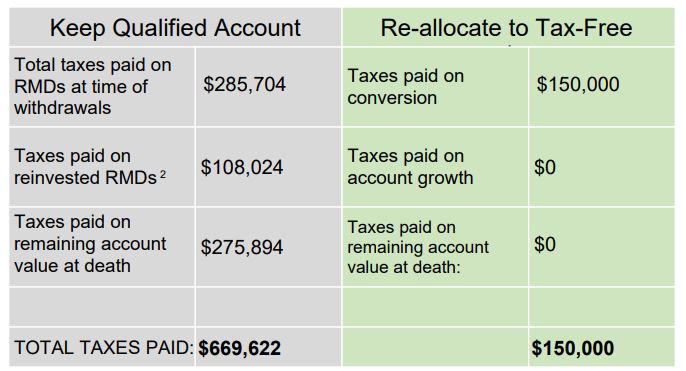

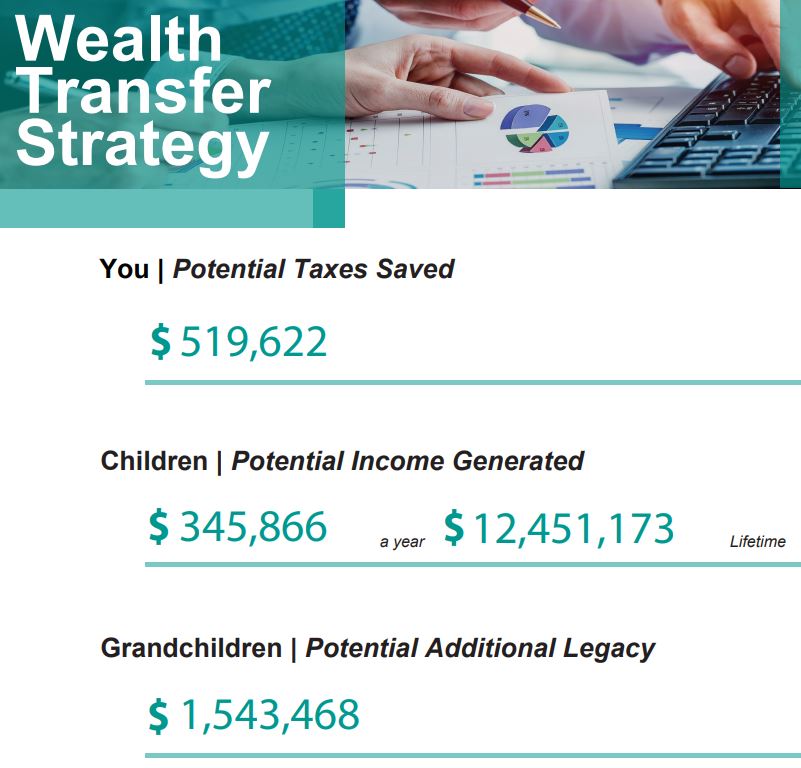

Multi-Generational Strategy

|

A SHORT VIDEO ON WEALTH TRANFER PLANNING

|

|

WATCH THIS WEBINAR