WHO YOU WORK WITH MATTERS...

|

A PROVEN PLAN PROVIDES PEACE OF MIND

Retirement only happens once, so making sure you have the right strategies in place can make all the difference for Retirement. Many of my clients have told me over years that they really appreciate that I take the time to customize a retirement plan at no cost so that I can offer the most accurate and beneficial advice possible. At Birdseye Financial, we start with listening to your needs, analyzing your retirement portfolio, and offering you both the education and implementation of strategies that will help improve your situation. Similar to a visit with a doctor, you expect them to use their years of experience and specific tools like an MRI or X-RAY to diagnose your situation. In a similar way, we use amazing software tools to help you achieve your goals. |

WHAT DOES YOUR RETIREMENT PLAN LOOK LIKE?

We believe good decisions come from informed clients. We start with an analysis of your existing portfolio. We discuss the concerns that you may have. We educate you on how to improve your portfolio. We discuss proven strategies that could help you enjoy your retirement with with less stress.

We believe good decisions come from informed clients. We start with an analysis of your existing portfolio. We discuss the concerns that you may have. We educate you on how to improve your portfolio. We discuss proven strategies that could help you enjoy your retirement with with less stress.

The Birdseye Team...

Our Philosophy...

LICENSES: AZ #7101306, CA #4140429, FL #W825259, GA #3621424, ID #863617, KS #7101306, MA #2176921, NV#3879853, NC #7101306, OK #3001663224, OR #7101306, TX #2695866, WA #190780. Note, that in California, our DBA is Birdseye Financial and Insurance Services.

BIRDSEYE FINANCIAL FOCUS

Corbin Lindsey started Birdseye Financial back in 2002 with the goal of offering his clients an absolutely peaceful experience of working with a financial advisor who listens to his clients’ needs and concerns. By offering a customized retirement plan, his clients discover key strategies that enhance their portfolio. These keys include a tax reduction analysis, Safe Money and Risk Money approach to overcome market volatility and education on how to asset protect your nest egg.

Corbin’s main goal is to offer retirees and pre-retirees proven strategies that deliver security, consistency, and predictability in retirement regardless of stock market volatility from year to year. According to Vanguard and Morningstar, a solid retirement plan that maximizes proven strategies can add upwards of 31% value to your retirement plan in comparison to conventional wisdom.

Birdseye Financial is an independently owned, non-captive agency with the advantage of offering clients access to more products on the market than captive agencies can. With a dual platform of both a fiduciary platform through an Asset Management company and an insurance platform with about 45 insurance companies with access to hundreds of products so that his clients can choose the most competitive products on the market. Birdseye services clients in multiple states.

Corbin Lindsey started Birdseye Financial back in 2002 with the goal of offering his clients an absolutely peaceful experience of working with a financial advisor who listens to his clients’ needs and concerns. By offering a customized retirement plan, his clients discover key strategies that enhance their portfolio. These keys include a tax reduction analysis, Safe Money and Risk Money approach to overcome market volatility and education on how to asset protect your nest egg.

Corbin’s main goal is to offer retirees and pre-retirees proven strategies that deliver security, consistency, and predictability in retirement regardless of stock market volatility from year to year. According to Vanguard and Morningstar, a solid retirement plan that maximizes proven strategies can add upwards of 31% value to your retirement plan in comparison to conventional wisdom.

Birdseye Financial is an independently owned, non-captive agency with the advantage of offering clients access to more products on the market than captive agencies can. With a dual platform of both a fiduciary platform through an Asset Management company and an insurance platform with about 45 insurance companies with access to hundreds of products so that his clients can choose the most competitive products on the market. Birdseye services clients in multiple states.

|

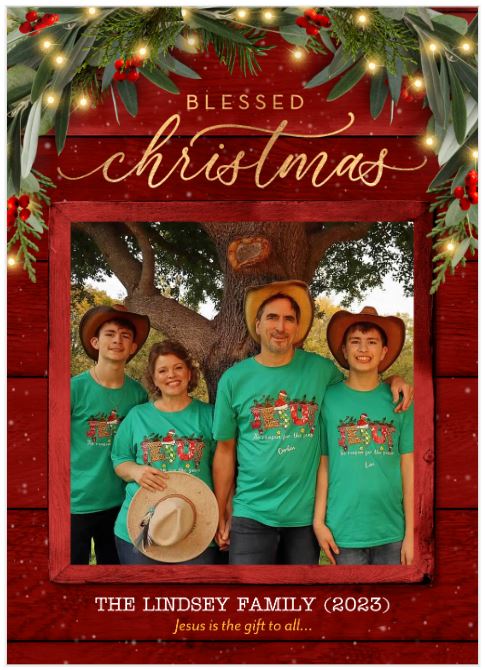

On a personal note, Corbin married his beautiful bride, Tiffany, back in 2000 and has three amazing young men; Micah, Levi, and Joshua.

His favorite activities are spending time with family and being involved in his church. When free time allows, he loves to travel and go to the theater. Corbin attended De Anza College in California with a major Business Marketing. Corbin is also recognized as an Eagle Scout and has spent years serving the homeless in his community. |

Corbin believes planning is important, both financially and spiritually...

WHAT IS THE GREATEST INVESTMENT YOU CAN MAKE?

Corbin loves his family and loves to serve God and share his faith in Jesus Christ. He invites you to take a fresh look at God in the bible and discover the amazing Love that he has for you. Corbin was an active member of his church, Open Door Church of Burleson, TX. His passion is for the Homeless ministry and helping kids escape Sex Trafficking and believes that if the church will stand up to evil, the world will be a better place. However, we must exercise our faith in the process.

WHAT IS THE GREATEST INVESTMENT YOU CAN MAKE?

Corbin loves his family and loves to serve God and share his faith in Jesus Christ. He invites you to take a fresh look at God in the bible and discover the amazing Love that he has for you. Corbin was an active member of his church, Open Door Church of Burleson, TX. His passion is for the Homeless ministry and helping kids escape Sex Trafficking and believes that if the church will stand up to evil, the world will be a better place. However, we must exercise our faith in the process.