Employee Retention Tax Credit

Government Tax Credits

In order to provide economic relief to businesses and individuals during the Coronavirus pandemic, the CARES (Coronavirus Aid, Relief and Economic Security) Act was signed into law in March 2020. The $370 Billion stimulus package makes funding available to small companies which can be used to allow certain employers who retain employees during the crisis, to claim a tax credit. This tax credit is known as the Employee Retention Credit (ERC)

In order to provide economic relief to businesses and individuals during the Coronavirus pandemic, the CARES (Coronavirus Aid, Relief and Economic Security) Act was signed into law in March 2020. The $370 Billion stimulus package makes funding available to small companies which can be used to allow certain employers who retain employees during the crisis, to claim a tax credit. This tax credit is known as the Employee Retention Credit (ERC)

Find out if you qualify for benefits...

HOW IT WORKS

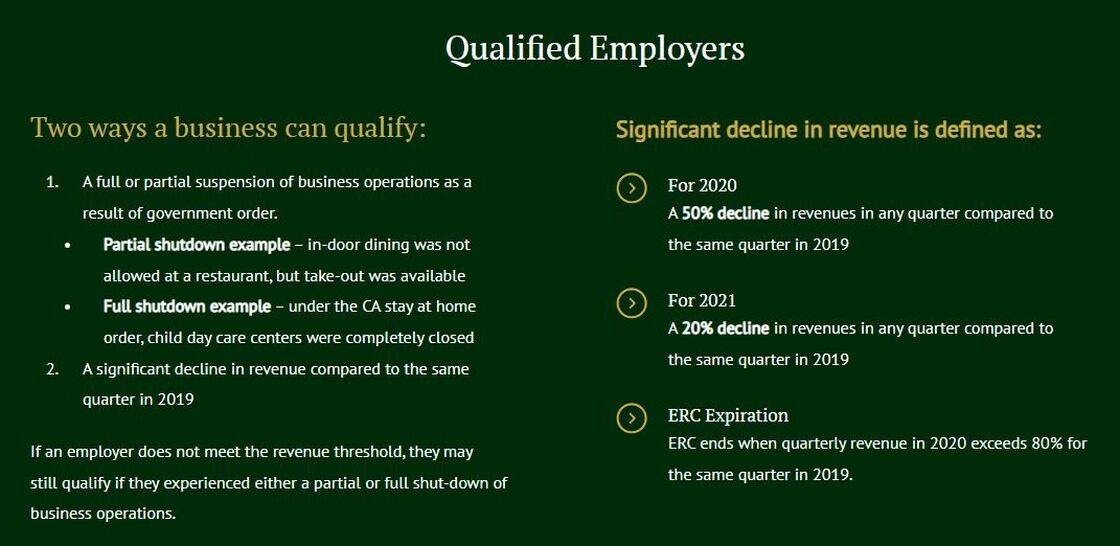

The employee Retention Credit (ERC) was created by Congress to help employers affected by the Covid-19 pandemic. The ERC is a refundable payroll tax credit. The benefits are different for 2020 and 2021.

The employee Retention Credit (ERC) was created by Congress to help employers affected by the Covid-19 pandemic. The ERC is a refundable payroll tax credit. The benefits are different for 2020 and 2021.

|

2020 Cares Act

|

2021 Covid-19 Relief Package

|

The Process... |

We handle all the necessary steps to access the ERC

|