Consider your options...

Pension maximization is the process of analyzing and choosing a pension payout option at the time of your retirement. It’s never too early to begin the process of reviewing pension options and weighing alternatives, however it is a process most commonly done within three years of your anticipated retirement date.

Every pension program is different, but the process we take to help you evaluate your various options is generally the same. It’s easiest to begin your understanding of the process by reviewing a hypothetical.

Every pension program is different, but the process we take to help you evaluate your various options is generally the same. It’s easiest to begin your understanding of the process by reviewing a hypothetical.

|

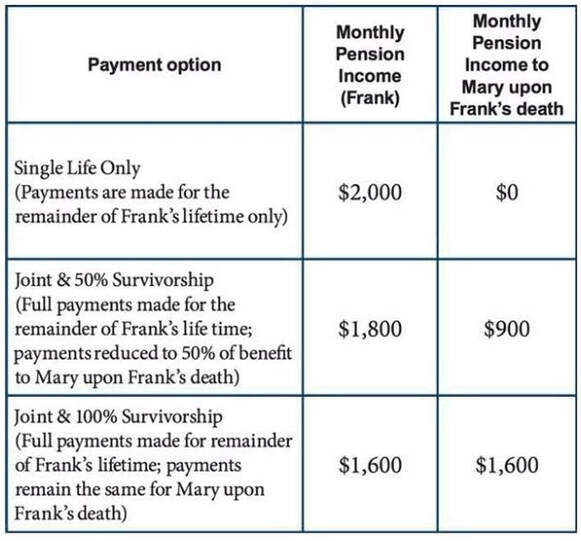

Let’s assume Frank and Mary are married. Frank is eligible for a pension at age 65. In this example, we’ll assume Frank (and Mary) have the following options: As the example illustrates, Frank could take a reduction in payout in order to provide some assurances that his wife, Mary, will continue to receive some level of continued pension income should Frank predecease Mary. |

What if you had additional Pension Options?

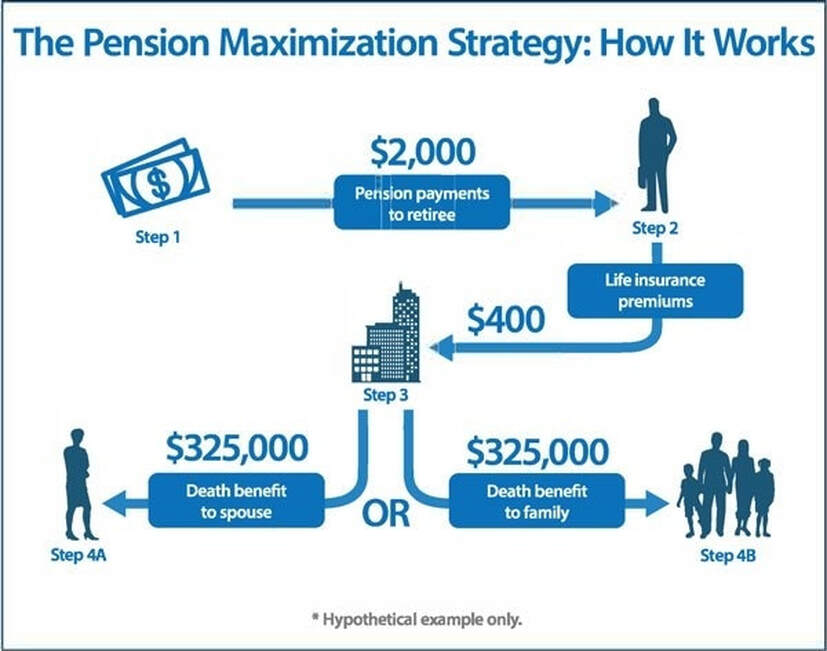

By using a Cash Value Life Insurance, you are able to leverage your pension fee to often accomplish more benefits then you may receive from the pension only. This is an example of how the process works.

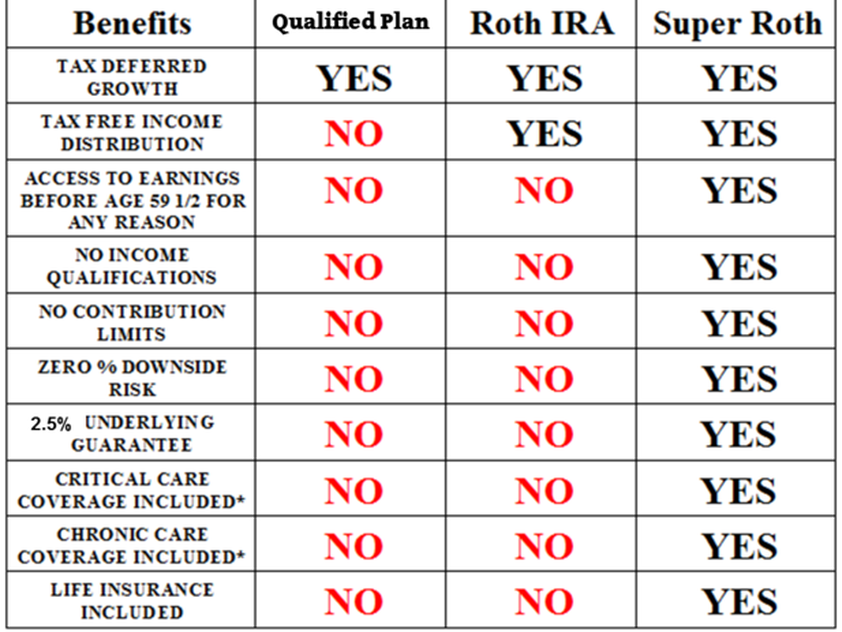

LIFE INSURANCE ADVANTAGES

|

Long-Term Care Benefits

If the Pension Owner chooses, the life policy death benefit could be used to help pay for Long-Term Care benefit included with the Life Policy. For Example, a $250,000 Life Insurance Death Benefit, may offer 2% of this amount tax-free monthly to help pay for Long-Term Care needs. |

*** There are many differences between Cash Value Life Policies. Please refer to an insurance illustration for complete details. The list of SUPER ROTH benefits may differ between products and how they are set-up.

EXPLORE YOUR PENSION OPTIONS...

- How might health insurance coverage factor into your decision?

- How will taxes impact your decision?

- Does it make more sense to take a reduced payout to protect your spouse OR should you consider taking a higher payout and using the increased income to acquire a life insurance policy?

- A possible strategy would require an analysis to determine proper coverage amounts necessary (life insurance is subject to underwriting requirements).

- How might longevity (of you and your spouse) factor into your decision?

- How does your pension decision affect your Social Security benefits?

- How does your pension decision affect your other retirement and investment assets?

Get a Pension Maximization Comparison Analysis!!!