Multi-Generational Strategy

|

A SHORT VIDEO ON WEALTH TRANFER PLANNING

|

|

Multi-Generational Wealth Transfer Concept

You could potentially SAVE money with a ROTH IRA or maybe use the power of a Fixed Index Universal Life Policy (FIUL) to provide children with a TAX-FREE, market SAFE income for life and avoids the ROTH 10 year rule for disbursement.

You could potentially SAVE money with a ROTH IRA or maybe use the power of a Fixed Index Universal Life Policy (FIUL) to provide children with a TAX-FREE, market SAFE income for life and avoids the ROTH 10 year rule for disbursement.

|

What does a parent with a $750,000 Traditional IRA that is earmarked for their children do to create wealth and lesson the tax burdens in the future?

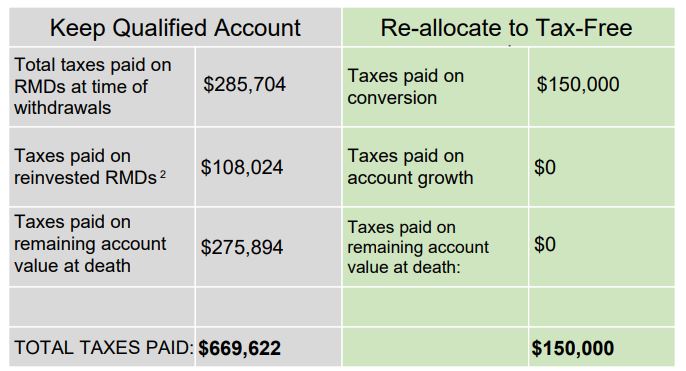

This sample shows you the comparison Assumptions: Age 60, $750,000, 6% interest rate, 1% Expense Fee, 20% tax rate

This sample demonstrates how a ROTH IRA could save the tax-payer up to $519.622 of additional tax.

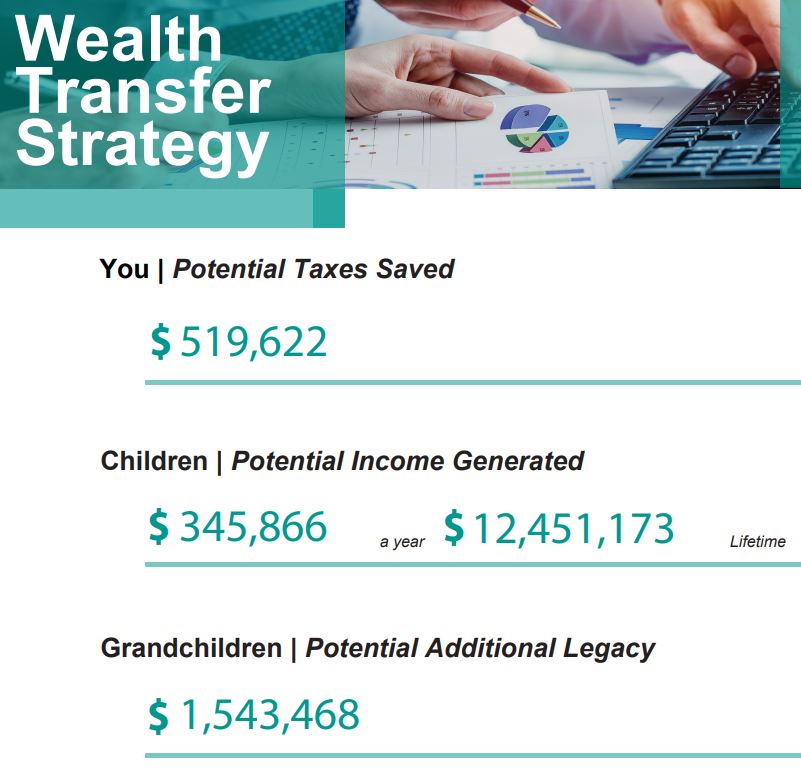

So now let's take these funds earmarked for the children and put it into a TAX-FREE Fixed Index Universal Life Policy and find out what happens. |

This example shows how a parent can convert $750,000 pre-tax dollars ($519,622 after tax dollars) and convert this into a potential TAX-FREE income of $345,866 per year for their two children starting at their kids ages of 65 through age 90; over 25 years. This could be $12,451,173.

|

SAMPLE ILLUSTRATIONS

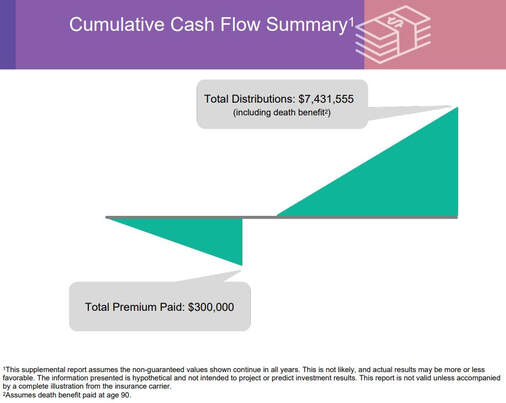

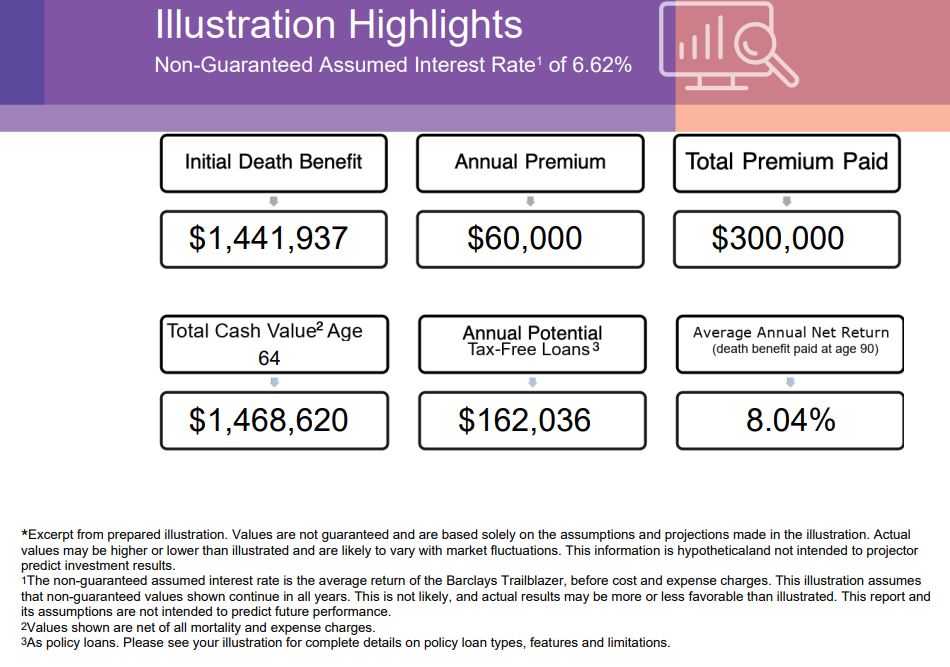

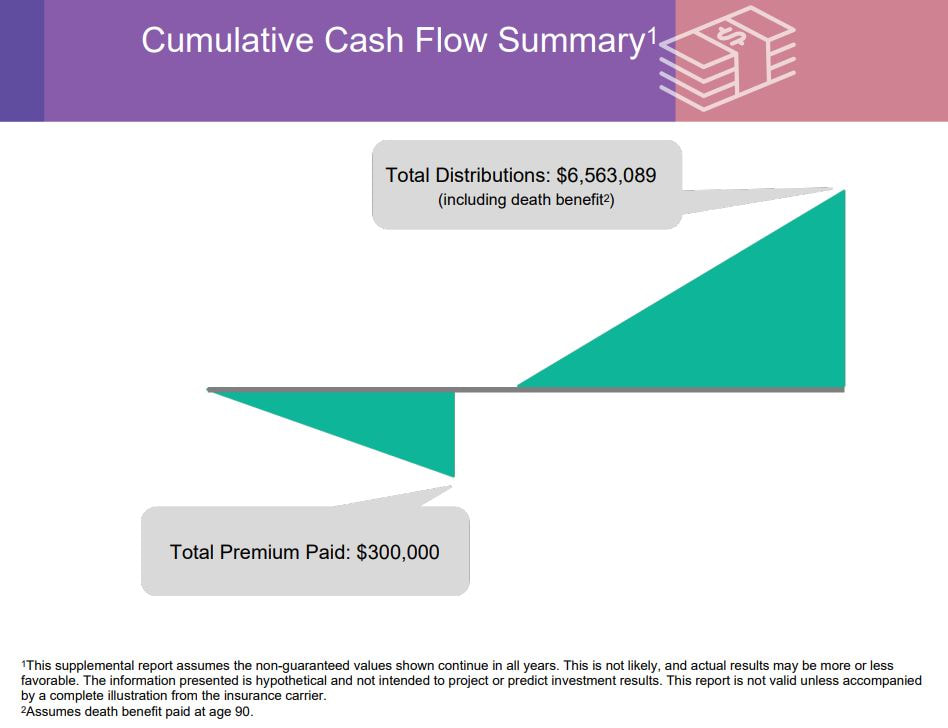

If you take $750,000 less the $150,000 paid in taxes you would have $600,000. If you earmarked $300,00 to each child inside a Fixed Index Universal Life, it would grow TAX-FREE and free from market risk as these policies protect growth from any downside but captures a % the upside.

If you take $750,000 less the $150,000 paid in taxes you would have $600,000. If you earmarked $300,00 to each child inside a Fixed Index Universal Life, it would grow TAX-FREE and free from market risk as these policies protect growth from any downside but captures a % the upside.

|

Child #1 - $300,000

Vertical Divider

|

Child #2 - $300,000

|

For the complete details on every image above, we have provided the complete illustration which will give you all the numbers you see illustrated. In addition, we have provided the Insurance company product illustration for you to review. This is for educational purposes only.