|

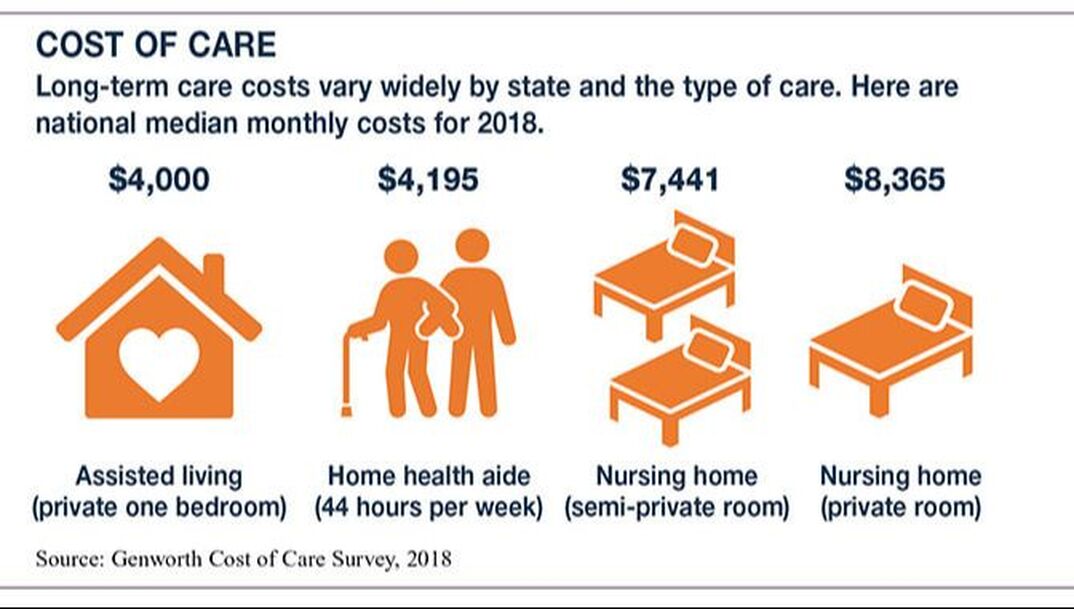

LONG-TERM CARE When we get older we have the concern for the cost of our care. We know the cost is not cheap and in fact it can be very expensive. The main four types of care consist of Home Health, Assisted Living, Nursing Home, and Alzheimer's.

WHO WILL USE LONG-TERM CARE? With over 70% of the population at age 80 using some form of Long-Term care services it is no wonder why the cost is high. |

|

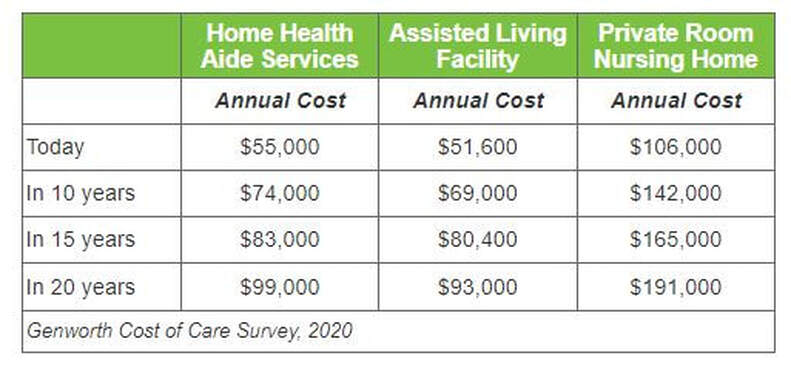

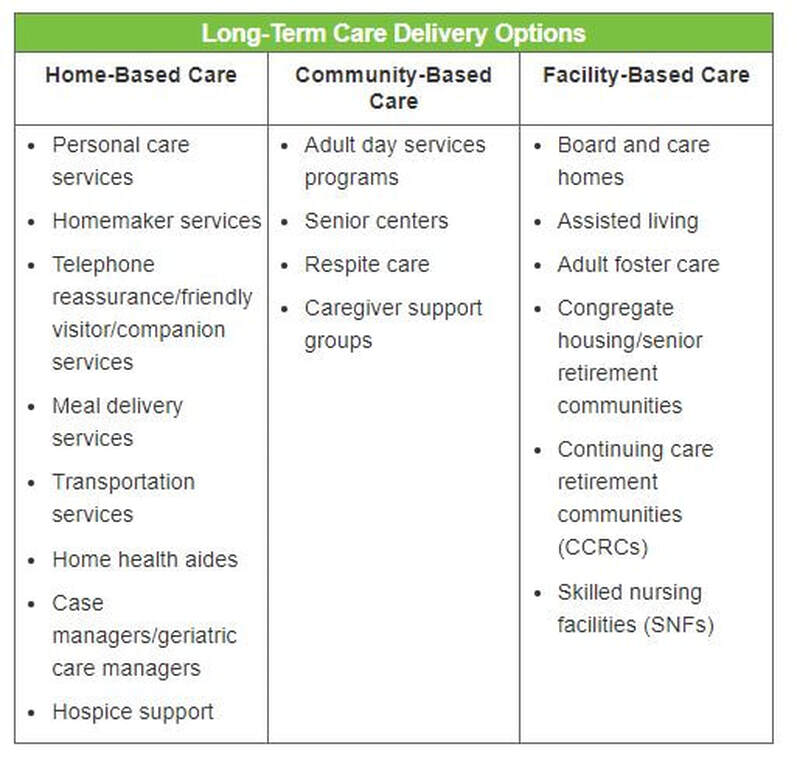

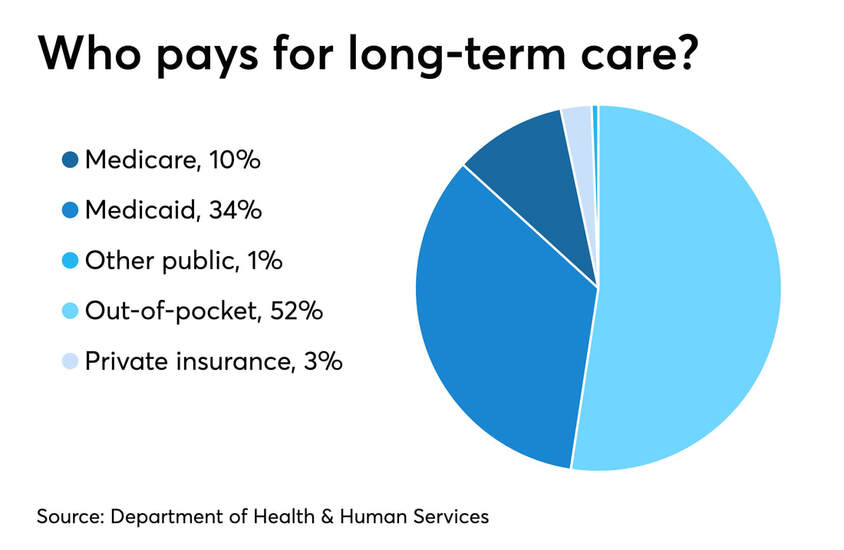

WHAT ABOUT FUTURE COST??? DIFFERENT TYPES OF LONG-TERM CARE WHO MIGHT PAY FOR YOUR LONG-TERM CARE COSTS? |

Long Term Care Services Home Health Care A home health care provider visits your home for a few hours or up to 24 hours per day. Adult Day Care Adult Day Care Facilities are for those who have caregivers at home. Adult day care provides care while the primary caregiver goes to work or attends to personal matters such as shopping or banking. This option can help to keep the patient out of a nursing home. Assisted Living Assisted living facilities are for people who need minor assistance due to cognitive impairment or with their activities of daily living. These facilities can be a very good alternative to nursing homes and often provide many activities for their residents. Residents can have their own apartment where they may be able to bring their own furniture. Nursing Homes This setting which provides 24-hour care. There are options for private rooms but semi-private rooms are most common. Over 40 percent of all long term care is provided in a nursing home. |

How Life Insurance works and LTC work together

|

EXAMPLE ONLY

If a person is purchased a $300,000 Universal Life Policy for $200,000 with a single payment, then the client would have labout $300,000 of Long-term Care benefit for only the cost of $200,000 (About a 50% enhancement). |

Death Benefit (DB) - $300,000

Cash Value (CV) - $200,000 Long-Term Care - $300,000 (approx) *** This is for educational purpose only and all numbers may differ. Please see a hypothetical illustration for more detail |

|

Example #1 - What if the client had Qualified Long-Term Care Needs of $100,000 Death Benefit (DB)

$300,000 - $100,000 = $200,000 Remaining Cash Value (CV) $200,000 - $100,000 = $100,000 Remaining |

Example #2 - What if the client had Qualified Long-Term Care Needs of $250,000 Death Benefit (DB)

$300,000 - $250,000 = $50,000 Remaining Cash Value (CV) $200,000 - $200,000 = $0 Remaining |