Historical S&P 500 Market Performance (Volatility)

PORTFOLIO DIVERSIFICATION

We believe in planning. We know that strategy has proven to work with enhancing what can be accomplished in Retirement Portfolios. So we share with you these graphics below. These show how should position funds for retirement. Your broker may want all the money in the RISK MONEY (the market) while the insurance agent may want all the money in SAFE MONEY (fixed annuities). But we have found that having money in both RISK and SAFE buckets along with LIQUID funds is the best scenario. Let us share this strategy in greater detail...

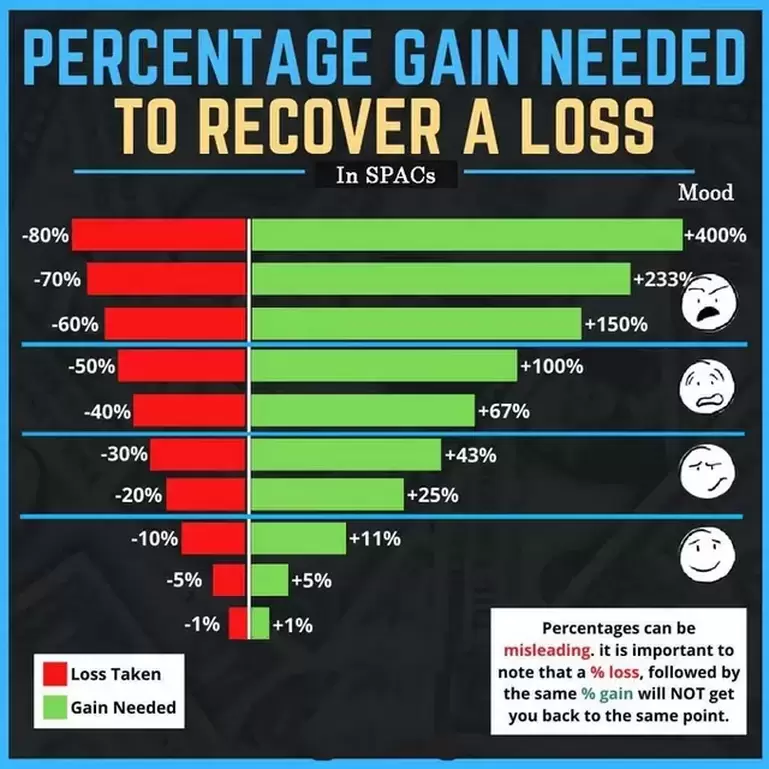

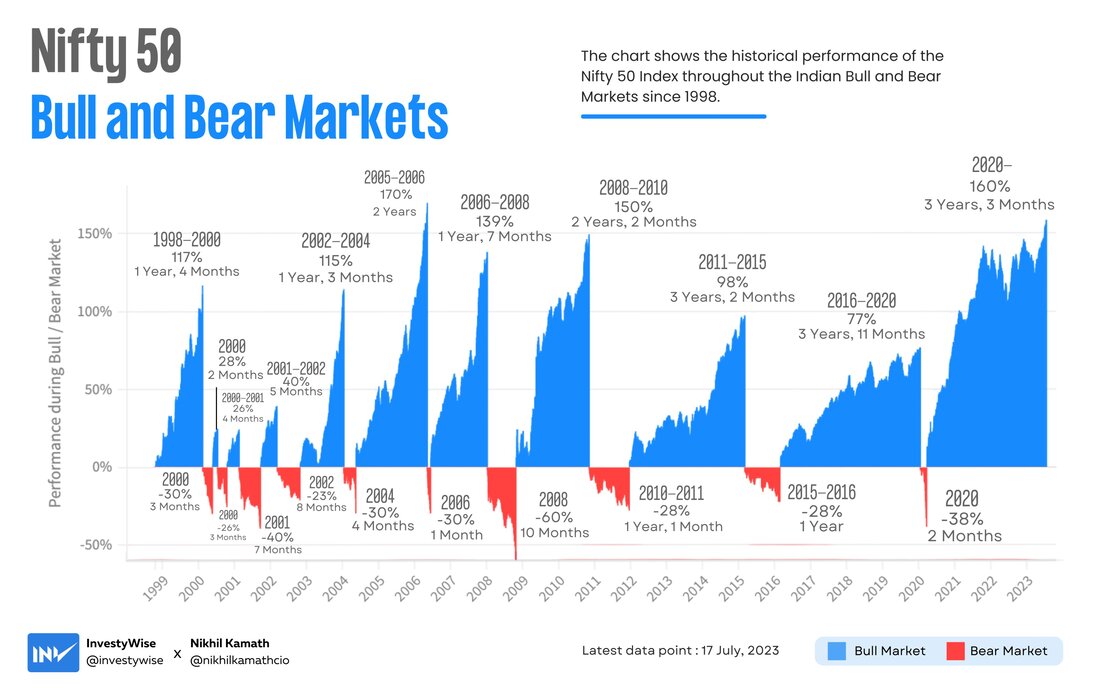

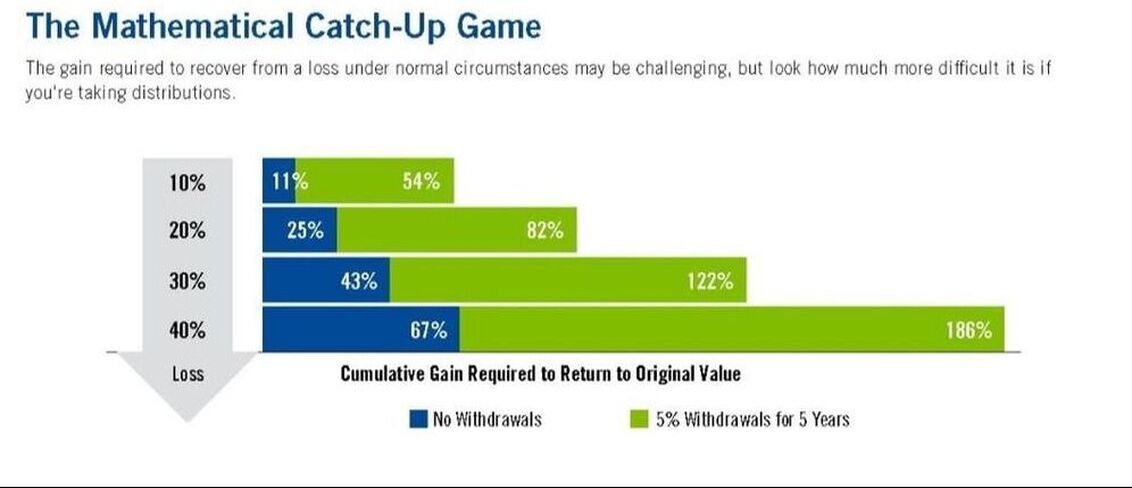

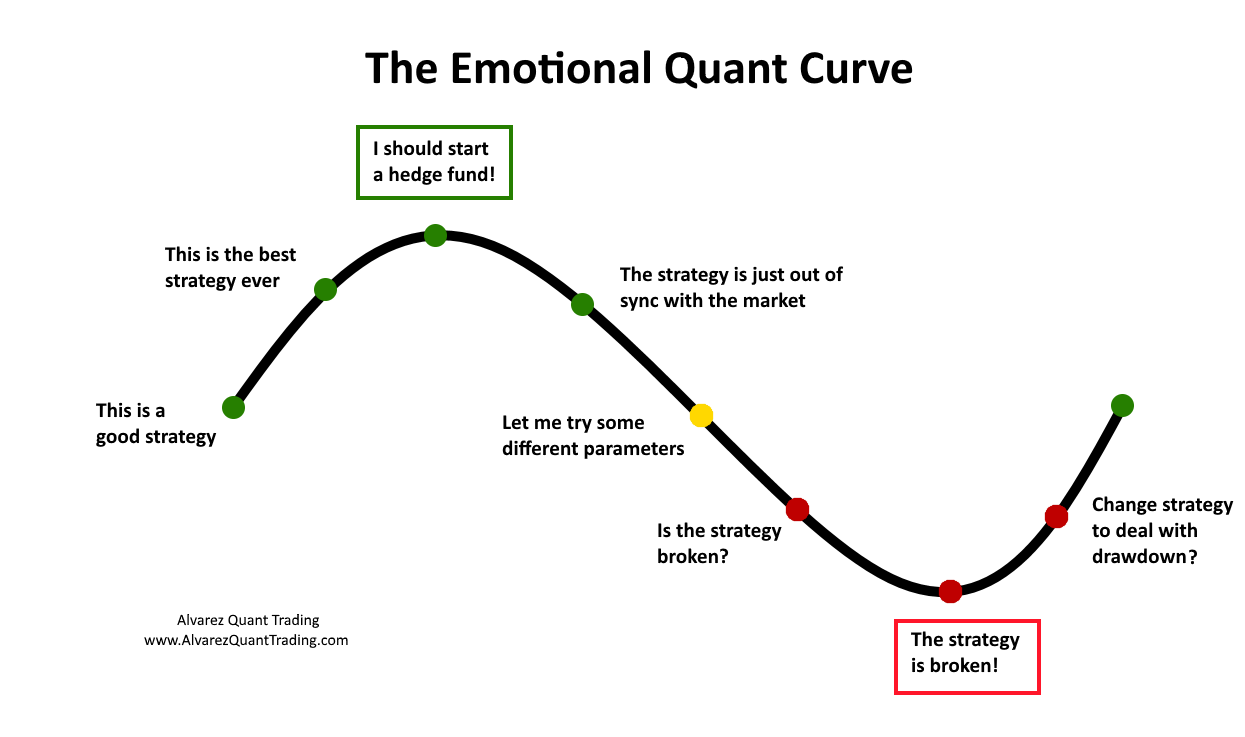

EMOTIONAL INVESTING

|

We have the choice to invest with emotion (Behavior) or with logic (Statistical). When we make investment options with logic, we do not fall into making rash decisions of FEAR and GREED during a volatile market. Let us walk you though how to make good decisions that can be used as a compass over your lifetime.

|

Click to enlarge Image

|

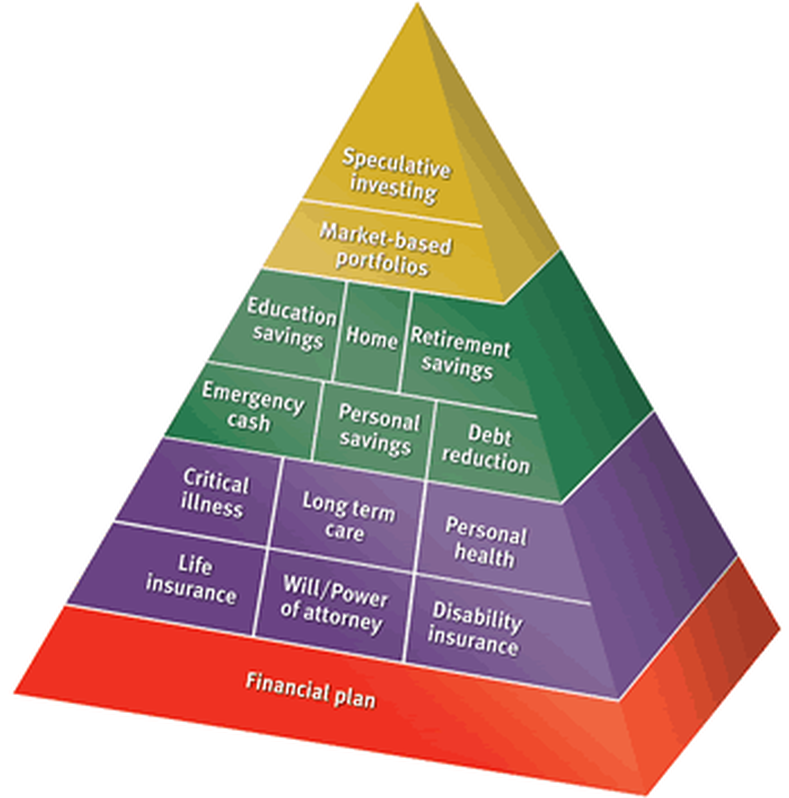

PLANNING STAGES OF LIFE

|

Often we find those in and near retirement, buying products with no plan in place. Before you buy the wood to build a house, you create a plan. This plan helps you know the cost and risks involved. So with life we have many stages that should be addressed and well planned out. This planning will help you know best which type of products you need for retirement. These products could be Investments and insurances combined to enhance what your currently doing. We help you on each step of planning so your goals are the focus and on target to be achieved.

|

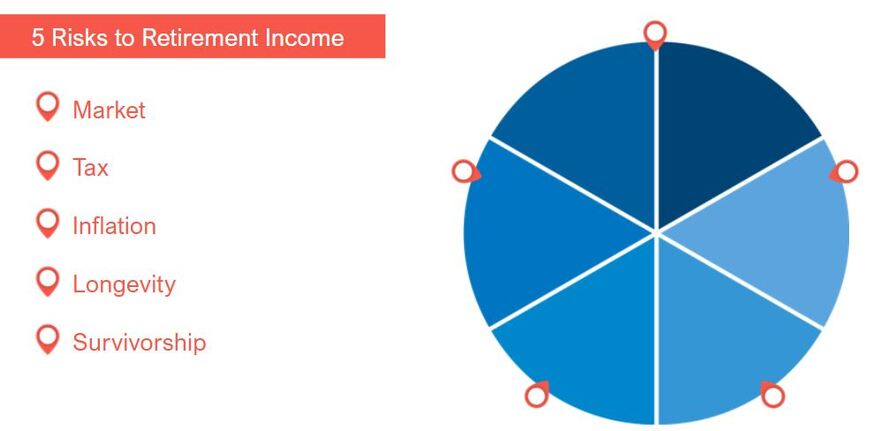

WHAT CAN AFFECT YOUR INCOME?

Growth Calculator

How will your assets grow?

Use this free savings calculator to see how much you'll earn over time.

Use this free savings calculator to see how much you'll earn over time.