|

Schedule your FREE Tax Strategy Session today...

|

The Power of Tax Strategies

What Strategies have you implemented?

|

Learn more about:

We offer you webinar education training to help you understand your options on many topics. |

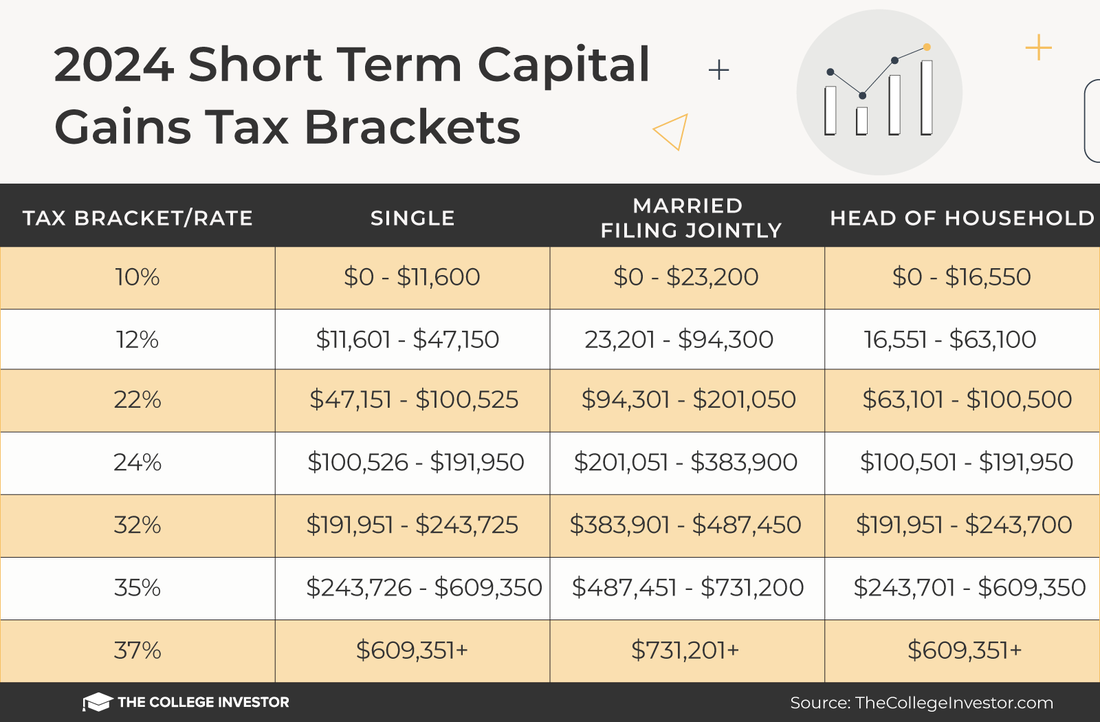

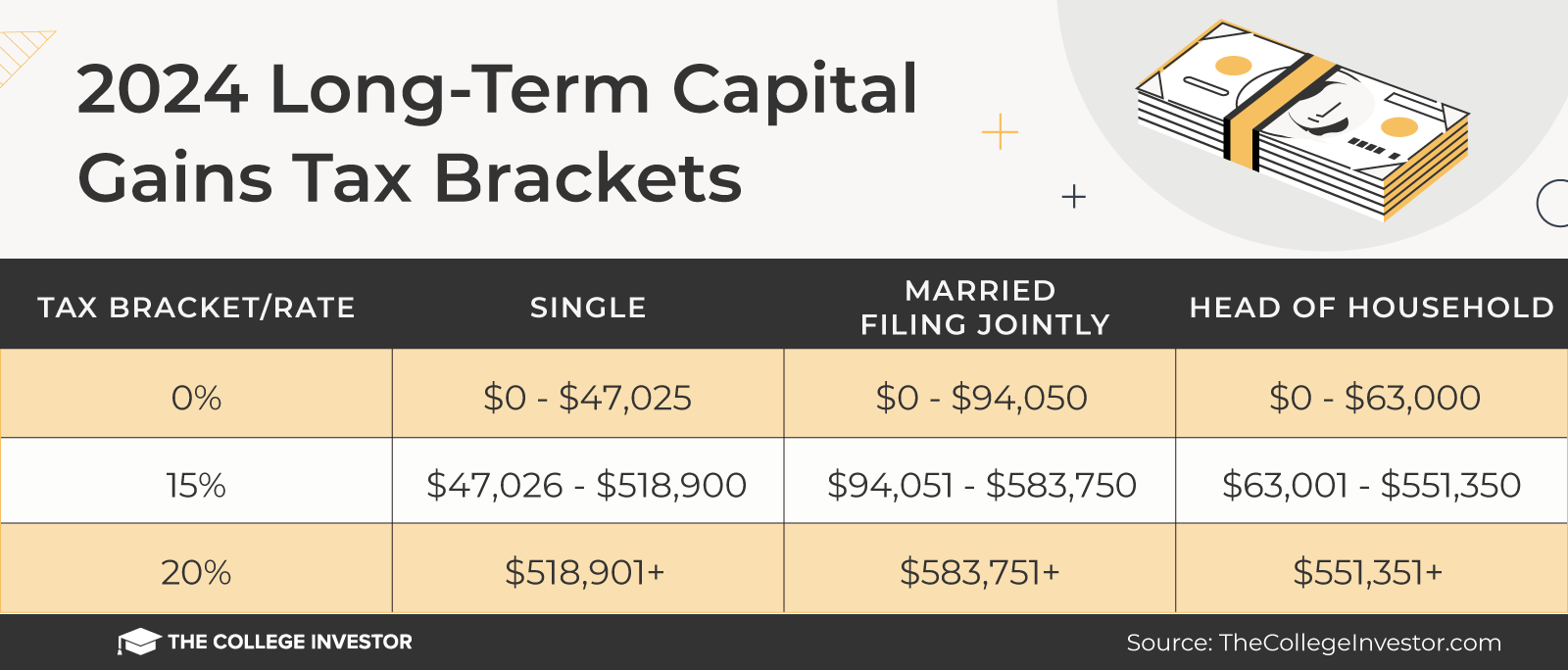

Ordinary and Long-Term Capital Gains

This chart above is for educational purposes only and may differ over time.

|

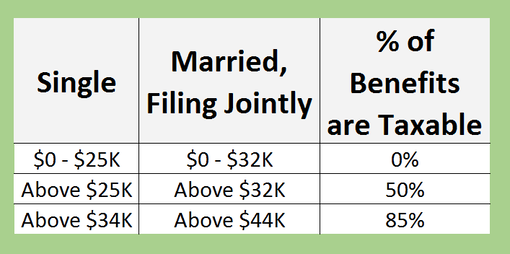

Provisional Tax Social Security Tax |

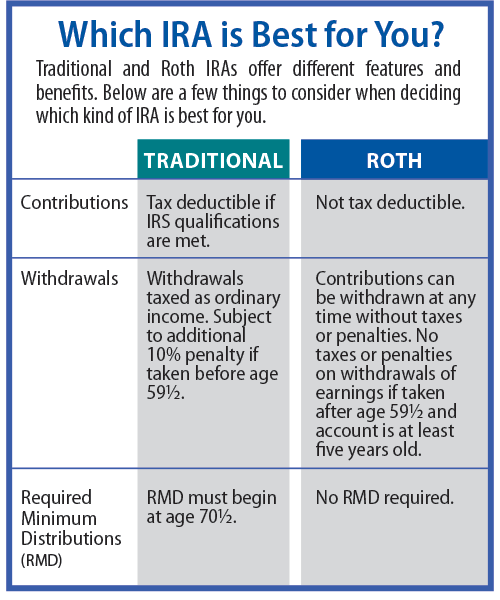

Required Minimum Distributions @ age 72 |

|

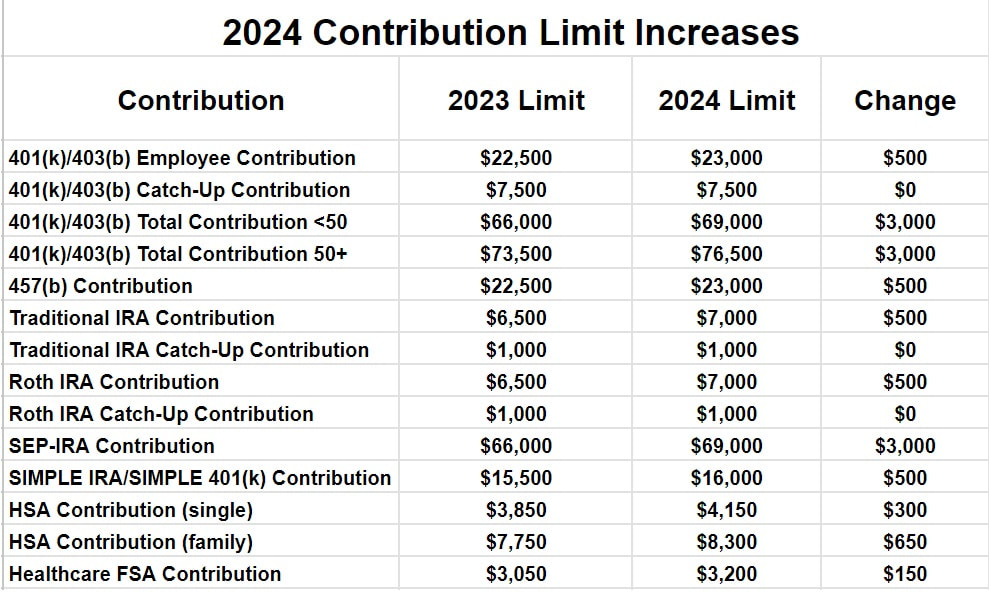

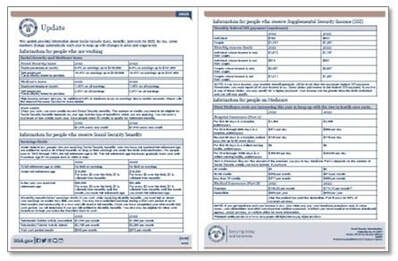

2024 Tax Guide

|

The rule of 55 is an IRS provision that allows people who are 55 or older to withdraw money from their 401(k) or 403(b) plans without penalty if they leave their job during or after the year they turn 55. This is an exception to the IRS rule that usually imposes a 10% penalty on withdrawals from employer-sponsored retirement plans before age 59 1/2. However, account holders are still responsible for paying income taxes on the withdrawals.

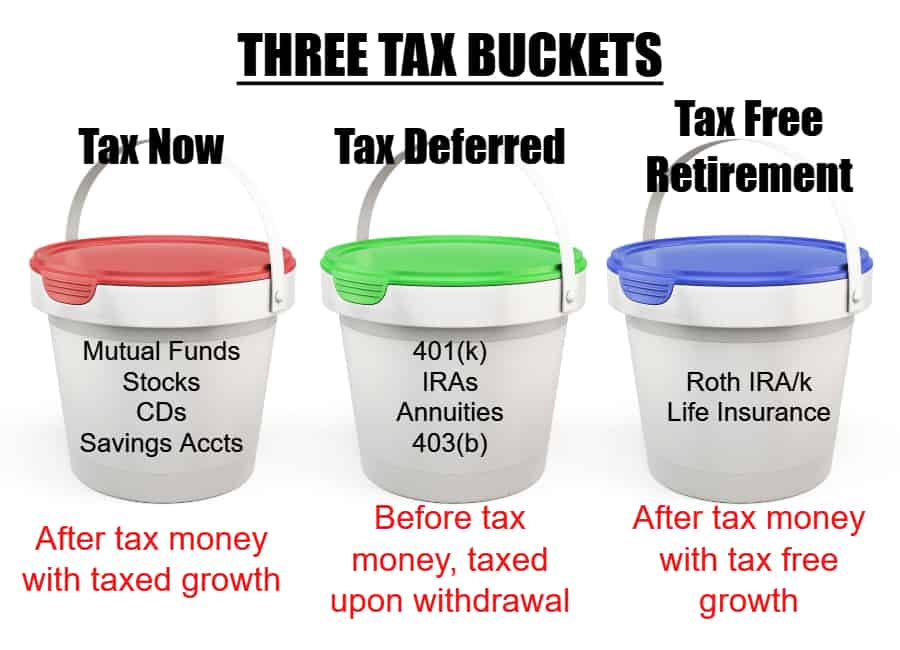

HOW ARE YOU BEING TAXED

What option should you be using?

What option should you be using?

|

Non-Qualified Annuities are taxed as ORDINARY INCOME, not as LONG-TERM Capital Gains. Which means that you could end up paying much more in tax then you may have expected.

ROTH IRAs' are a tax strategy that is an after tax investment that can grow Tax-Free. Which contains funds from the market, annuities, banks and more. |

Roth 401(k) accounts are subject to the same required minimum distribution (RMD) rules that apply to traditional 401(k) accounts. Therefore, the account owner must start taking RMDs from their Roth 401(k) for the year in which they reach age 73 and continue for every year thereafter. Learn how to avoid RMD's on a ROTH 401(k) Read More

|

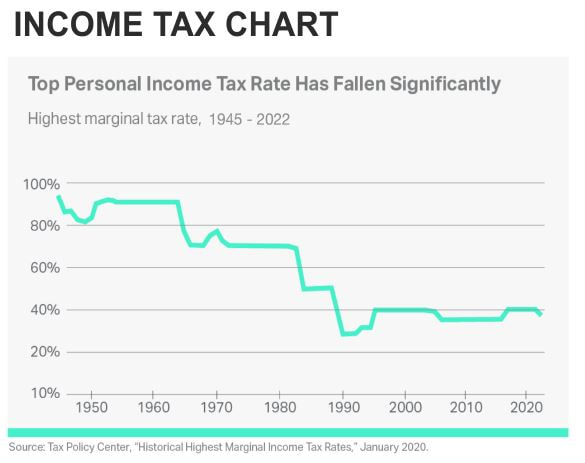

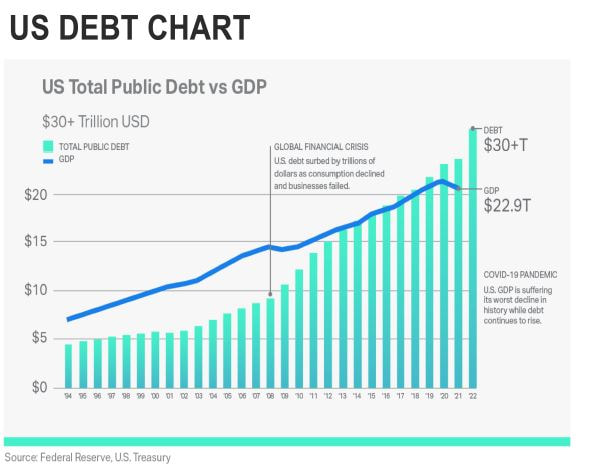

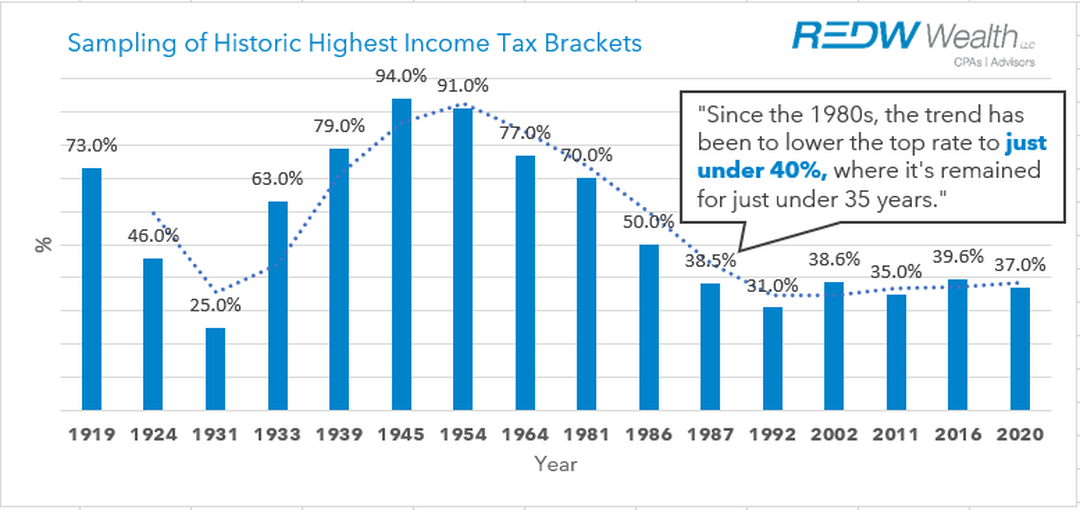

With historic LOW taxes and HIGH debt, Will Taxes Go Up or Down???

EDUCATIONAL TAX VIDEOS

|

Learn about different types of taxes and how they affect you in retirement such as Social Security Spikes and how Short and Long-Term taxes strategies can be applied. |

Learn about how the future of taxes may impact your Retirement and what you can do to to create TAX-FREE income strategy. You can even request your own personalized report. |

|

|

|

CAN YOU CREATE MORE TAX-FREE INCOME IN RETIREMENT?

|

TAX RULES HAVE CHANGE

Understand the potential impact taxes have on your retirement income. Retirement is rated one of life’s most stressful events. Do you have a Retirement Tax Strategy? Many aspects of your everyday life begin to change as you prepare for retirement. One of the biggest changes you are faced with involves your finances. The paycheck you have become accustomed to receiving is no longer coming in. Instead, it is now up to you to decide from which accounts you will take income. Your paycheck may have stopped, but taxes continue. It is important to know and understand the potential tax implications of selecting which assets from which you draw your retirement income. Schedule your FREE Tax Strategy Session today...

|

Request your own Tax Analysis

We will send you our FORM that will help us generate your own personalized tax analysis that you have seen in the video above. This is a value educational only piece. Have a proper Tax advisor review.

We will send you our FORM that will help us generate your own personalized tax analysis that you have seen in the video above. This is a value educational only piece. Have a proper Tax advisor review.

Additional Tax Strategy Solutions

WHAT IS TAX SAVING BY BUNCHING?