What Is a Roth IRA?

A Roth IRA is a type of tax-advantaged individual retirement account to which you can contribute after-tax dollars. The primary benefit of a Roth IRA is that your contributions and the earnings on those contributions can grow tax-free and be withdrawn tax-free after the age 59½ assuming the account has been open for at least five years. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars—this means that the contributions are not tax-deductible, but once you start withdrawing funds, the money is tax-free.

Understanding Roth IRAs

Similar to other qualified retirement plan accounts, the money invested within the Roth IRA grows tax-free. However, a Roth IRA is less restrictive than other accounts. The account holder can maintain the Roth IRA indefinitely; there are no required minimum distributions (RMDs) during their lifetime, as there are with 401(k)s and traditional IRAs

Conversely, traditional IRA deposits are generally made with pretax dollars; you usually get a tax deduction on your contribution and pay income tax when you withdraw the money from the account during retirement.

A Roth IRA can be funded from a number of sources:

The Internal Revenue Service (IRS) limits how much can be deposited annually in any type of IRA, adjusting the amounts periodically. The contribution limits are the same for traditional and Roth IRAs. These limits apply across all your IRAs, so even if you have multiple accounts you can't contribute more than the maximum.

Who’s Eligible for a Roth IRA?

Anyone who has earned income can contribute to a Roth IRA—as long as they meet certain requirements concerning filing status and modified adjusted gross income (MAGI). Those whose annual income is above a certain amount, which the IRS adjusts periodically, become ineligible to contribute.

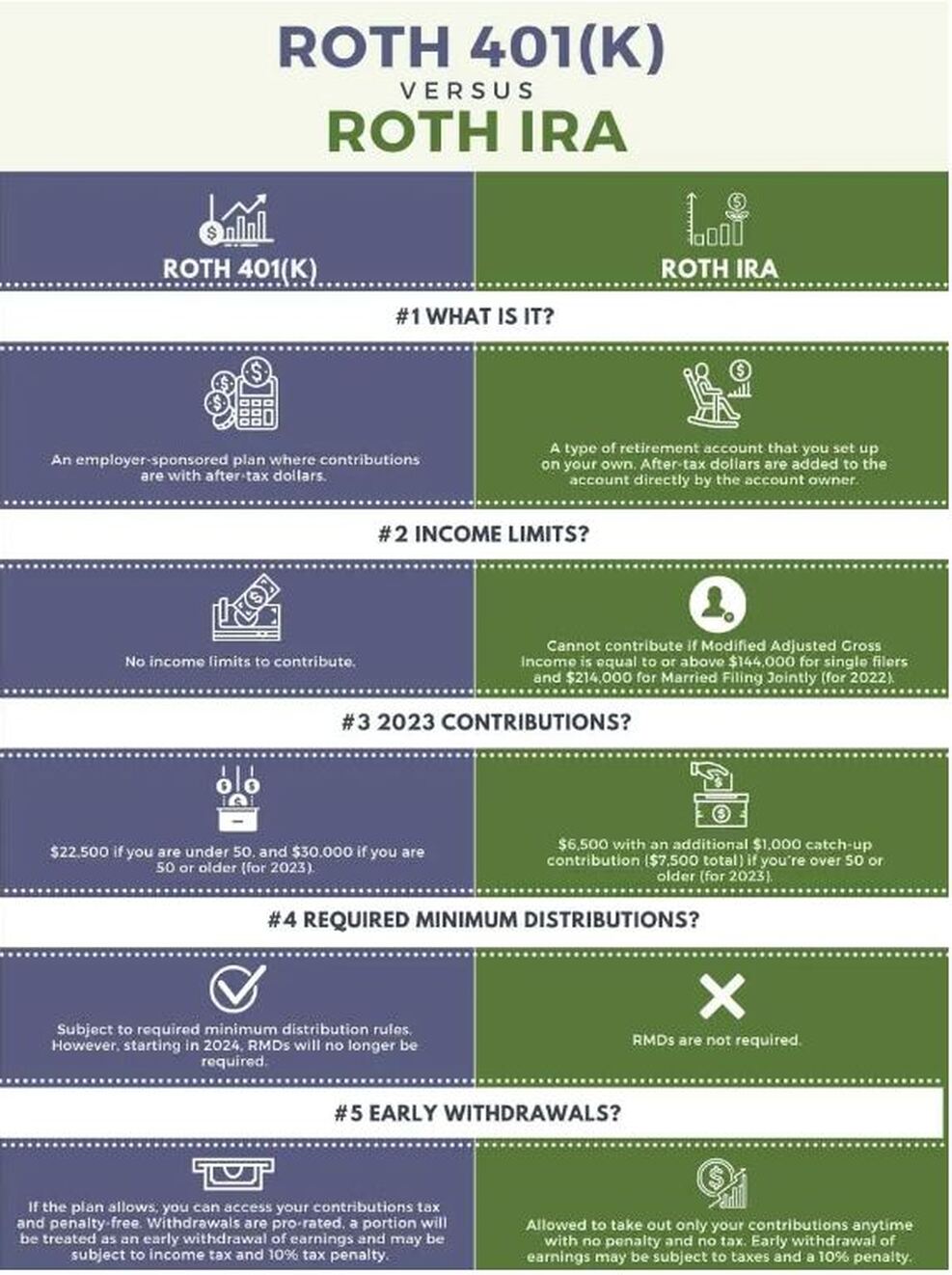

Differences between a ROTH IRA and ROTH 401(k) or ROTH 403(B)

Roth IRAs do not require withdrawals until after the death of the owner. Designated Roth accounts in a 401(k) or 403(b) plan are subject to the RMD rules for 2022 and 2023. However, for 2024 and later years, RMDs are no longer required from designated Roth accounts. You must still take RMDs from designated Roth accounts for 2023, including those with a required beginning date of April 1, 2024. (more Info)

A Roth IRA is a type of tax-advantaged individual retirement account to which you can contribute after-tax dollars. The primary benefit of a Roth IRA is that your contributions and the earnings on those contributions can grow tax-free and be withdrawn tax-free after the age 59½ assuming the account has been open for at least five years. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars—this means that the contributions are not tax-deductible, but once you start withdrawing funds, the money is tax-free.

Understanding Roth IRAs

Similar to other qualified retirement plan accounts, the money invested within the Roth IRA grows tax-free. However, a Roth IRA is less restrictive than other accounts. The account holder can maintain the Roth IRA indefinitely; there are no required minimum distributions (RMDs) during their lifetime, as there are with 401(k)s and traditional IRAs

Conversely, traditional IRA deposits are generally made with pretax dollars; you usually get a tax deduction on your contribution and pay income tax when you withdraw the money from the account during retirement.

A Roth IRA can be funded from a number of sources:

- Regular contributions

- Spousal IRA contributions

- Transfers

- Rollover contributions

- Conversions

The Internal Revenue Service (IRS) limits how much can be deposited annually in any type of IRA, adjusting the amounts periodically. The contribution limits are the same for traditional and Roth IRAs. These limits apply across all your IRAs, so even if you have multiple accounts you can't contribute more than the maximum.

Who’s Eligible for a Roth IRA?

Anyone who has earned income can contribute to a Roth IRA—as long as they meet certain requirements concerning filing status and modified adjusted gross income (MAGI). Those whose annual income is above a certain amount, which the IRS adjusts periodically, become ineligible to contribute.

Differences between a ROTH IRA and ROTH 401(k) or ROTH 403(B)

Roth IRAs do not require withdrawals until after the death of the owner. Designated Roth accounts in a 401(k) or 403(b) plan are subject to the RMD rules for 2022 and 2023. However, for 2024 and later years, RMDs are no longer required from designated Roth accounts. You must still take RMDs from designated Roth accounts for 2023, including those with a required beginning date of April 1, 2024. (more Info)

|

How do ROTH IRA conversions work?

|

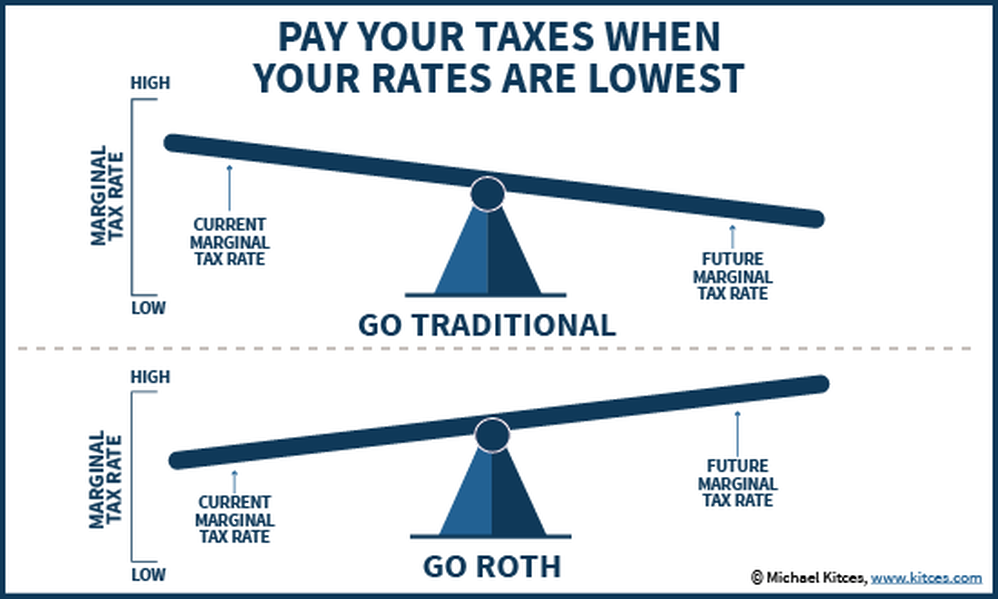

Will taxes go up or down in the future?

THE ROTH 5-YEAR RULE

ROTH CONTRIBUTIONS (THE FIVE YEAR RULE)

ROTH CONVERSIONS (THE FIVE YEAR RULE)

ROTH 401(k) TRANSFERS INTO ROTH IRA (THE FIVE YEAR RULE)

What are Qualified Distributions?

A qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements.

Required Minimum Distributions (RMDs)

401(k) accounts are subject to the same required minimum distribution (RMD) rules that apply to traditional IRAs accounts. Therefore, the account owner must start taking RMDs from their 401(k) for the year in which they reach the age for RMD distributions and continue for every year thereafter unless they are still employed.

Ordering Rules of Distributions

If you receive a distribution from your Roth IRA that isn't a qualified distribution, part of it may be taxable. There is a set order in which contributions (including conversion contributions and rollover contributions from qualified retirement plans) and earnings are considered to be distributed from your Roth IRA. For these purposes, disregard the withdrawal of excess contributions and the earnings on them (discussed under What if You Contribute Too Much? in chapter 2 of Pub. 590-A). (More Info)

Order the distributions as follows.

RESOURCES IRS Publications:

- To satisfy this rule, you must have owned a ROTH IRA for 5 consecutive tax years.

- Once you satisfy the rule for ONE ROTH IRA, you have satisfied it for all of your current and future ROTH IRA's forever.

- If you have not met this rule, any earnings distributed will be treated as taxable income

- Even if you are 59 1/2 or older

- Even if you are a first-time homebuyer

- Even for beneficiaries

- The 5-Year rule does NOT determine whether you will pay a 10% penalty. See Qualified Distributions

ROTH CONVERSIONS (THE FIVE YEAR RULE)

- The rule determines weather you will pay a 10% penalty on any distributions

- The 5-year rule must be satisfied for EACH AND EVERY Conversion

- Rule does not apply once you reach 59 1/2 years old

- ROTH IRA conversion ladder strategy (For those who retire early), they might convert a years worth of expenses each year over a number of years and wait for the 5-year period to lapse so you can access the money without a penalty.

ROTH 401(k) TRANSFERS INTO ROTH IRA (THE FIVE YEAR RULE)

- The 5-year holding period of the ROTH 401(k) doesn't carry over to the Roth IRA, so unless an employee already has a Roth IRA, the 5-year holding period starts over for any measure of tax-free gain on the IRA side. You get NO credit for years you held the ROTH 401(k).

- If the Roth 401(k) has met the 5-year holding period and a qualifying event occurs (usually age 59 1/2) then the Roth elective deferrals plus the gain on those deferrals come over to the Roth IRA as 100% as a tax-free basis. But any future growth on that basis has to meet a brand new 5 year holding period. It doesn’t get the benefit of the 5 years that the Roth 401k already satisfied. So a Roth IRA should be set up simultaneously while in the ROTH 401(k) so that both 5 year periods are running concurrently.

- Roth 401(k)s have higher contribution limits than a ROTH IRA.

What are Qualified Distributions?

A qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements.

- It is made after the 5-year period beginning with the first tax year for which a contribution was made to a Roth IRA set up for your benefit.

- The payment or distribution is:

- Made on or after the date you reach age 59½,

- Made because you are disabled (defined earlier),

- Made to a beneficiary or to your estate after your death, or

- One that meets the requirements listed under First home under Exceptions in chapter 1 (up to a $10,000 lifetime limit).

Required Minimum Distributions (RMDs)

401(k) accounts are subject to the same required minimum distribution (RMD) rules that apply to traditional IRAs accounts. Therefore, the account owner must start taking RMDs from their 401(k) for the year in which they reach the age for RMD distributions and continue for every year thereafter unless they are still employed.

Ordering Rules of Distributions

If you receive a distribution from your Roth IRA that isn't a qualified distribution, part of it may be taxable. There is a set order in which contributions (including conversion contributions and rollover contributions from qualified retirement plans) and earnings are considered to be distributed from your Roth IRA. For these purposes, disregard the withdrawal of excess contributions and the earnings on them (discussed under What if You Contribute Too Much? in chapter 2 of Pub. 590-A). (More Info)

Order the distributions as follows.

- Regular contributions.

- Conversion and rollover contributions, on a first-in, first-out basis (generally, total conversions and rollovers from the earliest year first). See Aggregation (grouping and adding) rules, later. Take these conversion and rollover contributions into account as follows.

- Taxable portion (the amount required to be included in gross income because of the conversion or rollover) first.

- Nontaxable portion.

- Earnings on contributions

RESOURCES IRS Publications:

- Distributions from Individual Retirement Arrangements (IRAs) 590B

- Ten Differences Between a ROTH IRA and a Designated ROTH Account