Sequence of Return Risk

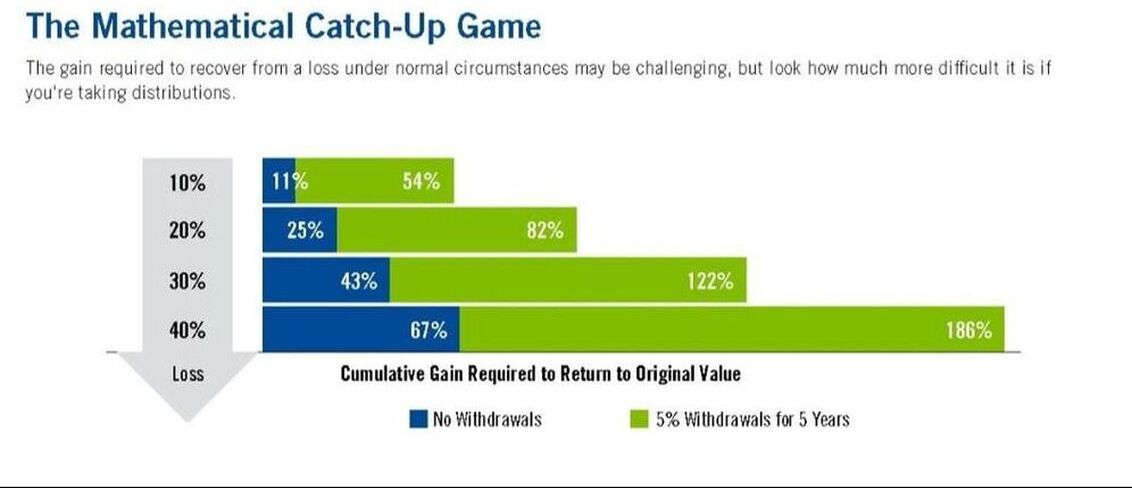

The risk of receiving lower or negative returns early in a period when withdrawals are made from an investment portfolio is known as sequence of return risk. If you are taking withdrawals from your portfolio, the order or the sequence of investment returns can significantly impact your portfolios overall value.

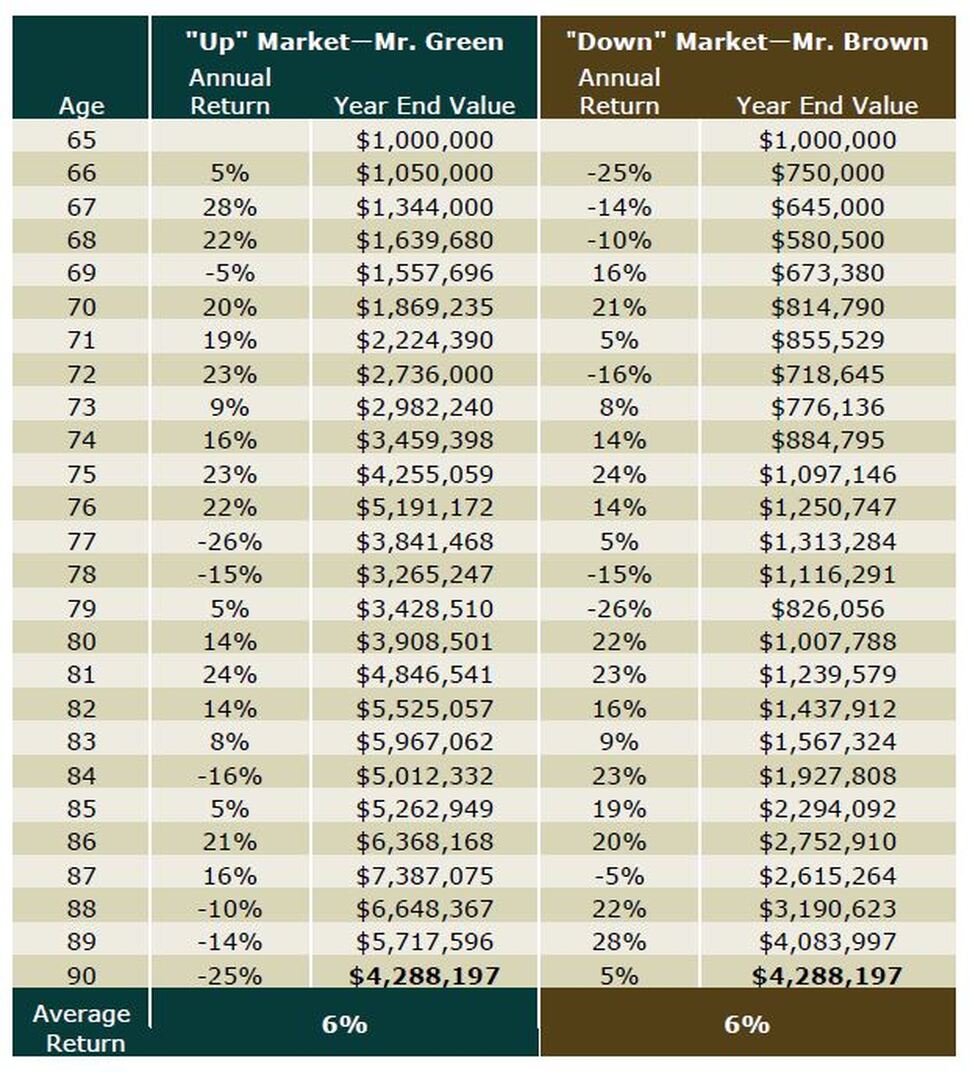

Consider the following hypothetical investment scenarios for Mr. Green and Mr. Brown:

Mr. Green and Mr. Brown both started with a $1 million investment portfolio at age 65. Both averaged a 6% annual return that grows to the same value after 25 years, but they experience their annual returns in an inverse order from each other. See the chart below demonstrating their different paths to their ending values.

The risk of receiving lower or negative returns early in a period when withdrawals are made from an investment portfolio is known as sequence of return risk. If you are taking withdrawals from your portfolio, the order or the sequence of investment returns can significantly impact your portfolios overall value.

Consider the following hypothetical investment scenarios for Mr. Green and Mr. Brown:

Mr. Green and Mr. Brown both started with a $1 million investment portfolio at age 65. Both averaged a 6% annual return that grows to the same value after 25 years, but they experience their annual returns in an inverse order from each other. See the chart below demonstrating their different paths to their ending values.

In this case, the sequence of investment returns had no bearing on portfolio values because the average annual rate of return was the same and no distributions were taken from the account.

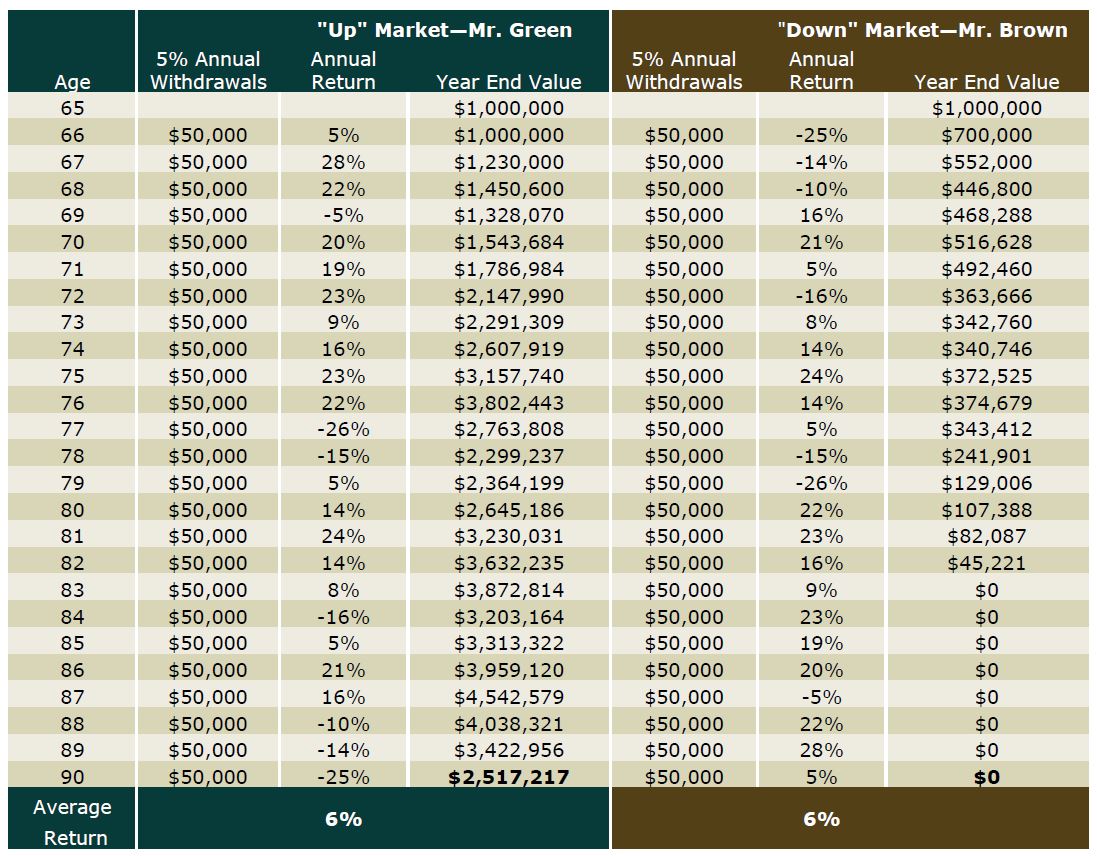

Now let’s look at how the sequence of returns can impact a portfolio when taking distributions:

Mr. Green and Mr. Brown still start with an initial $1 million investment portfolio. But in this example, they start taking 5% withdrawals (of the initial value) beginning immediately at age 65. Mr. Green begins taking withdrawals in an up market, giving him the optimal environment to maintain his portfolio value long-term. Unfortunately for Mr. Brown, he starts taking income in a down market and depletes his entire portfolio before reaching age 83.

Now let’s look at how the sequence of returns can impact a portfolio when taking distributions:

Mr. Green and Mr. Brown still start with an initial $1 million investment portfolio. But in this example, they start taking 5% withdrawals (of the initial value) beginning immediately at age 65. Mr. Green begins taking withdrawals in an up market, giving him the optimal environment to maintain his portfolio value long-term. Unfortunately for Mr. Brown, he starts taking income in a down market and depletes his entire portfolio before reaching age 83.

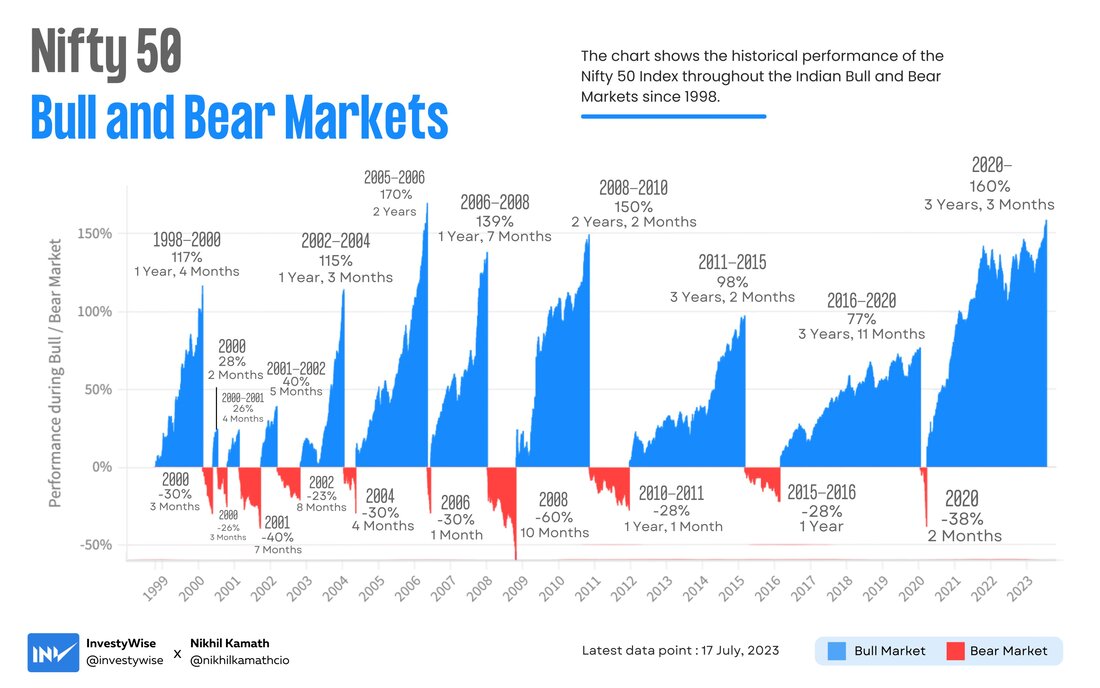

Historical Market Performance

|

Learn about the Volatility Buffer

|