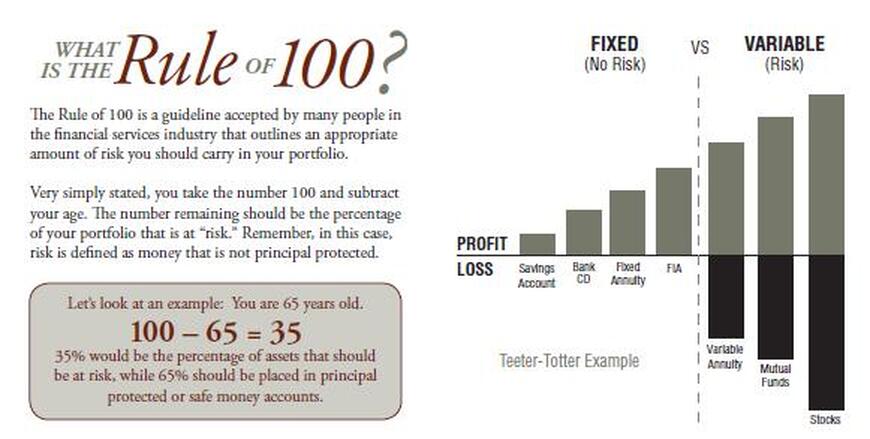

The Rule of 100 is a guideline accepted by many people in the financial services industry that outlines an appropriate amount of risk you should carry in your portfolio. Very simply stated, you take the number 100 and subtract your age. The number remaining should be the percentage of your portfolio that is at "RISK." Remember, in this case, risk is defined as money that is not principal protected.

Then your age represents SAFE

100 Minus your age represents RISK

EXAMPLE

If you are 65 years old

100 - 65 = 35

THE RESULTS

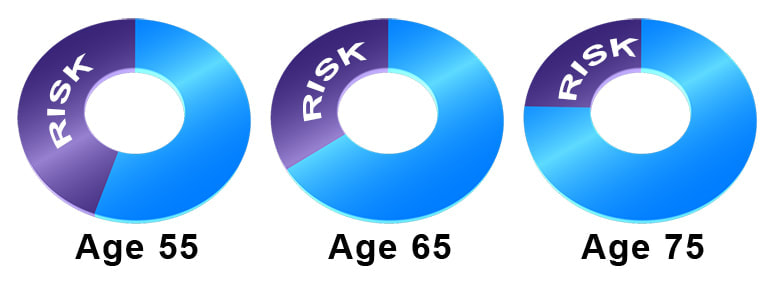

When we grow older, our money is positioned with less risk. This is important because as we grow older, our time horizon is shorter and during retirement when income is needed, we don't want to leave our nest egg open to market declines.

Then your age represents SAFE

100 Minus your age represents RISK

EXAMPLE

If you are 65 years old

100 - 65 = 35

- 65% should be placed in principal protected or safe money accounts

- 35% would be the percentage of assets that should be at risk

THE RESULTS

When we grow older, our money is positioned with less risk. This is important because as we grow older, our time horizon is shorter and during retirement when income is needed, we don't want to leave our nest egg open to market declines.