How much money might you have coming?

|

|

What would you do with $51,000?

June 22, 2021 The Employee Retention Credit (ERC) was created by Congress to help employers affected by the Covid-19 pandemic. Do you qualify? |

|

R&D Tax Credit Testimonial

April 27, 2021 Hear from Jill at Integrity Title in Alexandria, MN on their experience with the R&D Tax Credit |

|

Talking Taxes with Jillian Michaels

March 10, 2021 Listen in to Stacey Doege, Partner at Finances Made Simple, telling Jillian Michaels about the R&D Tax Credit |

|

The Next Relief Bill — Congress Eyes R&D Tax Credit

July 8, 2020 Congress is sharpening its pencils as to the next round of legislation seeking to address the problems facing the nation due to the continuing impact of Covid-19. High on the list — as a means to encourage economic growth — is expanding the R&D tax credit. Time for business owners to make sure they are taking a hard look at whether they qualify for this key business incentive. |

|

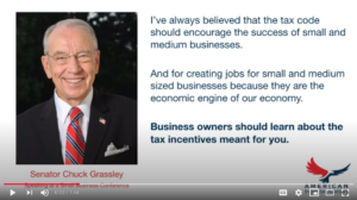

Senator Chuck Grassley Speaks on R&D Tax Credit

October 20, 2019 |

|

Level Funded Small Group Health – Better Coverage Managed Costs

June 17, 2019 As you prepare to navigate the insurance market for small group health, a new tool has come to the market that could help you increase coverage, reduce costs and keep employees satisfied. Level Funded Small Group Health insurance puts control of your health care back in your hands by having the predictability of a fully funded program with the flexibility of the self funded program. Perfect for companies with 5 employees and up. |

|

Using Level Funded Coverage to Improve Service and Reduce Costs

May 1, 2018

|