|

Medicare Tax Deductions:

If you are on Medicare and looking for ways to minimize your tax bill, here’s what you need to know about Medicare premiums and income tax. Birdseye Financial does NOT offer or give any tax advice. We are merely sharing information from various respected resources. YOU SHOULD ALWAYS TALK WITH A TAX PROFESSIONAL. |

Are My Medicare Premiums Tax Deductible?

Tax Deductions Answer: Maybe!

The rules for deduction depend on your specific circumstances, including your income and employment status. Your income, possible deductions and other circumstances can also affect which Medicare premiums you’re able to deduct.

In general, you can deduct:

You can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of AGI (adjusted gross income).

Do You Itemize Deductions?

The Tax Cuts and Jobs Act nearly doubled the standard deduction amounts for 2018 through 2025. As a result, fewer individuals are claiming itemized deductions. If you have significant medical expenses, including Medicare health insurance premiums, they may add up to enough that it will be advantageous to itemize deductions and collect some tax savings.

What Documents Do You Need To Deduct Medicare Premiums?

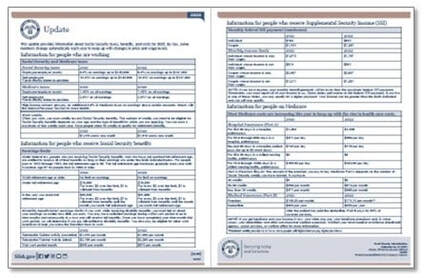

Tax Deductions Answer: SSA-1099

Most people have any Medicare Part A and Part B premiums deducted from their Social Security benefit. If you do, you will receive a form each year called SSA-1099. The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes.

In addition, you will receive a form from Medicare called a Medicare Summary Notice. This lists all the services you received, what Medicare paid for them, and the amount billed to you.

Medicare sends you a summary notice every 3 months. If you have a myMedicare account, you can get the same information at any time.

Self-Employed - Are Medicare Premiums Tax Deductible?

Tax Deductions Answer: Yes!

So, for example, if you’re doing freelance consulting work in retirement, you could deduct your Medicare premiums pretax. If your business didn’t earn you any income, though, you can’t deduct your benefits pretax.

This deduction is available whether or not you itemize. It is NOT subject to the 10% test of AGI (adjusted gross income) that applies to medical expenses.

One caveat pointed out by Kiplinger’s: You can’t claim this deduction if you are eligible to be covered under an employer subsidized health plan offered by either your employer (if you have retiree medical coverage, for example) or your spouse’s employer (if he or she has a job that offers family medical coverage) on for their health insurance premiums, including Medicare premiums. So, they don’t need to itemize to get the tax savings from their premiums.

What Other Expenses Can Help You Meet The Deductible Limits?

In addition to your Medicare premiums, and Medicare insurance premiums, you can deduct various medical expenses. They include:

Only expenses that you actually pay out-of-pocket count toward the itemized deductions. In other words, if you have a $15,500 hospital bill, and Medicare pays all but $1,200 of it, only the $1,200 that you pay for your care can be itemized on your return, not the entire $15,500 bill.

If you go by car for Medicare care, you can deduct a flat per-mile rate (Changes yearly) or you can keep track of your actual out-of-pocket expenses for gas, oil and repairs.

Tax Deductions Answer: Maybe!

The rules for deduction depend on your specific circumstances, including your income and employment status. Your income, possible deductions and other circumstances can also affect which Medicare premiums you’re able to deduct.

In general, you can deduct:

- Medicare Part A premiums. After age 65, most people get Medicare Part A without paying a premium. As a result there isn’t anything to deduct. If you do pay a Part A premium and aren’t getting any Social Security benefits, you can deduct the premium.

- Medicare Part B premiums. Medicare Part B premiums are tax deductible as long as you meet the income rules.

- Medicare Part C premiums. You can deduct any Medicare Part C premiums if you meet the income rules.

- Medicare Part D premiums. As with Parts B and C, you can deduct your Part D premiums if you meet the income rules.

- Medicare Supplement insurance (Medigap). Medigap premiums can also be tax deductible.

You can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of AGI (adjusted gross income).

Do You Itemize Deductions?

The Tax Cuts and Jobs Act nearly doubled the standard deduction amounts for 2018 through 2025. As a result, fewer individuals are claiming itemized deductions. If you have significant medical expenses, including Medicare health insurance premiums, they may add up to enough that it will be advantageous to itemize deductions and collect some tax savings.

What Documents Do You Need To Deduct Medicare Premiums?

Tax Deductions Answer: SSA-1099

Most people have any Medicare Part A and Part B premiums deducted from their Social Security benefit. If you do, you will receive a form each year called SSA-1099. The SSA-1099 statement will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes.

In addition, you will receive a form from Medicare called a Medicare Summary Notice. This lists all the services you received, what Medicare paid for them, and the amount billed to you.

Medicare sends you a summary notice every 3 months. If you have a myMedicare account, you can get the same information at any time.

Self-Employed - Are Medicare Premiums Tax Deductible?

Tax Deductions Answer: Yes!

- If you are self-employed you can generally deduct the premiums you pay for Medicare Part B and Part D. Plus, you can deduct the cost of a Medicare Supplement (Medigap) policy or the premiums paid for a Medicare Advantage policy.

- You are considered self-employed if you own a business that earns income, even if you’re a sole proprietor.

So, for example, if you’re doing freelance consulting work in retirement, you could deduct your Medicare premiums pretax. If your business didn’t earn you any income, though, you can’t deduct your benefits pretax.

This deduction is available whether or not you itemize. It is NOT subject to the 10% test of AGI (adjusted gross income) that applies to medical expenses.

One caveat pointed out by Kiplinger’s: You can’t claim this deduction if you are eligible to be covered under an employer subsidized health plan offered by either your employer (if you have retiree medical coverage, for example) or your spouse’s employer (if he or she has a job that offers family medical coverage) on for their health insurance premiums, including Medicare premiums. So, they don’t need to itemize to get the tax savings from their premiums.

What Other Expenses Can Help You Meet The Deductible Limits?

In addition to your Medicare premiums, and Medicare insurance premiums, you can deduct various medical expenses. They include:

- Deductibles, co-pays, coinsurance, non-covered services

- Hospital, hospice, or skilled nursing care

- Outpatient services including doctor visits, ambulance rides, and diagnostic tests

- Prescription medications

- Dental and vision care (including dentures, eye exams and eyeglasses)

- Hearing aids and preventive care

- Home modifications necessary to keep you safe

Only expenses that you actually pay out-of-pocket count toward the itemized deductions. In other words, if you have a $15,500 hospital bill, and Medicare pays all but $1,200 of it, only the $1,200 that you pay for your care can be itemized on your return, not the entire $15,500 bill.

If you go by car for Medicare care, you can deduct a flat per-mile rate (Changes yearly) or you can keep track of your actual out-of-pocket expenses for gas, oil and repairs.