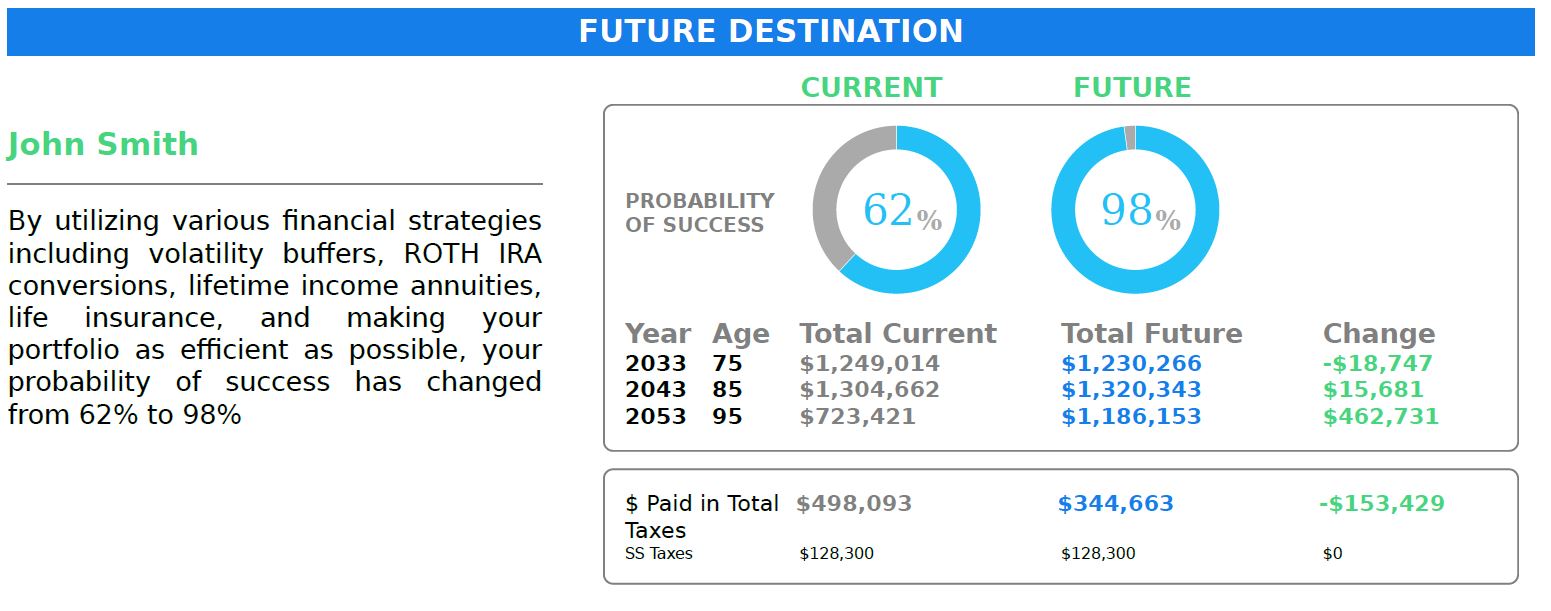

Strategy Overview

Volatility Buffer using a FIXED INDEX Annuity

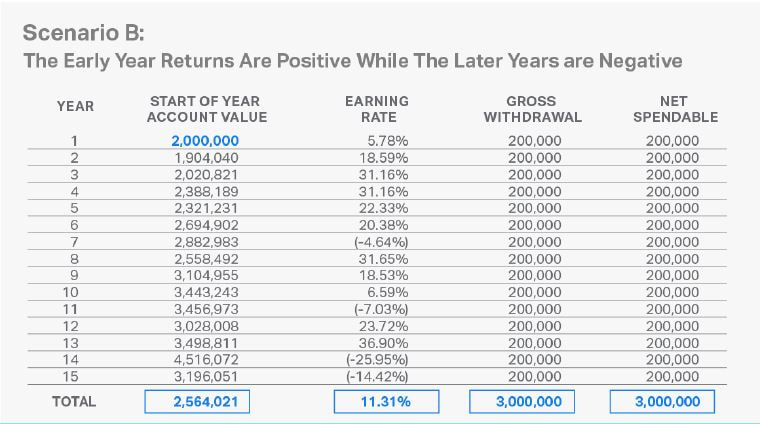

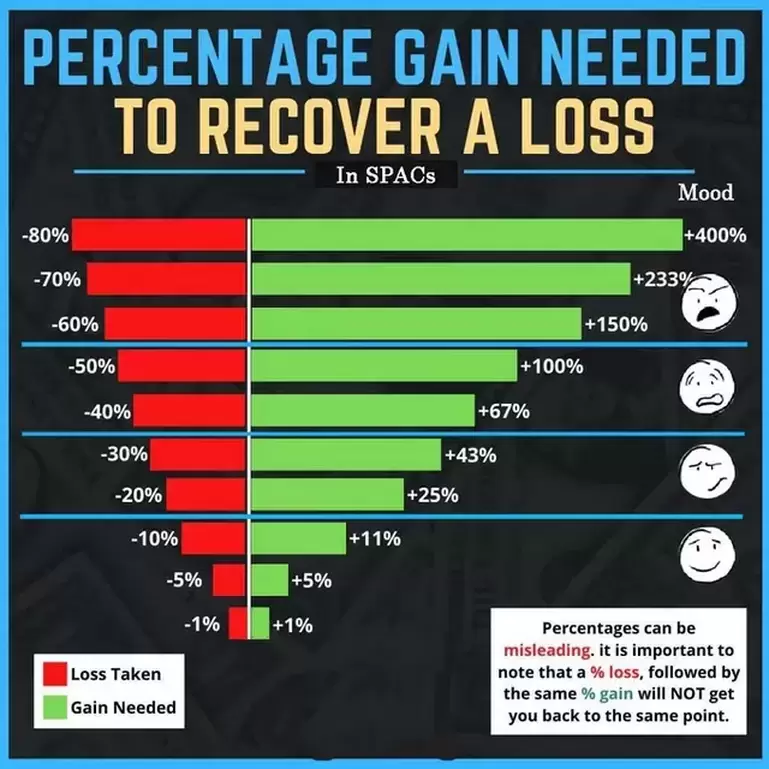

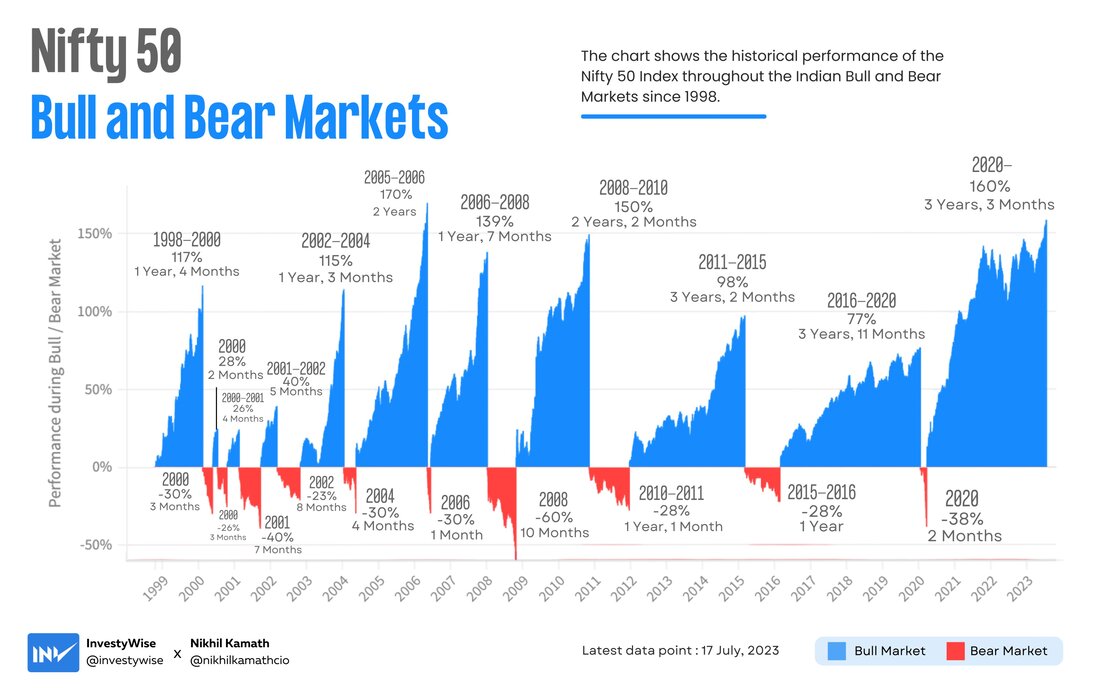

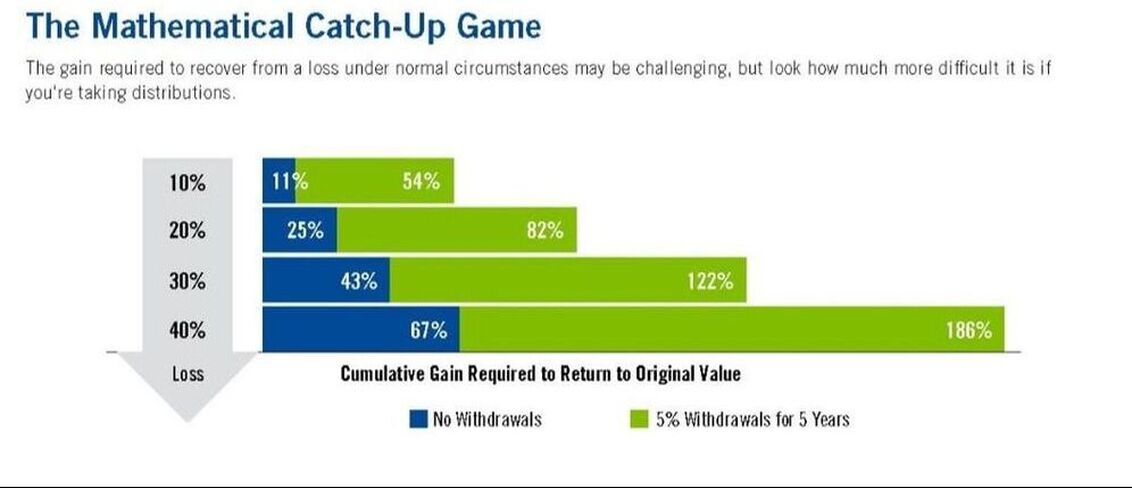

During the Income phase of Retirement, often we may encounter an issue of a down market. When taking money out during a down market the chance of recovery can be very severe to the asset portfolio. This is called a Sequence-of-returns issue. Sequence-of-returns risk, or sequence risk, is the risk that an investor will experience negative portfolio returns very late in their working lives and/or early in retirement. As shown below, is two examples of the same rate of return, but in a reverse order. When funds are being drawn down during retirement and the market is negative, this can lead to a person depleting their account value.

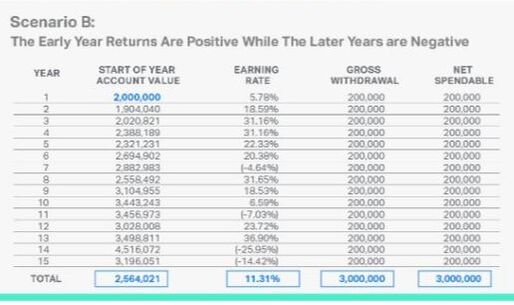

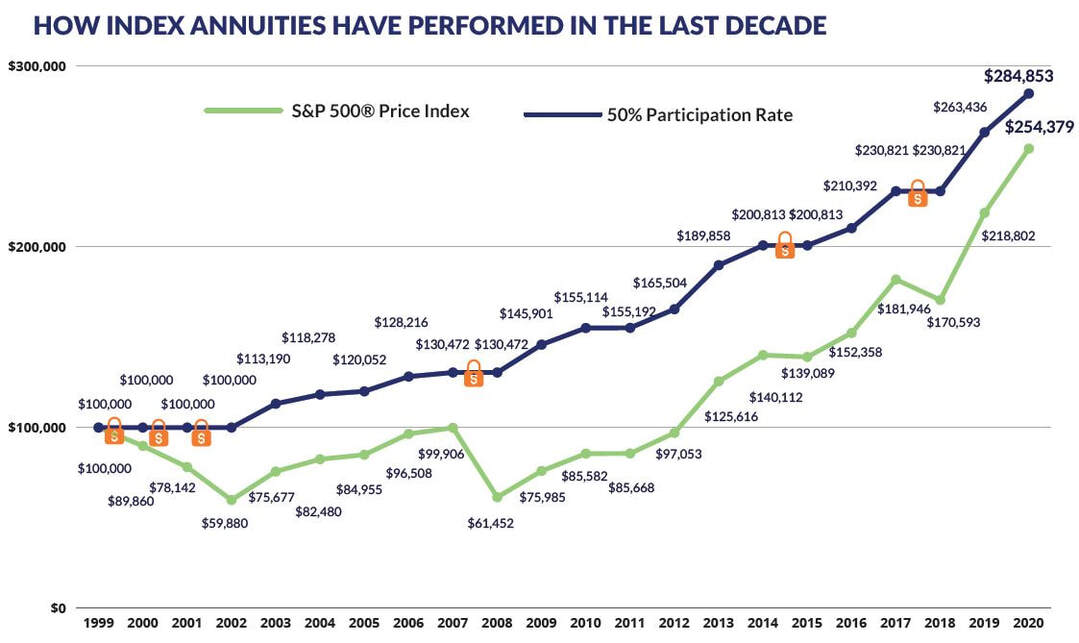

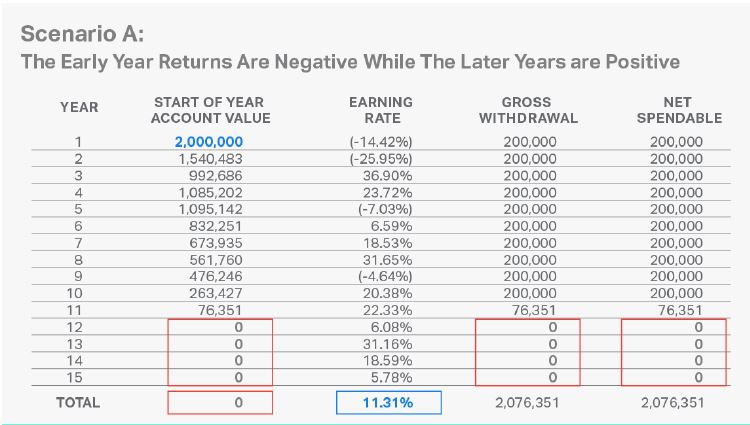

Here is a sample chart below:

Here is a sample chart below:

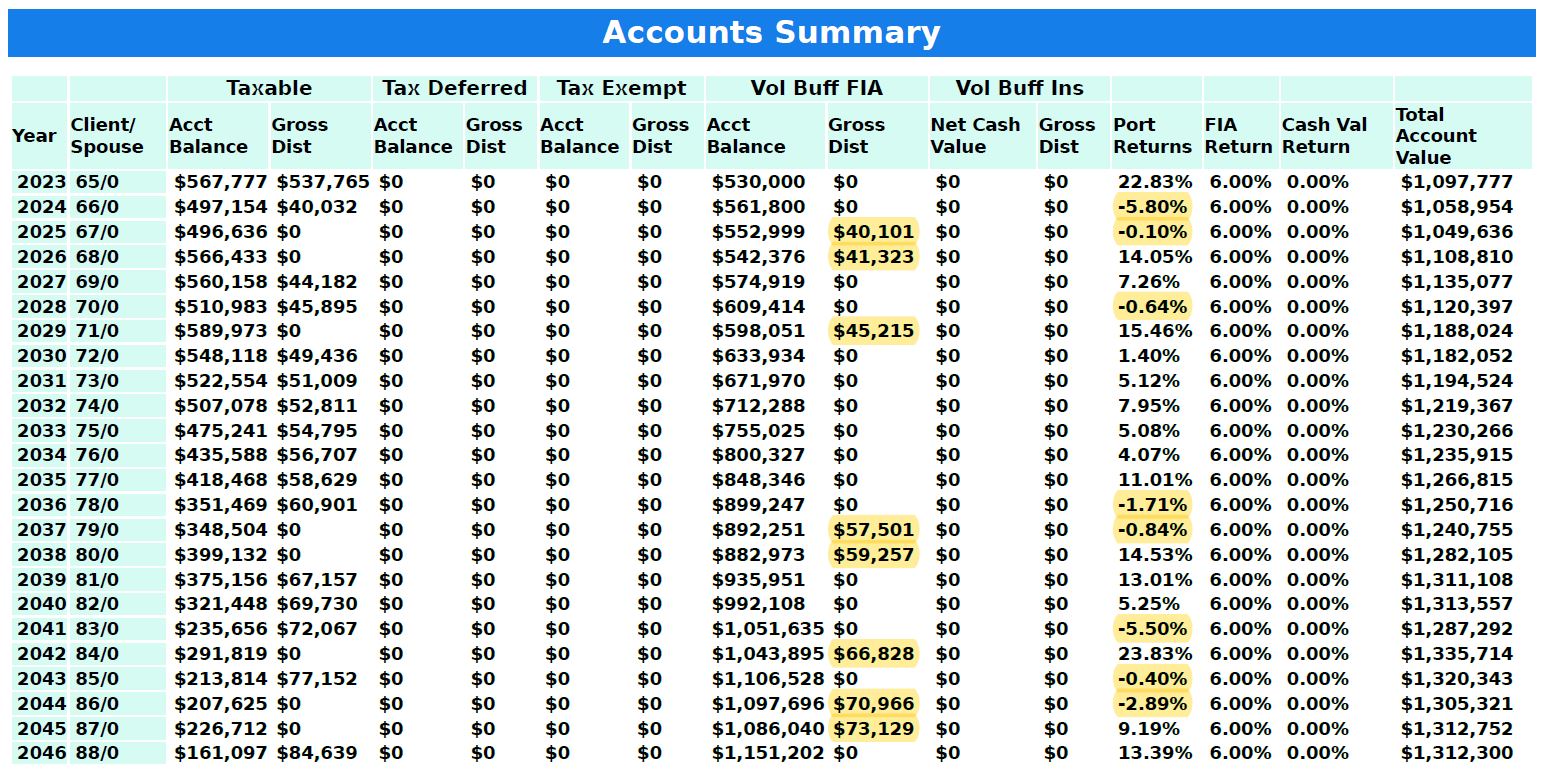

One powerful method to eliminate this is to use what we call the VOLATILITY BUFFER otherwise known as a Fixed Index Annuity. This allows you to grow your money based upon a chosen set of indexes offered by an insurance company. While your rate or return is based upon the market, your annuity assets are parked safely in long-term bonds. So, when the market goes up, you benefit based upon the crediting strategy. If the market goes down, you suffer no negative losses from the market. In fact, you get to keep the principle and all interest that you have earned less any withdrawals you have taken out.

These Fixed Index Annuities offer you the upside potential of double digits and the downside risk of ZERO. The average rate of return may have an average potential of 5 to 7%, with NO RISK and NO FEES.

Some annuities do have the option of an enhanced potential crediting for an additional fee but most of the time we use NO FEE indexes. Many annuities offer Income Riders, but I do not believe these are in your interest. I have analyzed the potential of a Growth Annuity to an Income Annuity and found growth at 5% outperforms the guaranteed income.

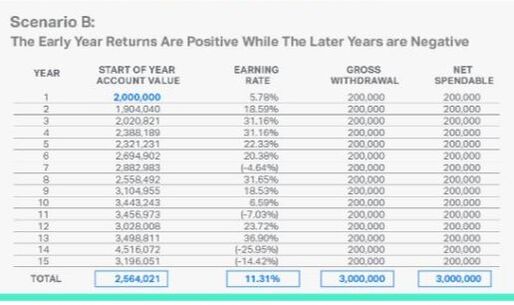

This is a sample of how an Index annuity might work compared to the market. For a complete understanding please refer to the product illustration offered by the insurance company. Each insurance company may have different indexes offered, crediting strategies, and features.

These Fixed Index Annuities offer you the upside potential of double digits and the downside risk of ZERO. The average rate of return may have an average potential of 5 to 7%, with NO RISK and NO FEES.

Some annuities do have the option of an enhanced potential crediting for an additional fee but most of the time we use NO FEE indexes. Many annuities offer Income Riders, but I do not believe these are in your interest. I have analyzed the potential of a Growth Annuity to an Income Annuity and found growth at 5% outperforms the guaranteed income.

This is a sample of how an Index annuity might work compared to the market. For a complete understanding please refer to the product illustration offered by the insurance company. Each insurance company may have different indexes offered, crediting strategies, and features.

THE VOLATILITY BUFFER WEBINAR

These illustrations are for educational purposes only. Please refer to all insurance company illustrations for details you will need to make an informed decision. We provide these examples for you to better understand how the concept works.