Select the tab that interest you...

-

ANNUITIES

-

RISK INVESTMENTS

-

MEDICARE

-

LONG-TERM CARE

-

FINAL EXPENSE

<

>

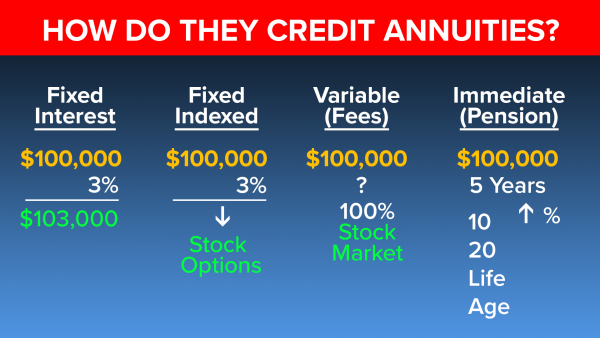

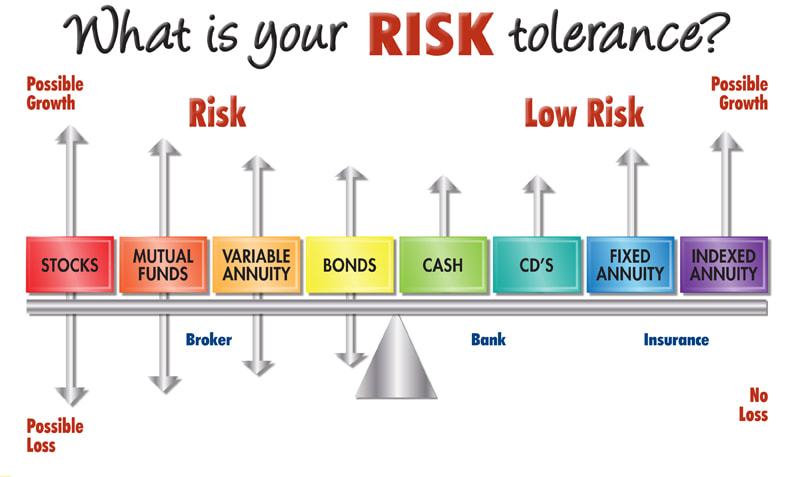

What Are Annuities?An annuity is a contract between you and an insurance company that is designed to meet retirement and other long-range goals, under which you make a lump-sum payment or series of payments.

Annuities typically offer tax-deferred growth of earnings and may include a death benefit that will pay your beneficiary a specified minimum amount, such as your total purchase payments or payments with growth. While tax is deferred on earnings growth, when withdrawals are taken from the annuity, gains are taxed at ordinary income rates, and not capital gains rates. If you withdraw your money early from an annuity, you may pay substantial surrender charges to the insurance company, as well as tax penalties. Free Download Books |

|

FIDUCIARY vs. BROKERS

We often have client come to us without knowing the difference between a Fiduciary and a Broker or the difference between Retail and Institutional investments. Once they learn, the level of service and products that are available, they never go back. Watch this funny video below that drives the point home and then schedule a FREE consultation with us. GET YOUR FREE INVESTMENT ANALYSIS |

|

Choosing the RIGHT plan is important and vital to save you money.

|

Medicare Insurance

There are many options and plan differences that choosing a Medicare plan that is right for you can be confusing and exhausting. We offer you a side by side analysis for the plans we recommend. We explore which plans your doctors accepts, the cost of your medicine and how you plan to use it. We offer you all three types of Medicare options (Advantage, Supplement and Stand Alone Drug Plans from almost all the carriers. We believe Medicare is a yearly choice that should be made, so we contact our clients, show them what is new, remind them of what is important and answer all their questions both at the time of enrollment and though the year.

|

|

The SIX Activities of Daily Living

|

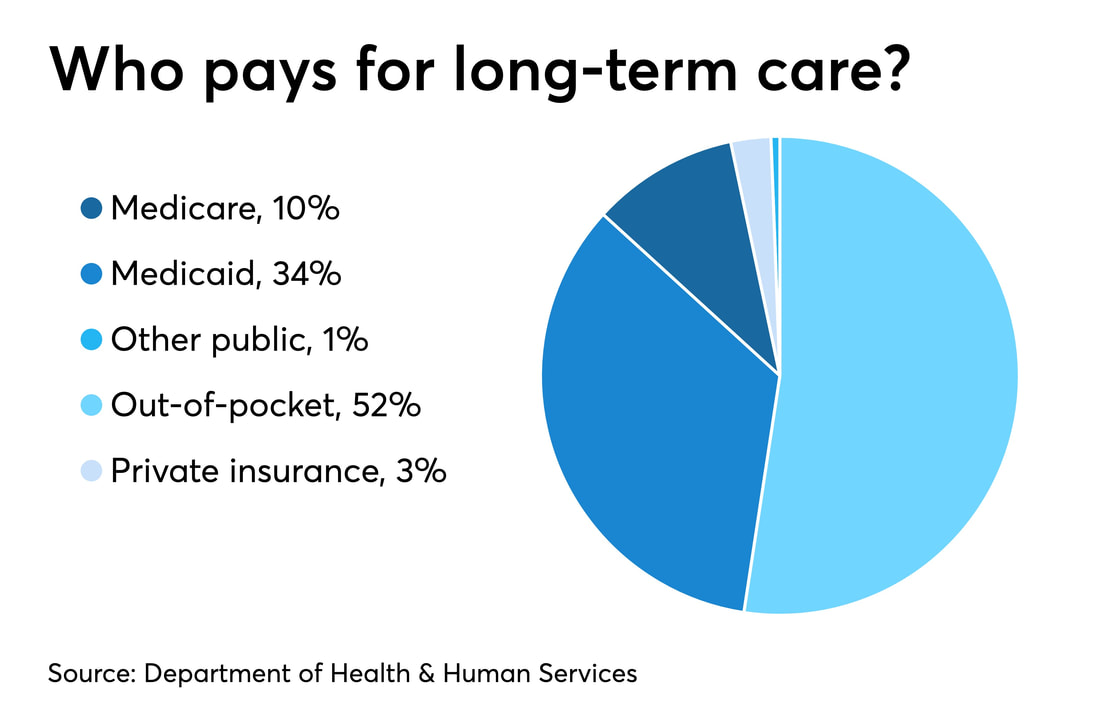

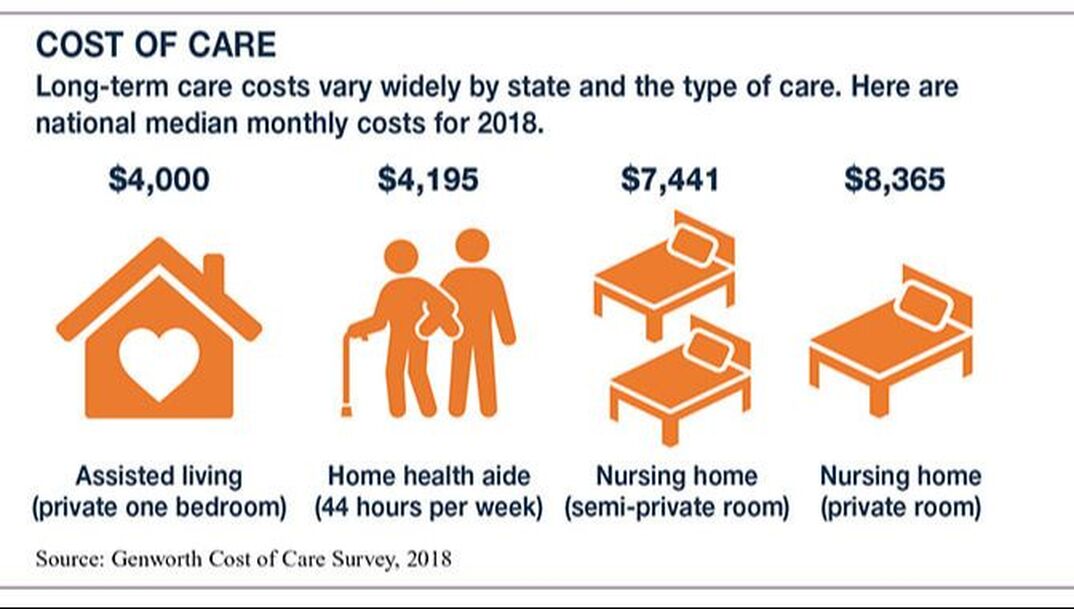

Long-Term Care

When we get older we have the concern for the cost of our care. We know the cost is not cheap and in fact it can be very expensive. The main four types of care consist of Home Health, Assisted Living, Nursing Home, and Alzheimer's. How will you pay for your long-term care needs? With over 70% of the population at age 80 using some form of Long-Term care services it is no wonder why the cost is high. We can offer you two great solutions. One is traditional Long-Term care and the other is a method of Leveraging. Both are important to explore and learn about. |

|

FINAL EXPENSE (Burial Insurance)

Final expense insurance can protect your family from the burden of funeral, burial and even medical expenses. Final expense insurance can protect your family from the burden of final expenses, like funeral, burial and even medical expenses. Final expenses can be difficult to talk about. Yet final expenses can be a major burden to your family and loved ones and compound an already difficult time. Being prepared with final expense insurance is one way to be certain your family won't have to dip into their savings to cover the funeral or burial costs and medical bills you may leave behind. |