|

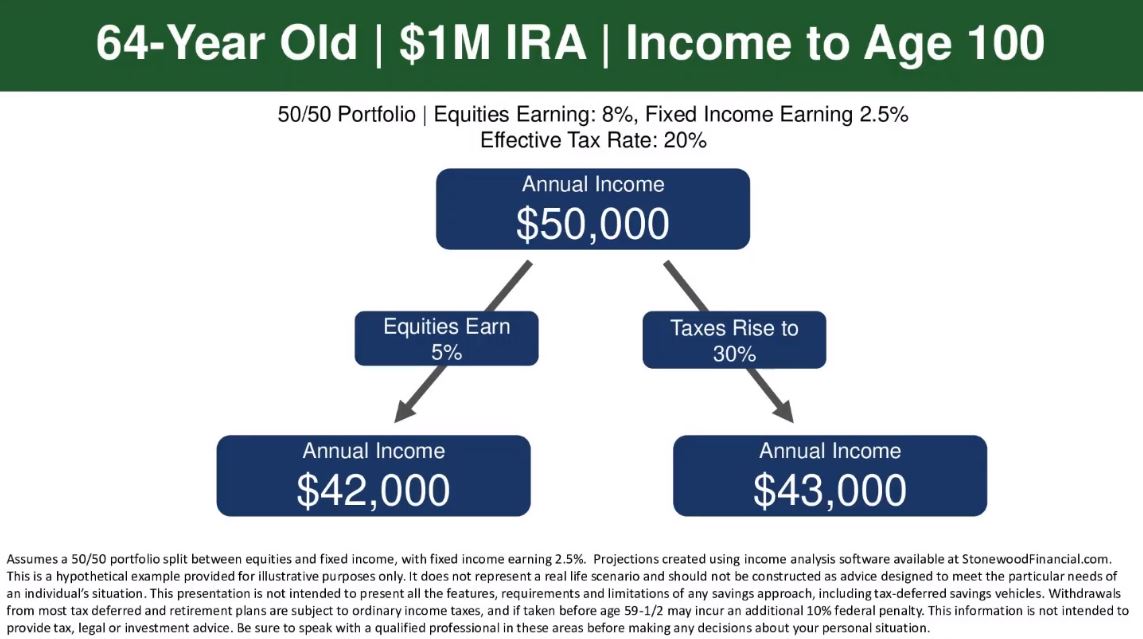

Concerned about the success of your retirement approach in the post-COVID era? Worried about decisions in Washington impacting your retirement plans? Then The New Holistic Retirement is for you. Learn ways to help protect and position your retirement assets for long-term success no matter what future market and tax conditions may be.

|

|

Request your FREE Tax Declassified Customized Report

|

How this plan might work...

|

Corbin Lindsey, Financial Advisor Corbin Lindsey started Birdseye Financial back in 2002 with the goal of offering his clients an absolutely peaceful experience of working with a financial advisor who listens to his clients’ needs and concerns. By offering a customized retirement plan, his clients discover key strategies that enhance their portfolio. These keys include a tax reduction analysis, Safe Money and Risk Money approach to overcome market volatility and education on how to asset protect your nest egg.

Corbin’s main goal is to offer retirees and pre-retirees proven strategies that deliver security, consistency, and predictability in retirement regardless of stock market volatility from year to year. According to Vanguard and Morningstar, a solid retirement plan that maximizes proven strategies can add upwards of 31% value to your retirement plan in comparison to conventional wisdom. Birdseye Financial is an independently owned, non-captive agency with the advantage of offering clients access to more products on the market than captive agencies can. With a dual platform of both a fiduciary platform through an Asset Management company and an insurance platform with about 45 insurance companies with access to hundreds of products so that his clients can choose the most competitive products on the market. Birdseye services clients in multiple states. |

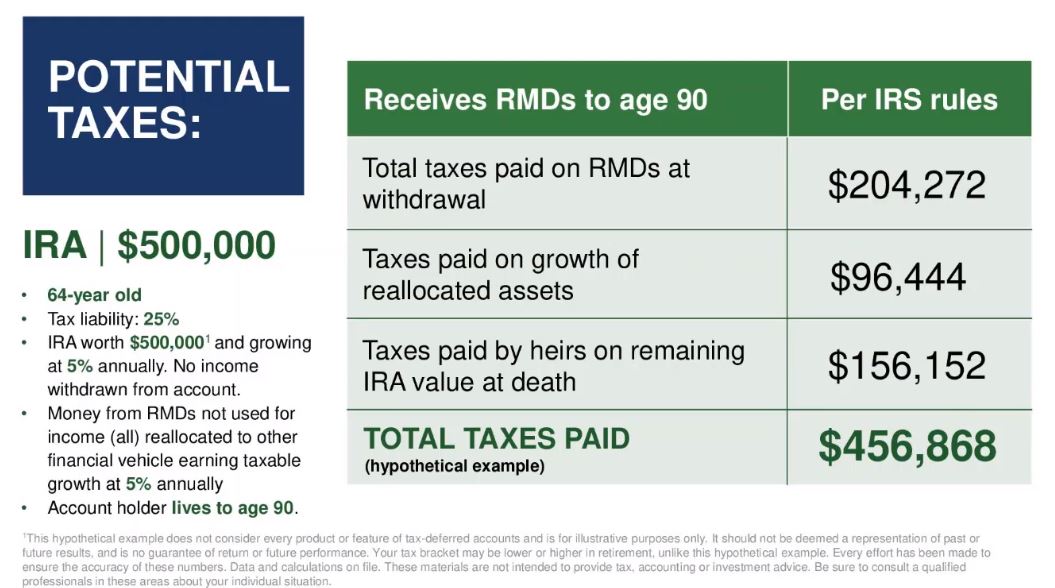

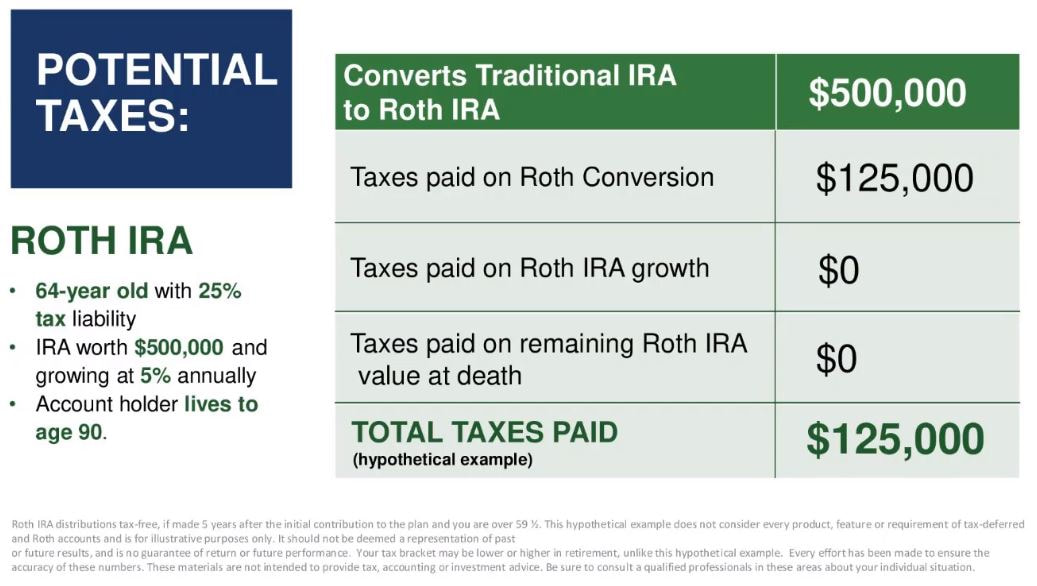

Notes & Disclosure: 1 Current taxes based on maintaining your existing Qualified Account. Qualified accounts are funded using pre-tax dollars, and taxes are generally owed on principal and interest when the funds are distributed. 2 Adjustment modeled is based on Roth conversion of funds. Roth accounts are funded with post-tax dollars and withdrawals of principal and interest are generally distributed tax-free. This is not a complete discussion of the benefits, limitations and requirements of Roth accounts or tax-free savings vehicles. This analysis is designed to provide general information only. Pursuant to IRS Circular 230 and any license limitations of the licensed professional presenting this material, this analysis is not intended to provide tax or legal advice. Be sure to speak with a qualified professional in these areas before making any decisions about your personal situation. This analysis does not consider every product or feature of tax-deferred or Roth accounts and is for illustrative purposes only. It should not be deemed a representation of past or future results, and is no guarantee of return or future performance. Your tax bracket may be lower or higher in retirement, unlike this hypothetical example. Every effort has been made to ensure the accuracy of these numbers. RMD calculation data gathered from Stonewood RMD calculation software based on IRS guidelines and tables, and is hypothetical only. Your actual RMDs are determined by a variety of factors. The contents of this website are for educational purposes only. Any material and its attachments, links, downloads, and/or any emails from our company are not intended to provide legal or tax advice. To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal or state tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein. Please seek the advice of appropriately licensed individuals for legal or tax advice relating to your individual situation. Birdseye Financial and its employees are not tax or legal advisors and are not operating in such a manner. Birdseye financial and those working for the company are not licensed Investment Advisors which prohibits us from offering such advice. Any advice you get should be taken as non-investment advice and only educational in nature. Should our clients need a licensed investment advisor, we partner with LifePro Asset Management. *Investing carries an inherent element of risk. No strategy can guarantee a profit or prevent a loss. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individualized tax, legal, fiduciary or investment advice. Any illustrations used are hypothetical and were used for explanatory purposes only. THANK YOU!