Market Value Adjustment (MVA) and Annuities

Annuities are uniquely positioned for retirement planning because they're the only financial product that can guarantee retirement income. That's powerful. It means that even after you stop working, you can still receive regular income.

Receiving steady income throughout retirement can take the stress out of budgeting and help you enjoy your golden years with peace of mind. There are many different types of annuities and lots of ways to customize them to fit your needs.

One annuity term you may have heard is a market value adjustment.

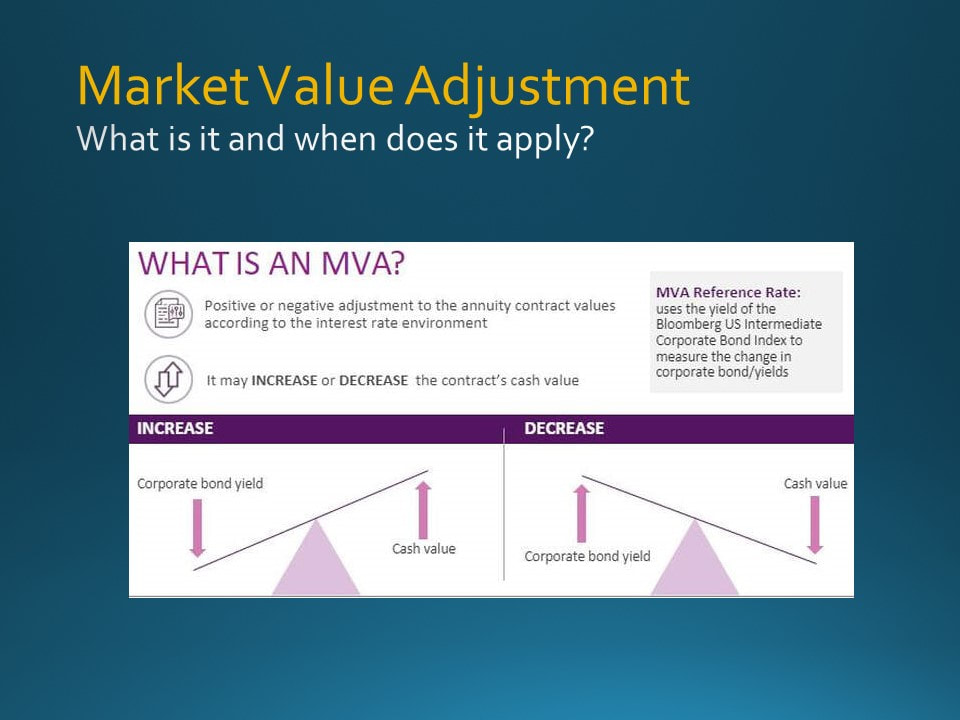

A market value adjustment (MVA) is a monetary adjustment that insurance companies impose on early withdrawals from annuities. As the name implies, market value adjustments depend on the market rates when you want to withdraw. Depending on how interest rates have changed since you purchased your annuity, an MVA may add to early withdrawal fees, or it may offset those charges in your favor.

Annuity Recap: Surrender Charges

Before we talk about MVAs, let's skim over some annuity basics very quickly.There are many different types of annuities and lots of ways to customize them to fit your needs.

You can choose from deferred annuities and immediate annuities; fixed annuities, variable annuities, and fixed indexed annuities; qualified and non-qualified annuities; and many more. The variety helps you find an annuity that’s just right for you.

But no matter what type of annuity you choose, you will likely have a surrender charge period. A surrender charge period is the period during which you're penalized for withdrawing money from your annuity. The penalty comes in the form of early withdrawal fees known as "surrender charges.".

Surrender charges are meant to encourage people to use annuities for their intended purpose—retirement planning—rather than short-term investing. Sometimes, the insurance company does allow you to withdraw a certain amount to penalty-free.

For example, most allow you to withdraw 10% of your total annuity account value without penalty in a given year. This is called the "penalty-free withdrawal amount." It's best to check your annuity contract to see if your insurer allows you any penalty-free withdrawals.

Annuities are uniquely positioned for retirement planning because they're the only financial product that can guarantee retirement income. That's powerful. It means that even after you stop working, you can still receive regular income.

Receiving steady income throughout retirement can take the stress out of budgeting and help you enjoy your golden years with peace of mind. There are many different types of annuities and lots of ways to customize them to fit your needs.

One annuity term you may have heard is a market value adjustment.

A market value adjustment (MVA) is a monetary adjustment that insurance companies impose on early withdrawals from annuities. As the name implies, market value adjustments depend on the market rates when you want to withdraw. Depending on how interest rates have changed since you purchased your annuity, an MVA may add to early withdrawal fees, or it may offset those charges in your favor.

Annuity Recap: Surrender Charges

Before we talk about MVAs, let's skim over some annuity basics very quickly.There are many different types of annuities and lots of ways to customize them to fit your needs.

You can choose from deferred annuities and immediate annuities; fixed annuities, variable annuities, and fixed indexed annuities; qualified and non-qualified annuities; and many more. The variety helps you find an annuity that’s just right for you.

But no matter what type of annuity you choose, you will likely have a surrender charge period. A surrender charge period is the period during which you're penalized for withdrawing money from your annuity. The penalty comes in the form of early withdrawal fees known as "surrender charges.".

Surrender charges are meant to encourage people to use annuities for their intended purpose—retirement planning—rather than short-term investing. Sometimes, the insurance company does allow you to withdraw a certain amount to penalty-free.

For example, most allow you to withdraw 10% of your total annuity account value without penalty in a given year. This is called the "penalty-free withdrawal amount." It's best to check your annuity contract to see if your insurer allows you any penalty-free withdrawals.

What Is a Market Value Adjustment?

A market value adjustment is one strategy that life insurance companies use to protect themselves against losses from early withdrawals.

Think of it this way: You pay a premium to the insurance company and purchase your annuity. The insurance company invests your premium to earn investment income.

It's those earnings that pay the crediting rates on your policy so your annuity can grow over time.

In reality, the way insurance companies invest is quite complex. But the easiest way to explain an MVA is to think of the insurance company investing your money in relatively safe investments (like bonds) that have the same term as your annuity.

So if you purchase a 10-year annuity, the company might invest your premiums in 10-year bonds. But now imagine you change your mind and cash out your annuity before the 10 years is up. If interest rates have gone up and the company now has to sell those bonds to pay you, it may lose money. The company may impose a negative MVA to help recoup those losses.

On the other hand, if interest rates have gone down, the company may earn money by selling the bonds. In that case, the insurance company would make a profit. They may apply a positive MVA and you could receive a credit to partially offset any other surrender charges you owe.

So, the MVA is an adjustment to the value of your contract. It is a way of accounting for gains or losses the insurer will incur if you choose to withdraw from your annuity early.

It’s confusing because it could benefit you or harm you; it just depends on how the market has fluctuated since you bought your annuity.

A market value adjustment is one strategy that life insurance companies use to protect themselves against losses from early withdrawals.

Think of it this way: You pay a premium to the insurance company and purchase your annuity. The insurance company invests your premium to earn investment income.

It's those earnings that pay the crediting rates on your policy so your annuity can grow over time.

In reality, the way insurance companies invest is quite complex. But the easiest way to explain an MVA is to think of the insurance company investing your money in relatively safe investments (like bonds) that have the same term as your annuity.

So if you purchase a 10-year annuity, the company might invest your premiums in 10-year bonds. But now imagine you change your mind and cash out your annuity before the 10 years is up. If interest rates have gone up and the company now has to sell those bonds to pay you, it may lose money. The company may impose a negative MVA to help recoup those losses.

On the other hand, if interest rates have gone down, the company may earn money by selling the bonds. In that case, the insurance company would make a profit. They may apply a positive MVA and you could receive a credit to partially offset any other surrender charges you owe.

So, the MVA is an adjustment to the value of your contract. It is a way of accounting for gains or losses the insurer will incur if you choose to withdraw from your annuity early.

It’s confusing because it could benefit you or harm you; it just depends on how the market has fluctuated since you bought your annuity.

When Do Market Value Adjustments Apply?

MVAs generally only apply when you withdraw from your MVA annuity during the surrender charge period (although some companies apply an MVA charge to death benefits as well).

When you buy a multi-year guaranteed fixed annuity, you choose a term or "guarantee period.” For example, annuities have terms such as 3, 5, or 7 years.

This is the number of years that you will receive a guaranteed rate of interest. Each annuity also has a surrender charge period (during which you pay surrender charges) and a penalty-free withdrawal amount. Both are stipulated in the contract.

If you withdraw more than the penalty-free amount during the surrender charge period, then surrender charges and an MVA may apply. Note: If you do not withdraw from your annuity early, you will not be subject to MVA charges.

Keep in mind that every company does MVAs a little differently. You’ll be able to read exactly how your MVA works in your contract.

How Much Are the Adjustments?The value of your annuity MVA will depend on several factors, including the market conditions at the time you request a withdrawal. Part of what makes MVAs confusing is that each insurer may use a different formula for calculating it. An MVA index value is typically assigned to your contract at issue. The insurance company may use a corporate bond index to benchmark against.

Then, if the value of this index e is higher when you withdraw than when you bought your annuity, your MVA will be negative and will be added as a fee. If the index has gone down since you bought your annuity, the MVA will be positive and may offset surrender charges.

MVA Example Calculation

Imagine you bought a fixed annuity with a contract term of 5 years. You funded the annuity with $200,000. Now imagine that you choose to withdraw $50,000 after the third contract year. The value of the MVA depends on the difference in the MVA index rate from when you bought the annuity to when you withdraw your money. So let's say that your insurance company measures this difference using the corporate bond index.

And let’s imagine that interest rates on that index were 3% when you bought and current interest rates are 5%.

In this example, we'll say that your insurance company calculates the MVA using the following formula: (1 + Index when you purchased) / (1 + Current index) - 1. In our example, the MVA would equal 1.03 / 1.05 - 1 or -1.9%. That means a 1.9% charge would be applied in addition to any surrender fees on any amount withdrawn over above the withdrawal limit.

Let’s imagine that your 5-year annuity had a fixed rate of return of 2.95%. The contract value after 3 years would then be $218,227. Let’s say the withdrawal limit is 10% so $21,823 may be withdrawn without any penalty. And let’s say that there is a surrender charge of 5%. So, of the $50,000 withdrawal, $21,823 is withdrawn without penalty. The 5% surrender charge would apply to the remaining $28,177 and is equal to $1,409. Finally, the MVA of 1.90% would also apply to the $28,177. So the market value adjustment is $545.

The net withdrawal (sometimes called "cash surrender value") would be $50,000 - $1,409 - $545 = $48,049.

Again, this is a simplified example, but it illustrates how MVAs can apply to early withdrawals. Remember that each insurance company has its own MVA calculation formula. Check your annuity contract to find out how an MVA may apply to your annuity. Also, keep in mind that annuity withdrawals are taxed as ordinary income at regular income tax rates. Withdrawals from an annuity may face an additional tax penalty from the IRS. See our article on annuity taxation for more details.

MVAs generally only apply when you withdraw from your MVA annuity during the surrender charge period (although some companies apply an MVA charge to death benefits as well).

When you buy a multi-year guaranteed fixed annuity, you choose a term or "guarantee period.” For example, annuities have terms such as 3, 5, or 7 years.

This is the number of years that you will receive a guaranteed rate of interest. Each annuity also has a surrender charge period (during which you pay surrender charges) and a penalty-free withdrawal amount. Both are stipulated in the contract.

If you withdraw more than the penalty-free amount during the surrender charge period, then surrender charges and an MVA may apply. Note: If you do not withdraw from your annuity early, you will not be subject to MVA charges.

Keep in mind that every company does MVAs a little differently. You’ll be able to read exactly how your MVA works in your contract.

How Much Are the Adjustments?The value of your annuity MVA will depend on several factors, including the market conditions at the time you request a withdrawal. Part of what makes MVAs confusing is that each insurer may use a different formula for calculating it. An MVA index value is typically assigned to your contract at issue. The insurance company may use a corporate bond index to benchmark against.

Then, if the value of this index e is higher when you withdraw than when you bought your annuity, your MVA will be negative and will be added as a fee. If the index has gone down since you bought your annuity, the MVA will be positive and may offset surrender charges.

MVA Example Calculation

Imagine you bought a fixed annuity with a contract term of 5 years. You funded the annuity with $200,000. Now imagine that you choose to withdraw $50,000 after the third contract year. The value of the MVA depends on the difference in the MVA index rate from when you bought the annuity to when you withdraw your money. So let's say that your insurance company measures this difference using the corporate bond index.

And let’s imagine that interest rates on that index were 3% when you bought and current interest rates are 5%.

In this example, we'll say that your insurance company calculates the MVA using the following formula: (1 + Index when you purchased) / (1 + Current index) - 1. In our example, the MVA would equal 1.03 / 1.05 - 1 or -1.9%. That means a 1.9% charge would be applied in addition to any surrender fees on any amount withdrawn over above the withdrawal limit.

Let’s imagine that your 5-year annuity had a fixed rate of return of 2.95%. The contract value after 3 years would then be $218,227. Let’s say the withdrawal limit is 10% so $21,823 may be withdrawn without any penalty. And let’s say that there is a surrender charge of 5%. So, of the $50,000 withdrawal, $21,823 is withdrawn without penalty. The 5% surrender charge would apply to the remaining $28,177 and is equal to $1,409. Finally, the MVA of 1.90% would also apply to the $28,177. So the market value adjustment is $545.

The net withdrawal (sometimes called "cash surrender value") would be $50,000 - $1,409 - $545 = $48,049.

Again, this is a simplified example, but it illustrates how MVAs can apply to early withdrawals. Remember that each insurance company has its own MVA calculation formula. Check your annuity contract to find out how an MVA may apply to your annuity. Also, keep in mind that annuity withdrawals are taxed as ordinary income at regular income tax rates. Withdrawals from an annuity may face an additional tax penalty from the IRS. See our article on annuity taxation for more details.