Civil Service Retirement System (CSRS)

The Civil Service Retirement Act, which became effective on August 1, 1920, established a retirement system for certain Federal employees. It was replaced by the Federal Employees Retirement System (FERS) for Federal employees who first entered covered service on and after January 1, 1987.

The Civil Service Retirement System (CSRS) is a defined benefit, contributory retirement system. Employees share in the expense of the annuities to which they become entitled. CSRS covered employees contribute 7, 7 1/2 or 8 percent of pay to CSRS and, while they generally pay no Social Security retirement, survivor and disability (OASDI) tax, they must pay the Medicare tax (currently 1.45 percent of pay). The employing agency matches the employee's CSRS contributions.

CSRS employees may increase their earned annuity by contributing up to 10 percent of the basic pay for their creditable service to a voluntary contribution account. Employees may also contribute a portion of pay to the Thrift Savings Plan (TSP) (external link). There is no Government contribution, but the employee contributions are tax-deferred.

This section of the website covers the Civil Service Retirement System (CSRS). Through the menu links on the left, you can find information about the following CSRS retirement topics:

Voluntary Retirement

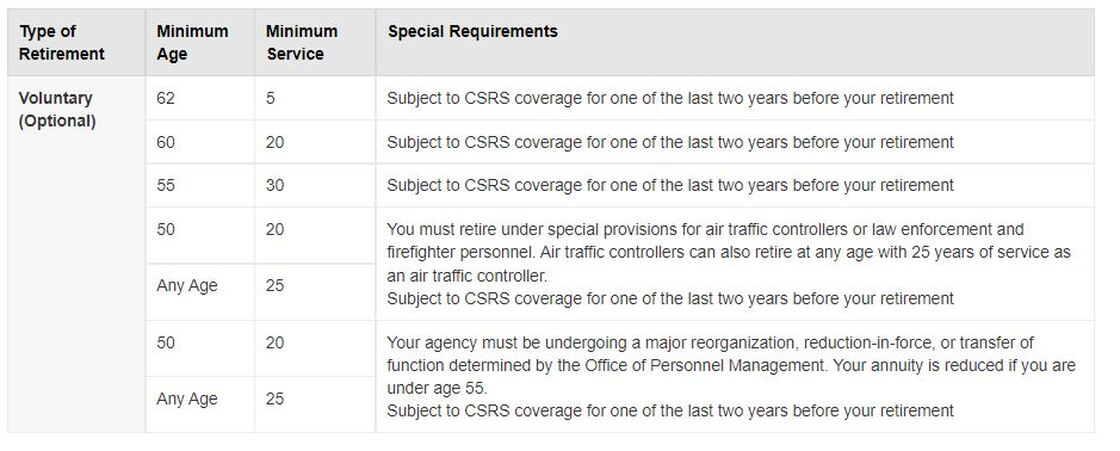

Eligibility is based on your age and the number of years of creditable service and any other special requirements. In addition, you must have served in a position subject to CSRS coverage for one of the last two years before your retirement. If you meet one of the following sets of requirements, you may be eligible for a voluntary immediate retirement benefit. An immediate annuity is one that begins within 30 days after your separation.

The Civil Service Retirement System (CSRS) is a defined benefit, contributory retirement system. Employees share in the expense of the annuities to which they become entitled. CSRS covered employees contribute 7, 7 1/2 or 8 percent of pay to CSRS and, while they generally pay no Social Security retirement, survivor and disability (OASDI) tax, they must pay the Medicare tax (currently 1.45 percent of pay). The employing agency matches the employee's CSRS contributions.

CSRS employees may increase their earned annuity by contributing up to 10 percent of the basic pay for their creditable service to a voluntary contribution account. Employees may also contribute a portion of pay to the Thrift Savings Plan (TSP) (external link). There is no Government contribution, but the employee contributions are tax-deferred.

This section of the website covers the Civil Service Retirement System (CSRS). Through the menu links on the left, you can find information about the following CSRS retirement topics:

- Eligibility – The main eligibility requirements for the common types of retirements.

- Computation – How your retirement annuity is computed.

- Creditable Service – Rules showing the civilian and military service that can be used to compute your CSRS retirement benefits.

- Planning and Applying – It's never too early to start planning for retirement in order to ensure it goes smoothly. Here you will find information to help ensure your retirement starts well.

- Types of Retirement – Learn about the age, service requirements and considerations affecting the various types of retirement.

- Survivors – When a Federal employee dies, monthly or lump sum benefits may be payable to survivors. Learn about these Survivor benefits here.

- Military Retired Pay – Adding military service to your civilian service.

- Service Credit – Payment to increase your annuity for civilian service when no CSRS retirement deductions were withheld or were refunded or for military service after 1956.

- Former Employees – Options if you leave your Federal job before becoming eligible for retirement.

Voluntary Retirement

Eligibility is based on your age and the number of years of creditable service and any other special requirements. In addition, you must have served in a position subject to CSRS coverage for one of the last two years before your retirement. If you meet one of the following sets of requirements, you may be eligible for a voluntary immediate retirement benefit. An immediate annuity is one that begins within 30 days after your separation.

Your basic annuity is computed based on your length of service and “high-3” average salary. You also receive credit for unused sick leave if you retire on an immediate annuity. To determine your length of service for computation, add all your periods of creditable service, and the period represented by your unused sick leave, then eliminate any fractional part of a month from the total.

High-3 Average SalaryYour “high-3” average pay is the highest average basic pay you earned during any 3 consecutive years of service. These three years are usually your final three years of service, but can be an earlier period, if your basic pay was higher during that period. Your basic pay is the basic salary you earn for your position. It includes increases to your salary for which retirement deductions are withheld, such as shift rates. It does not include payments for overtime, bonuses, etc.

Computation

CSRS Annuity Formula

High-3 Average SalaryYour “high-3” average pay is the highest average basic pay you earned during any 3 consecutive years of service. These three years are usually your final three years of service, but can be an earlier period, if your basic pay was higher during that period. Your basic pay is the basic salary you earn for your position. It includes increases to your salary for which retirement deductions are withheld, such as shift rates. It does not include payments for overtime, bonuses, etc.

Computation

CSRS Annuity Formula

- First 5 years of service - 1.5 percent of your high-3 average salary for each year

- Second 5 years of service - Plus1.75 percent of your high-3 average salary for each year

- For all years of service over 10 - Plus 2 percent of your high-3 average salary for each year.

GET STARTED TODAY!!!

Federal Employee Benefit Planners LLC, and Birdseye Financial INC, and the website contents are not affiliated nor owned by any U.S. government agency or affiliate. The information provided on www.federalbenefitsnow.com and www.birdseyefinancial is for informational purposes only and is not intended to be a source of advice or credit analysis with respect to the material presented. The information and/or documents contained on this website do not constitute legal or financial advice and should never be used without first consulting with an insurance and/or a financial professional to determine what may be best for your individual needs. Federal Employee Benefit Planners LLC, Birdseye Financial, the publisher and the author of this website do not make any guarantee or other promise as to any results that may be obtained through the information and services offered. You should never make any investment decision without first consulting with your own financial advisor and conducting your own research and due diligence. To the maximum extent permitted by law, the publisher and the author disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations contained in this book prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Although the author and publisher have made every effort to ensure that the information found on this website are correct at press time, the author and publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Content contained or made available through this website do not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. The publisher and the author are providing the website and its contents on an “as is” basis. Your use of the information on this website is at your own risk.