THRIFT SAVINGS PLAN (TSP)

|

FERS

If you’re covered by the Federal Employees’ Retirement System (FERS), the TSP is one part of a three-part retirement package that also includes your FERS basic annuity and Social Security. |

CSRS

If you’re covered by the Civil Service Retirement System (CSRS) or are a member of the uniformed services, the TSP is a supplement to your CSRS annuity or military retired pay |

What is it?

Like private sector 401(k) plans, TSP is a government-sponsored defined contribution investment instrument. It is another potential retirement income stream for federal workers enrolled in the Federal Employees Retirement System (FERS) and, the now nearly legacy pension plan from 1920, the Civil Service Retirement System (CSRS). They are both defined benefit pension plans, offering annuities upon retirement.

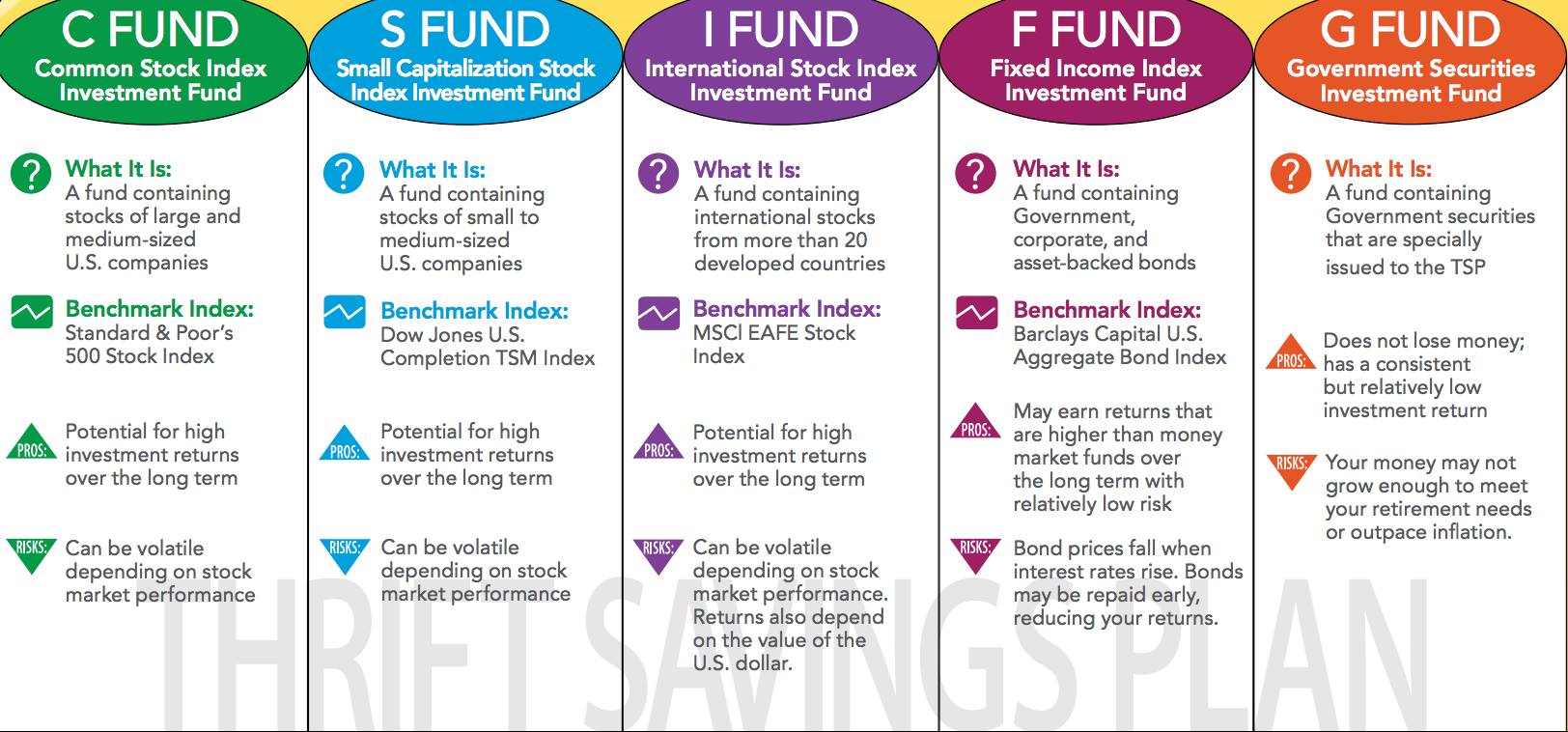

Investment Options -

Like private sector 401(k) plans, TSP is a government-sponsored defined contribution investment instrument. It is another potential retirement income stream for federal workers enrolled in the Federal Employees Retirement System (FERS) and, the now nearly legacy pension plan from 1920, the Civil Service Retirement System (CSRS). They are both defined benefit pension plans, offering annuities upon retirement.

Investment Options -

- Some are risky but offer a more generous return on your investment if the fund is performing well.

- Others are more conservative investments. But they tend to achieve greater stability and predictable — yet potentially not as generous — returns.

In-service withdrawal basics

In-service withdrawals are withdrawals you make from your TSP account while you’re still working for the federal government or a member of the uniformed services. An in-service withdrawal can have a serious impact on your TSP account. Remember that the purpose of your account is to accumulate savings so that you’ll have income during retirement.

Things to consider:

By law, we can’t pick your plan. But we can review your options. We also may recommend positioning you away from the TSP at some point, because of severe restrictions with the plan that come into effect when you decide to retire. Depending on your goals and financial situation, we may recommend other financial products that could optimize the investment you have made into your TSP.

In-service withdrawals are withdrawals you make from your TSP account while you’re still working for the federal government or a member of the uniformed services. An in-service withdrawal can have a serious impact on your TSP account. Remember that the purpose of your account is to accumulate savings so that you’ll have income during retirement.

Things to consider:

- Withdrawals permanently reduce your retirement savings as well as any earnings you would’ve earned.

- Withdrawals may be subject to income taxes or other penalties.

- If you’re a married FERS participant or a member of the uniformed services, your spouse must sign a consent waiver for your in-service withdrawal.

By law, we can’t pick your plan. But we can review your options. We also may recommend positioning you away from the TSP at some point, because of severe restrictions with the plan that come into effect when you decide to retire. Depending on your goals and financial situation, we may recommend other financial products that could optimize the investment you have made into your TSP.

How will your assets grow?

Use this free savings calculator to see how much you'll earn over time.

Use this free savings calculator to see how much you'll earn over time.

GET STARTED TODAY!!!

Federal Employee Benefit Planners LLC, and Birdseye Financial INC, and the website contents are not affiliated nor owned by any U.S. government agency or affiliate. The information provided on www.federalbenefitsnow.com and www.birdseyefinancial is for informational purposes only and is not intended to be a source of advice or credit analysis with respect to the material presented. The information and/or documents contained on this website do not constitute legal or financial advice and should never be used without first consulting with an insurance and/or a financial professional to determine what may be best for your individual needs. Federal Employee Benefit Planners LLC, Birdseye Financial, the publisher and the author of this website do not make any guarantee or other promise as to any results that may be obtained through the information and services offered. You should never make any investment decision without first consulting with your own financial advisor and conducting your own research and due diligence. To the maximum extent permitted by law, the publisher and the author disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations contained in this book prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Although the author and publisher have made every effort to ensure that the information found on this website are correct at press time, the author and publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Content contained or made available through this website do not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. The publisher and the author are providing the website and its contents on an “as is” basis. Your use of the information on this website is at your own risk.