FEDERAL BENEFITS OVERVIEW

OPM (Office of Personal Management)

TSP (Thrift Savings Plan) – like a 401K

- TSP Website with Login

- Vesting Details

- FUND Details and FUND Chart

CSRS / FERS – Pension Options

- Civil Service Retirement System

- Federal Employees Retirement System

SSB (Surviving Spousal Benefit)

Website -

FEHB (Federal Employee Health Benefit)

Website - https://www.opm.gov/healthcare-insurance/

IN THIS SECTION

FEGLI (Federal Employee Group Life Ins)

Website - https://www.opm.gov/healthcare-insurance/life-insurance/

You can also look on a copy of your most recent Standard Form 50, Notification of Personnel Action, to determine the coverage you currently have:

- Phone - 888-767-6738

- E-mail - [email protected]

- Website - https://www.servicesonline.opm.gov

- Retirees - https://www.opm.gov/healthcare-insurance/Guide-Me/Retirees-Survivors/

TSP (Thrift Savings Plan) – like a 401K

- TSP Website with Login

- Vesting Details

- FUND Details and FUND Chart

- L FUND - Lifecycle Fund (Lifecycle 2025, 2030, 2035, 2040, to 2065 and Retired L)

- G FUND – Government Securities

- F Fund – Fixed Income (Bonds)

- C Fund – Common Stocks

- S Fund – Small Cap Stock

- I Fund – International Stocks

CSRS / FERS – Pension Options

- Civil Service Retirement System

- Federal Employees Retirement System

- CSRS – Higher Pension and NO Social Security or TSP

- FERS – Smaller Pension plus TSP and Social Security and Disability Benefits

- Highest 3 years Average basic pay

- UNDER 62 – 1 percent of your high-3 average salary for each year of service

- Age 62+ - 1.1 percent of your high-3 average salary for each year of service

- FERS SPECIAL - Air Traffic Controllers, Firefighters, Law Enforcement Officers, Capitol Police, Supreme Court Police, or Nuclear Materials Couriers

- 1.7% of your high-3 average salary multiplied by your years of service which do not exceed 20, PLUS

- 1% of your high-3 average salary multiplied by your service exceeding 20 years

- Money before Social Security kicks in

SSB (Surviving Spousal Benefit)

Website -

- 50% cost of 10%

- 25% cost of 5%

- 0% cost Nothing

FEHB (Federal Employee Health Benefit)

Website - https://www.opm.gov/healthcare-insurance/

IN THIS SECTION

- Life Events

- Changes in Health Coverage

- Healthcare

- FEHB Plan Comparison Tool

- Dental & Vision

- FEDVIP Plan Comparison Tool

- Life Insurance

- Flexible Spending Accounts

- Long Term Care

- Multi-State Plan Program

- Tribal Employers

- Special Initiatives

- Insurance Glossary

- Insurance FAQs

- Contact Healthcare & Insurance

- The Affordable Care Act

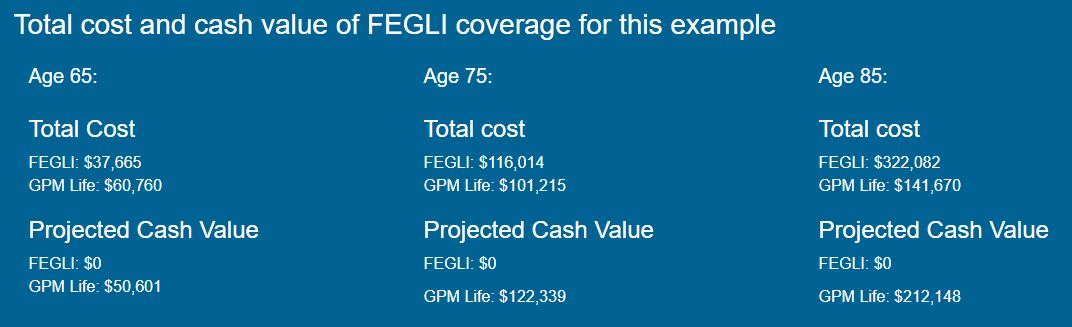

FEGLI (Federal Employee Group Life Ins)

Website - https://www.opm.gov/healthcare-insurance/life-insurance/

- Term Life Insurance ( 1 year to 6 times salary)

- Basic = Annual pay (Example with $57,100 you receive $60K using the formula) – you pay 2/3 of cost

- Optional Coverage types

- A = Employee for 10K

- B = Life of Employee (can elect upto 5 times annual salary)

- C = Life of employees spouse $5K and kids for $2K (can elect up to 5 multiples)

- Option A 2016 Rates

- Option B 2016 Rates

- Option C 2016 Rates

You can also look on a copy of your most recent Standard Form 50, Notification of Personnel Action, to determine the coverage you currently have:

- In Block 27 on that form, there is a 2-character code that represents your current coverage and a definition of the code.

- You can look up the SF50 codes and what they mean.

- You can then use the FEGLI Calculator to determine the current value of your FEGLI by inputting your current age, salary and type(s) of FEGLI coverage.

- If you wish to change your FEGLI life insurance beneficiaries, complete this form and submit it to your human resources office: www.opm.gov/forms/pdf_fill/sf2823.pdf

|

Vertical Divider

|

|

GET STARTED TODAY!!!

Federal Employee Benefit Planners LLC, and Birdseye Financial INC, and the website contents are not affiliated nor owned by any U.S. government agency or affiliate. The information provided on www.federalbenefitsnow.com and www.birdseyefinancial is for informational purposes only and is not intended to be a source of advice or credit analysis with respect to the material presented. The information and/or documents contained on this website do not constitute legal or financial advice and should never be used without first consulting with an insurance and/or a financial professional to determine what may be best for your individual needs. Federal Employee Benefit Planners LLC, Birdseye Financial, the publisher and the author of this website do not make any guarantee or other promise as to any results that may be obtained through the information and services offered. You should never make any investment decision without first consulting with your own financial advisor and conducting your own research and due diligence. To the maximum extent permitted by law, the publisher and the author disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations contained in this book prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Although the author and publisher have made every effort to ensure that the information found on this website are correct at press time, the author and publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Content contained or made available through this website do not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. The publisher and the author are providing the website and its contents on an “as is” basis. Your use of the information on this website is at your own risk.